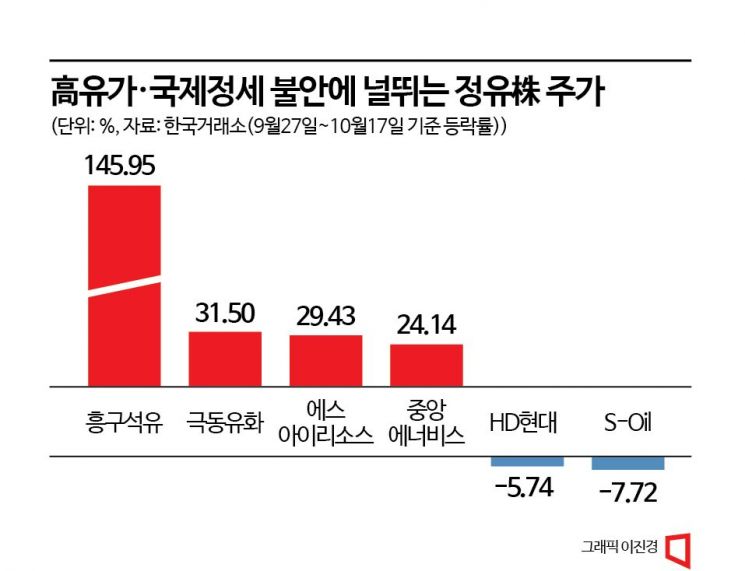

Stock Prices of Related Companies Like Heunggu Oil and Geukdong Petrochemical Volatile

Low Possibility of Middle East Conflict Escalation and Expected Decline in Oil Demand Next Year

Concerns Raised Over Middle Eastern Oil-Producing Countries Weaponizing Oil Amid Israel-Palestine War Worsening

International oil prices, which had been rising sharply in the second half of this year, appeared to stabilize somewhat this month. However, due to the rapidly destabilizing international situation such as the Israel-Palestine war, uncertainty is increasing again. The stock prices of energy and refining-related companies listed on the domestic stock market are also fluctuating wildly, raising concerns about the need for caution in investment.

According to the Korea Exchange on the 18th, the stock price of Heungkuk Oil, a KOSDAQ-listed company engaged in retail and wholesale of petroleum products such as gasoline, kerosene, and diesel, surged 145.95% this month alone (as of the closing price on October 17). On October 4th and 5th, the stock price plunged by 7-8% on consecutive days, but on the 10th, it suddenly rose to the price limit (30%) and then surged for five consecutive trading days. This is interpreted as an effect of increased oil price uncertainty due to the outbreak of war between Israel and the Palestinian militant group Hamas. However, Heungkuk Oil’s stock price plunged again by 7.37% in one day after news spread that U.S. President Joe Biden was planning to visit Israel, raising hopes for easing tensions in the Middle East. The stock price of Geukdong Petrochemical, a lubricant business and petroleum distribution company, also showed extreme volatility, rising 26.10% on the 10th and then declining for two consecutive days.

International oil prices, which had been steadily rising since July, peaked in the $90 range at the end of last month and have since fluctuated, showing instability. According to the New York Mercantile Exchange, the West Texas Intermediate (WTI) futures price hit a yearly high of $93.68 per barrel on September 27. Since then, it has followed a downward trend, entering the $80 range at the beginning of this month. Some had early expectations of a peak-out (decline after the peak), but the Israel-Palestine war has again threatened the $90 level, causing repeated ups and downs. On the 16th (local time), it closed at $86.66.

Projections for the international oil price trend are divided. Although instability in the Middle East continues, the core conflict areas are not major oil-producing regions, so there has been no disruption in supply yet. Kim Kwang-rae, senior researcher at Samsung Futures, explained, "The market is currently restraining excessive concerns about the possibility of escalation within the Middle East. The U.S. is focusing on suppressing escalation through direct diplomacy with Iran, Israel (a party to the war), and neighboring countries such as Saudi Arabia and Egypt. Reports of active negotiations to ease additional sanctions with Venezuela have also led to a slight adjustment in oil prices." Venezuelan crude oil had been difficult to export and import due to U.S. third-party sanctions until last year, but it has been exported to regions including the U.S. and Europe since early this year due to urgent inflation control. Kim added, "Although large-scale production increases are unlikely due to Venezuela’s poor infrastructure, it is expected to definitely help alleviate market supply concerns."

The International Energy Agency (IEA) recently lowered its forecast for next year’s oil demand increase from 1 million barrels per day to 880,000 barrels per day, which also exerted downward pressure on oil prices.

At the same time, there are forecasts that caution should still be exercised regarding the possibility of oil price increases. Even though Israel and Palestine are not oil-producing regions, the possibility that Middle Eastern oil-producing countries might weaponize oil, as in the 1970s, cannot be completely ruled out. Additionally, expectations that Saudi Arabia, one of the major oil producers, will continue its production cut policy into next year add to this. Jeon Gyu-yeon, a researcher at Hana Securities, said, "Before the Israel-Palestine war, Saudi Arabia sought to establish a mutual defense agreement with the U.S., and the U.S. wanted normalization of relations between Saudi Arabia and Israel. However, after the war, Saudi Arabia expressed support for Palestine, effectively halting negotiations for diplomatic ties with Israel. As a result, Saudi Arabia has lost incentives to increase oil production, and the production cut policy is likely to continue into next year, with Russia likely to follow suit."

The U.S. Energy Information Administration (EIA) also revised its oil price forecast for next year upward by 9.2% to an average of $90.9 per barrel (WTI basis), reflecting OPEC’s production cuts.

Given the instability of oil prices due to the unexpected armed conflict in the Middle East, there are calls for caution in investing in related stocks. Park Sang-hyun, a researcher at Hi Investment & Securities, said, "With the imminent ground troop deployment to Gaza by Israel and Iran’s warnings to Israel, this week is likely to be a crucial short-term turning point for the expansion of the Middle East conflict, which will increase oil price volatility. If concerns about the expansion of the Middle East conflict cause oil prices to threaten or exceed the $90 level again, there is a high possibility that the dollar’s strength will expand due to a rebound in U.S. Treasury yields."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)