1.8 Times Increase in 4 Years from 2018 to 2022

Inheritance of Securities at 28.5 Trillion Won...16.7 Times Rise

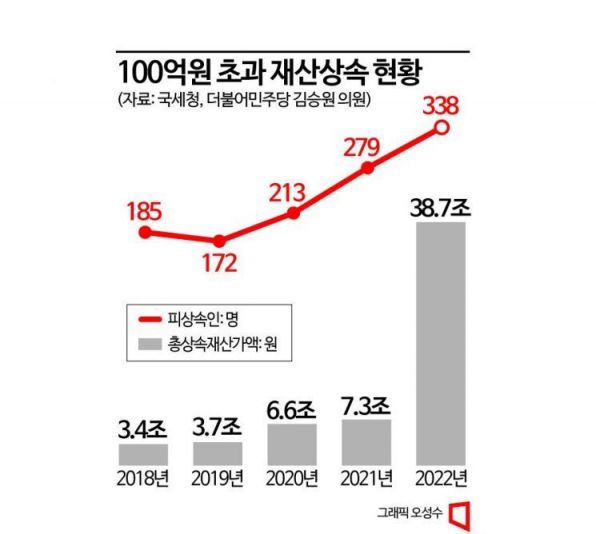

The number of decedents who left inheritances exceeding 10 billion won has increased by 1.8 times over the past four years. Last year, their inherited assets amounted to 39 trillion won.

According to the 'Inheritance Tax Decision Status' data received by Kim Seung-won, a member of the Democratic Party of Korea, from the National Tax Service on the 18th, there were 338 decedents (those who left assets) whose inherited assets exceeded 10 billion won last year.

This is an 82.7% increase compared to four years ago in 2018 (185 people). By year, the numbers were ▲2018 (185 people) ▲2019 (172 people) ▲2020 (213 people) ▲2021 (279 people) ▲2022 (338 people).

There were 26 decedents who left assets exceeding 50 billion won last year. Those with inherited assets exceeding 10 billion won but less than or equal to 50 billion won numbered 312. Compared to 2018, these increased by 14 people (116.7%) and 139 people (80.3%), respectively.

The total value of inherited assets for decedents with assets exceeding 10 billion won was 38.7 trillion won. This is an 11.4-fold increase from four years ago (3.4 trillion won). The inheritance tax imposed on these assets amounted to 16.5 trillion won, accounting for 85.4% of the total inheritance tax decided last year (19.3 trillion won).

Although the value of assets such as real estate, stocks, and land has increased due to price rises, there has been little change in inheritance tax deductions, leading to an increase in the scale of assets subject to inheritance tax. The value of inherited assets subject to inheritance tax last year was 62.7 trillion won, a 314.1% increase compared to 15.1 trillion won in 2018.

Stock Frenzy Led by COVID-19... Increase in Minors Holding Stocks

By asset type, the proportion of stock inheritance has significantly increased. Securities, which were worth 1.7 trillion won in 2018, rose to 28.5 trillion won, about 16.7 times higher. Additionally, buildings were valued at 15.3 trillion won, and financial assets such as deposits and savings reached 5.5 trillion won, increasing by 227.4% and 113.0%, respectively, over four years.

The National Tax Service believes that the stock frenzy triggered by the COVID-19 pandemic has also influenced minors' stock holdings.

The National Tax Service particularly noted that many parents have increasingly gifted assets expected to appreciate in value, such as stocks, to their children before tax law revisions. This is interpreted as parents transferring stocks before the 2021 tax law amendments, which were scheduled to impose both gift tax and income tax. In fact, the number of minors (aged 0-18) receiving dividend income increased more than twofold from 279,724 in 2020 to 673,414 in 2021.

Furthermore, the National Tax Service revealed that the number of '0-year-old dividend recipients'?newborns who received stocks immediately after birth?has increased 33 times over four years. By year, the numbers were ▲2017: 219 ▲2018: 373 ▲2019: 427 ▲2020: 2,439 ▲2021: 7,425. The 0-year-old dividend recipients, who numbered only 219 in 2017, increased 33-fold in four years.

Meanwhile, the government is considering reforming the inheritance tax system into an estate acquisition tax. Currently, the estate tax method, which taxes the entire value of inherited assets, is adopted, but it plans to change to a method that taxes inheritance based on the value of assets each heir receives.

Representative Kim said, "As wealth inheritance strengthens, the lives of ordinary people have become even more difficult," adding, "I hope the government will prepare policies where people are rewarded according to their work."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.