After KOSDAQ Listing in 2020, Annual External Fundraising

Profit Turnaround Delayed Compared to IPO Expectations

Video recognition artificial intelligence (AI) company Alchera has been raising funds every year by issuing new shares since its listing on the KOSDAQ market in 2020. This appears to be due to the delayed timing of turning a profit compared to initial expectations at the time of listing.

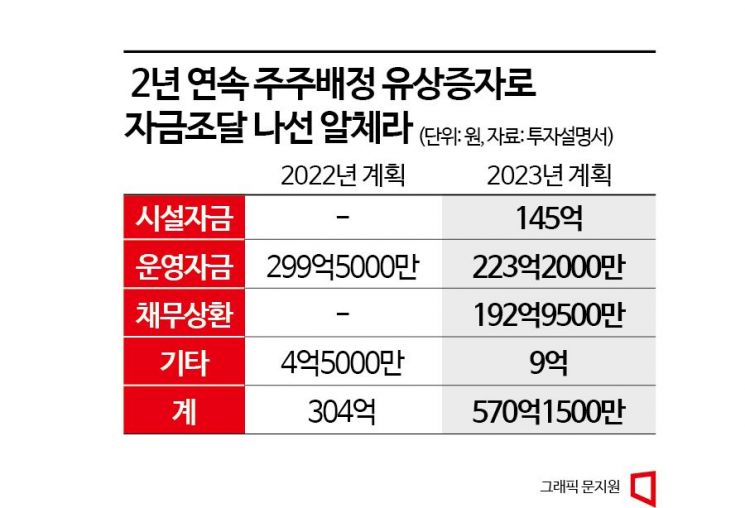

According to the Financial Supervisory Service, Alchera will issue 6.3 million new shares to raise 57 billion KRW. New shares will be allocated at a ratio of 0.29 shares per existing share. The final new share issuance price will be confirmed on December 1. If there are any unsubscribed shares after the subscription by existing shareholders, investors will be recruited through a public offering. Alchera plans to use the raised funds for research and development expenses, domestic marketing costs, operating expenses for overseas subsidiaries for overseas sales, and repayment of borrowings.

Previously, Alchera raised 30.4 billion KRW through a rights offering followed by a public offering of unsubscribed shares in November last year. It explained that the funds would be used for research and development expenses, domestic marketing costs, and operating expenses for overseas subsidiaries for overseas sales. Although it raised funds last year to be used until 2025, it has come back to raise funds again within a year.

Alchera stated that 23.2 billion KRW of the funds raised through last year's rights offering remain and will be executed by business segment according to the usage plan until 2025. The Alchera board of directors judged that additional funds are needed to expand the AI learning data business due to rapidly increasing demand. This is the reason for resolving another rights offering within a year.

Alchera has developed a platform and tools necessary for creating big data for AI technology development. The trained data is also sold to clients such as large corporations and research institutes for deep learning purposes. Sales from the AI learning data business division increased from 2.4 billion KRW in 2021 to 5.8 billion KRW last year, and recorded 1.4 billion KRW in the first half of this year.

Funds to respond to early redemption requests for convertible bonds (CB) issued in November 2021 will also be raised through this capital increase. Alchera privately issued convertible bonds worth 23 billion KRW for the purpose of strengthening AI technology, research and development (R&D), expanding overseas business networks, and operations. Since the issuance of the convertible bonds, Alchera's stock price has fallen below the conversion price. Convertible bond investors can request early redemption starting August 30 next year.

Alchera plans to raise redemption funds in advance through the rights offering, deposit them in financial products, and prepare for early redemption. If the stock price rises and conversion rights are exercised, the surplus redemption funds will be used for R&D and operating expenses.

Alchera raised 20 billion KRW through its initial public offering (IPO) at the end of 2020. The raised funds were explained to be used for R&D expenses incurred until the first half of 2021 and 2022. In the following September and November, it issued convertible bonds worth 26 billion KRW and 23 billion KRW respectively. Many domestic institutional investors participated.

The reason Alchera has continuously raised operating funds externally appears to be due to ongoing losses. Operating losses were 5.1 billion KRW in 2020, 11.1 billion KRW in 2021, and 16.9 billion KRW in 2022. At the time of the IPO, Alchera and the lead underwriter expected to turn a profit starting in 2021. They projected operating profits of 2.4 billion KRW in 2021, turning profitable compared to the previous year, and operating profits of 8.8 billion KRW and 17.3 billion KRW in 2022 and 2023 respectively. However, slower-than-expected revenue growth has delayed the timing of turning a profit.

The largest shareholder Snow, along with CEO Hwang Young-gyu and director Kim Jeong-bae, will acquire about 10% of the allocated new shares. The sale price will be determined based on Alchera's stock price between the 21st and 27th of next month, when new share subscription rights certificates can be traded. After the capital increase, the largest shareholder's stake may decrease from 31.2% to 24.9%.

Snow has promised to jointly hold shares with Alchera's management until December 20 this year. Although nothing has been finalized regarding the extension of the joint holding commitment, the possibility of extension is expected to be low. Depending on market conditions after next year, Snow may sell its shares. There is also a possibility that CEO Hwang may additionally purchase shares after the lock-up period on his holdings expires this December.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)