High Interest Rates and Exchange Rate Burdens Damage Fundamentals, Cooling Investor Sentiment

Investor Deposits and Market-Related Funds Continue to Decline

Recent CMA Balances Surge by About 7 Trillion Won

As uncertainties grow due to the sharp rise in long-term U.S. Treasury yields and the prolonged high interest rate environment, along with geopolitical instability caused by the escalating war between Israel and the Palestinian militant group Hamas, investor sentiment in the stock market is freezing up. Reflecting this, investor deposit funds, which serve as standby capital in the stock market, are rapidly decreasing. In contrast, the balance of securities firms' Comprehensive Asset Management Accounts (CMA) has increased. This is interpreted as investors, unable to find a definite investment destination, parking their funds in CMA to secure stable returns while seeking new investment opportunities.

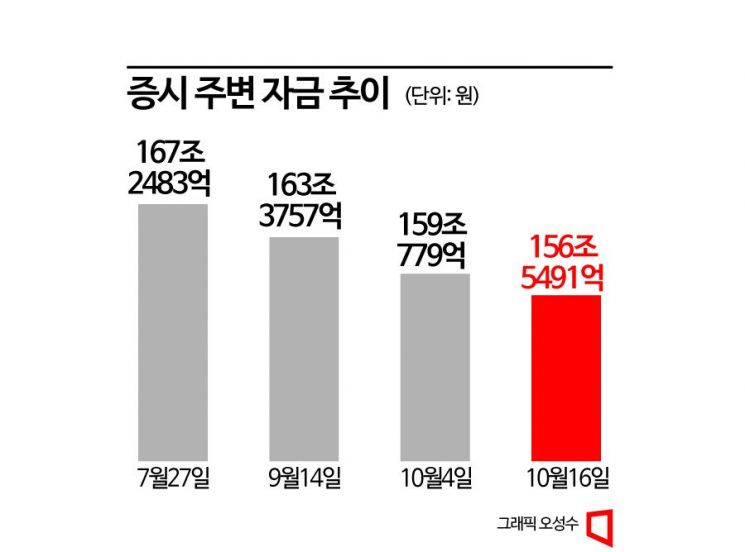

According to the Korea Financial Investment Association, as of the latest tally on the 16th, funds surrounding the stock market amounted to 156.5491 trillion won. Even as of the 11th, it was only 153.7225 trillion won. As of the 25th of last month, funds surrounding the stock market stood at 150.9838 trillion won, marking the lowest level in six months since March 31 (148.6097 trillion won), and it has remained at this low level without recovery even into October.

Funds surrounding the stock market include ▲investor deposit funds ▲derivatives transaction deposits ▲repurchase agreements (RP) ▲unsettled brokerage trades ▲credit transaction loan balances ▲and credit lending balances combined. Among these, investor deposit funds are considered a key indicator to gauge investor sentiment.

Investor deposit funds are heading toward their yearly low. As of the 16th, investor deposit funds were recorded at 47.7627 trillion won. On the first trading day of this month, the 4th, it was 52.2467 trillion won. Nearly 6 trillion won has exited the stock market. Investor deposit funds hit a low of 46.5389 trillion won on the 10th, the lowest since March 22 (46.3326 trillion won), and remained in the 46 trillion won range the following day. Currently, it fluctuates between 46 and 47 trillion won.

Experts see an increasing number of individual investors withdrawing from the domestic stock market. The rapid deterioration of investor sentiment is attributed to the sharp rise in U.S. long-term Treasury yields amid the Federal Reserve's prolonged high interest rate policy and the resulting increase in the won-dollar exchange rate. This phenomenon is more pronounced in the KOSDAQ than in the KOSPI. Lee Kyung-soo, a researcher at Hana Securities, analyzed, "Individuals have stopped investing in KOSDAQ since August," adding, "The net buying strength of individuals in KOSDAQ on days when the KOSDAQ index rose has not recorded a positive (+) value even once since August 10."

Many experts believe that investor sentiment among individual investors will not easily recover due to the combination of external risks such as prolonged high interest rates and high oil price forecasts, and internal problems like worsening trade balance and slowing economic growth, which weaken the fundamentals of the Korean stock market. In particular, high oil prices caused by the Israel-Palestine war are cited as a source of anxiety for individual investors. Kim Dae-jun, a researcher at Korea Investment & Securities, explained, "In a situation where the U.S. cannot act as an oil-producing country and the Middle East restricts oil supply, the global stock market, which was already slowing due to high inflation, could be hit again," adding, "Even if such signs are not immediately visible, the spread of potential anxiety is a significant burden for investors."

Meanwhile, unlike the decrease in investor deposit funds, the balance of securities firms' Comprehensive Asset Management Accounts (CMA), which had remained in the 64 trillion won range until recently, has suddenly exceeded 71 trillion won, attracting attention. On the 13th alone, the CMA balance surged by about 7 trillion won, indicating that individual investors, unable to find a definite investment destination, are flocking to CMA to secure stable returns while parking funds to seek new investments. As of the 16th, the CMA balance was recorded at 71.1743 trillion won.

CMA is a product where securities firms invest the funds entrusted by investors in short-term instruments such as government bonds, negotiable certificates of deposit (CD), and corporate bonds to generate returns. It offers an interest rate of around 3.5%, higher than that of deposit and withdrawal accounts at commercial banks, and has the advantage of earning interest even if the funds are deposited for just one day.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)