Office of Assemblyman Park Jae-ho's tally... Samsung Fire & Marine Insurance has the highest number of cases

Annual litigation costs amount to 17 to 18 billion KRW

It has been revealed that the insurance industry has filed a total of 54,464 lawsuits over the past three years. There are calls for measures to be put in place to prevent insurance companies from indiscriminately suing ordinary financial consumers.

According to data submitted by the Financial Supervisory Service to Park Jae-ho, a member of the National Assembly's Political Affairs Committee from the Democratic Party of Korea, the number of lawsuits filed by the insurance sector over the past three years reached a total of 54,464. During the same period, the litigation costs incurred due to legal disputes were estimated at approximately 44.223 billion KRW.

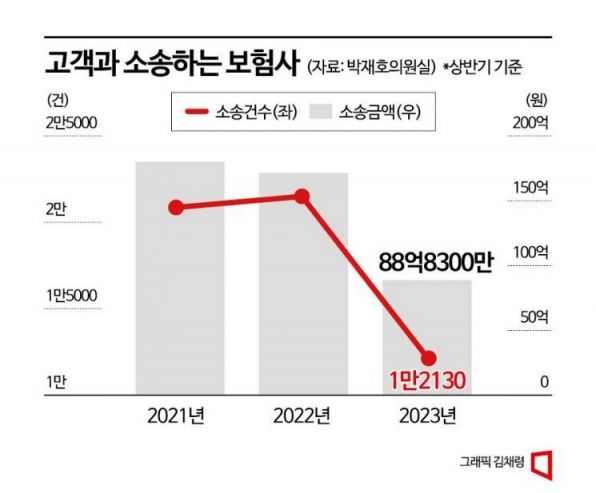

Insurance companies conducted ▲20,860 lawsuits in 2021 ▲21,501 lawsuits in 2022 ▲12,130 lawsuits in the first half of 2023. In terms of litigation expenses, they spent ▲18.0183 billion KRW in 2021 ▲17.157 billion KRW in 2022 ▲8.883 billion KRW in the first half of 2023.

By sector, life insurance lawsuits numbered 5,812, with litigation costs amounting to 10.547 billion KRW. Non-life insurance saw 48,652 lawsuits, with litigation expenses totaling 33.676 billion KRW.

The insurance companies involved in the most legal disputes were Samsung Fire & Marine Insurance (11,257 cases) and Hyundai Marine & Fire Insurance (8,364 cases). They spent 3.825 billion KRW (Samsung Fire & Marine Insurance) and 6.848 billion KRW (Hyundai Marine & Fire Insurance) respectively on litigation costs. In contrast, IBK Pension Insurance had no lawsuits at all over the three years.

The reason insurance companies incur such litigation costs is pointed out to be the continuous disputes with consumers during the insurance claim assessment and payment process.

Over the past three years, the number of complaints by sector was 42,256 for life insurance and 85,135 for non-life insurance. Among complaints related to non-life insurance, those concerning 'insurance claim assessment and payment' accounted for 44,239 cases, representing 52% of the total. In the life insurance sector, complaints related to 'insurance claim assessment and payment' were the second most frequent type after 'insurance solicitation.'

Assemblyman Park said, "Large insurance companies operate their businesses with money paid by customers, but paradoxically, they spend more than 17 billion KRW annually to give customers less money or no money at all," adding, "The Financial Supervisory Service should take the lead in guiding insurance companies to prevent them from indiscriminately filing lawsuits against ordinary consumers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.