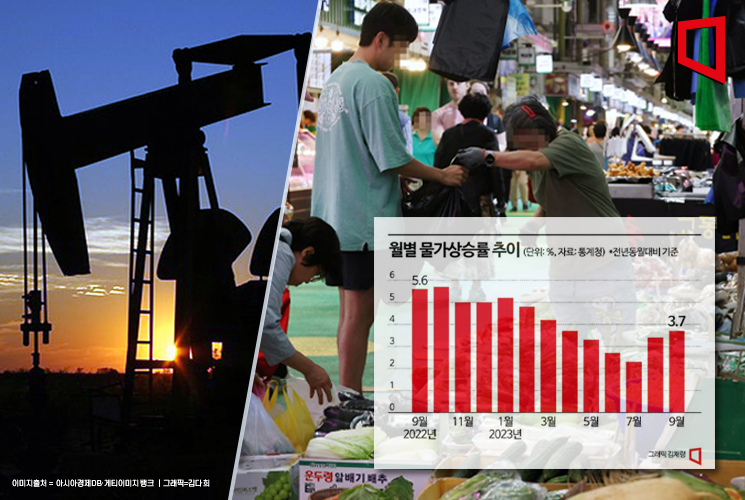

As the conflict between Israel and Hamas escalates, increasing uncertainty in the international oil price outlook, concerns are growing that the domestic inflation rate could re-enter the 4% range. If the situation expands to include oil-producing countries near the Middle East such as Iran, it is expected that the surge in energy prices like oil and gas will inevitably affect governments and the everyday economy of ordinary citizens worldwide.

On the 18th, the December delivery futures price of Brent crude oil at the London ICE Futures Exchange rose 0.28% from the previous day to $89.90 per barrel. After falling 2.09% to $85.82 per barrel on the 11th, the price rebounded sharply to $90.89 per barrel on the 13th, rising 5.69%, fluctuating in real time due to the impact of the Israel-Hamas armed conflict.

The problem is that the conflict shows signs of spreading to other Middle Eastern countries, which could accelerate the rise in oil prices. The key issue is whether Iran will intervene. Hamas, the Palestinian armed faction at the center of the conflict, is allied with Hezbollah, a Shiite armed group based in southern Lebanon, and Hezbollah has close ties with Iran's Islamic Revolutionary Guard Corps. If Iran intervenes in the war and blocks the Strait of Hormuz, through which 20% of the world's oil passes, a global oil supply disruption would become a reality. The International Finance Center, in a report titled 'Scenario-based Impact Assessment' released the day before, projected that in the worst-case scenario, international oil prices could surge to as high as $150 per barrel.

Concerns Over Rebound in Electricity, Gas, and Water Prices After Three Months

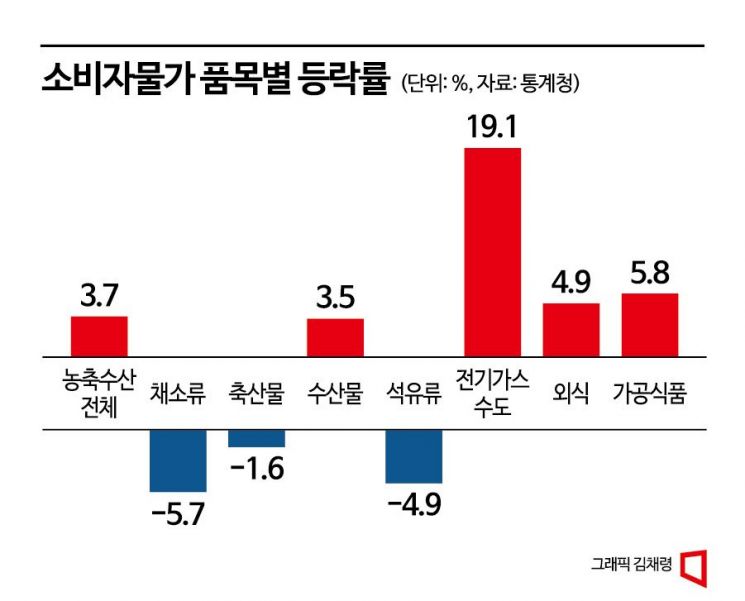

The unstable Middle East situation and fluctuating international oil prices are immediately increasing upward pressure on domestic energy prices such as electricity and gas. According to Statistics Korea, the inflation rate for electricity, gas, and water prices last month was 19.1%, marking a decline for three consecutive months since June (25.9%). However, this data is from before the Israel-Hamas conflict erupted on the 7th of this month. Considering that international oil prices typically take 2 to 3 weeks to be reflected in domestic prices, there is a high possibility that domestic electricity, gas, and water prices will rebound to the 20% range.

The possibility of heating cost increases this winter cannot be ruled out. Although the Ministry of Economy and Finance has been cautious about raising electricity and gas rates in the fourth quarter due to inflation concerns, there are opinions that the increase can no longer be postponed given Korea Electric Power Corporation's (KEPCO) growing deficit. KEPCO recorded a massive cumulative operating loss of 47 trillion won through the first half of this year, a consequence of soaring fuel prices such as oil and gas since 2021. Despite the government raising electricity rates five times since April last year by 39.6% (40.4 won) per kilowatt-hour (kWh), the deficit has not decreased.

If energy prices rise further this winter, the burden of heating costs and other difficulties for ordinary households are expected to increase. The government has taken measures to prepare for the surge in oil prices, such as extending the temporary reduction of fuel taxes, which was scheduled to end this month, for two more months until the end of the year. However, experts warn that if the Middle East conflict expands, the country must prepare for a situation where inflation soars, similar to the first and second oil shocks of the 1970s. The rise in energy prices due to soaring oil prices ultimately affects raw materials and manufactured goods, which in turn drives up consumer prices for processed foods, dining services, and more.

Everything Except Salaries Is Rising... Food and Dining Prices Surge

The food prices that ordinary people feel are also on the rise. Last month, the inflation rate for dining out was 4.9%, 1.2 percentage points higher than the overall consumer price inflation rate of 3.7%. This marks 28 consecutive months since June 2021 that the rate has exceeded the average. Among the 39 detailed dining out items surveyed by Statistics Korea, 31 items (79.5%) had inflation rates above average, and none showed a price decrease compared to the previous year.

Specifically, last month fruit prices soared 24.0%, with apples up 54.8%, peaches 40.4%, tangerines 40.2%, and strawberries 31.6%. Processed foods such as sugar and salt are also expected to continue rising for the time being. During the same period, the sugar price index rose 16.9% year-on-year. As of the previous day, the retail price of coarse salt (product) in a 5kg package was 13,277 won, up 18.5% from 11,202 won a year earlier.

Dining out prices are also soaring. The price of jajangmyeon, a popular affordable dish, has exceeded 7,000 won in Seoul. The price of a single serving (200g) of pork belly at restaurants rose by 103 won in one month to 19,253 won, and naengmyeon, which was in the 12,000 won range, increased to 11,308 won. Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho said, "The unfolding Israel-Hamas conflict has caused international oil prices to fluctuate sharply, expanding the uncertainty of global high inflation," adding, "We will form a pan-government joint inspection team to strengthen on-site inspections to prevent price hikes that ride on the volatility of international oil prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.