KB Housing Market Review "Rising from the Seoul Metropolitan Area to Daejeon, Chungbuk, and Gangwon"

50-Year Mortgage Loans Phased Out, Household Debt Increases Despite Interest Rate Hikes

Household Debt as of the 16th Shows Larger Increase Than Previous Month

The rise in housing prices is spreading from the Seoul metropolitan area to non-metropolitan regions. Financial authorities are making every effort to curb the increase in household loans, even going as far as suspending the sale of 50-year mortgage loans for the first time in 50 years, but it is proving insufficient to overcome the revived buying sentiment. Despite rising mortgage interest rates at banks, new loans are increasing, riding on the recovering housing market sentiment.

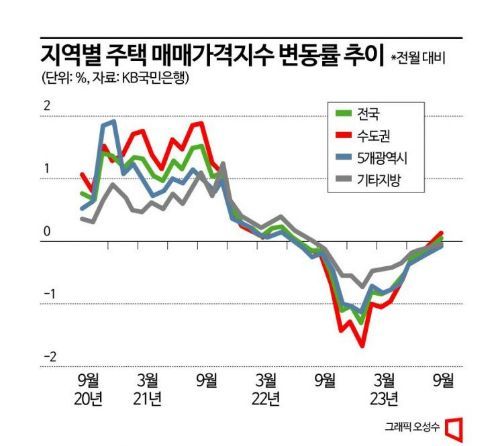

According to the 'KB Housing Market Review' released on the 18th by KB Financial Group Management Research Institute, "In September, nationwide housing sale prices rose by 0.06% compared to the previous month, with the metropolitan area increasing by 0.15%, and the total market value of 50 apartments saw an expanded rise for five consecutive months." It also stated, "In the metropolitan area, sale prices increased across all regions, while in non-metropolitan areas, the upward trend continued in Sejong City, with the rising regions expanding to Daejeon, Chungbuk, and Gangwon."

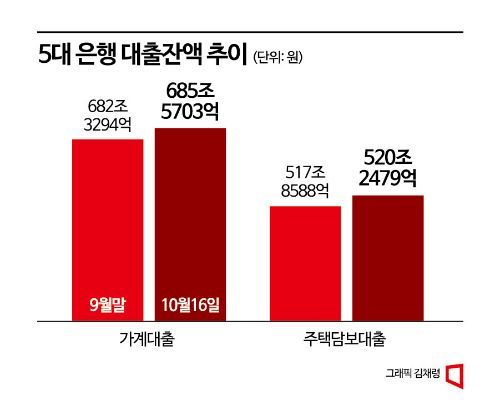

As the housing market recovers, the increase in household loans from the five major banks continues into October. As of the 16th, the outstanding household loans of the five major banks totaled 685.5703 trillion won, an increase of 3.2409 trillion won compared to the end of September (682.3294 trillion won). The increase in mortgage loans had the greatest impact. During the same period, mortgage loans rose by 2.3891 trillion won (from 517.8588 trillion won at the end of September to 520.2479 trillion won on October 16), pushing up the total household loan balance. If this trend continues, the pace of household loan growth could accelerate further. Between August and September alone, household loan balances increased by 1.5174 trillion won, and mortgage loans by 2.8591 trillion won.

An official from a commercial bank said, "Financial authorities have identified 50-year mortgage loans as the main culprit behind the increase in household loans and have pushed to remove them from the market, while bank loan interest rates have also shifted upward. Nevertheless, it seems difficult to stop the housing market from recovering and the accompanying buying sentiment."

The five major banks have been raising interest rates since last week by reducing preferential rates in line with financial authorities' demands to curb the surging household loan demand.

On the 11th, KB Kookmin Bank raised the mixed mortgage loan interest rate and the new balance-based COFIX variable rate (6-month new) by 0.1 percentage points and 0.2 percentage points, respectively. Woori Bank also increased the mixed mortgage loan interest rate and the new balance-based COFIX variable rate (6-month new) by 0.1 percentage points and 0.2 percentage points, respectively, starting from the 13th. NH Nonghyup Bank reduced the preferential mortgage loan interest rate by 0.2 percentage points and the preferential jeonse loan interest rate by 0.3 percentage points on the 17th.

Furthermore, with the COFIX announced on the 16th rising by 0.16 percentage points (from 3.66% in August to 3.82% in September), mortgage loan variable interest rates increased. As of the 17th, the variable mortgage loan interest rates at the five major banks ranged from 4.53% to 7.16%, and fixed rates ranged from 4.14% to 6.52%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.