Hoban Summit Gaebong, Sangdo Prugio Uncontracted Units Released

Experts Say "Blind Subscription" Is the Cause

High Interest Rates and Stricter Loan Requirements Cause Confusion in the Sales Market

With housing supply instability, the enthusiasm for apartment subscription is heating up, and a large number of non-priority subscriptions, so-called 'Jupjup,' are appearing in Seoul. The perception that 'today's sale price is the cheapest' is widespread, leading the industry to expect smooth sellouts. However, as high interest rates continue and loan requirements are tightening, experts advise that decisions should be made considering location and financial capability rather than 'blind subscriptions.'

According to Korea Real Estate Agency's Subscription Home on the 14th, Hoban Construction will conduct a non-priority subscription for 72 unsold units of 'Hoban Summit Gaebong' in Guro-gu, Seoul, on the 16th. The total general sale units of this apartment, including special supply, were 190, of which 38% were released as non-priority units. By area, the units consist of 1 unit of 49㎡, 7 units of 59㎡A, 4 units of 59㎡B, 20 units of 84㎡A, 29 units of 84㎡B, 9 units of 84㎡C, 1 unit of 84㎡P, and 1 unit of 114㎡. Hoban Summit Gaebong held a first-priority subscription last month. At that time, 2,776 people applied for 110 units (excluding special supply), recording an average competition rate of 25.24 to 1.

On the 15th, a first-come, first-served sale will be held for 'Sangdo Prugio Clavenue' in Dongjak-gu, Seoul. As a post-sale complex, the first-priority subscription attracted 5,626 applicants for 401 units (out of a total of 771 units), closing with an average competition rate of 14 to 1, but many contract cancellations occurred. Daewoo Construction, which supplied the complex, did not disclose the number of remaining units.

Recently, the apartment subscription market has been very hot due to the perception that 'today is the cheapest' and growing housing supply instability. Nevertheless, experts see the large number of contract cancellations as caused by prices exceeding appropriate sale prices and 'just applying first' blind subscriptions.

In fact, for Hoban Summit Gaebong, the highest sale price for an 84㎡ unit is 999.6 million KRW, and including balcony expansion fees, it exceeds 1 billion KRW. This is significantly higher than the recent actual transaction price of 840 million KRW for an 84㎡ unit at 'Gaebong Prugio,' located directly opposite this apartment. An industry insider explained, "The perception that 'sale prices are cheapest today' has led to many blind subscriptions without sufficient analysis of financial capability or product value, resulting in high competition rates but also many unsold units." Nevertheless, they added, "With rising material and labor costs, and the likelihood of continued price increases, most of the unsold units in Seoul will eventually find owners."

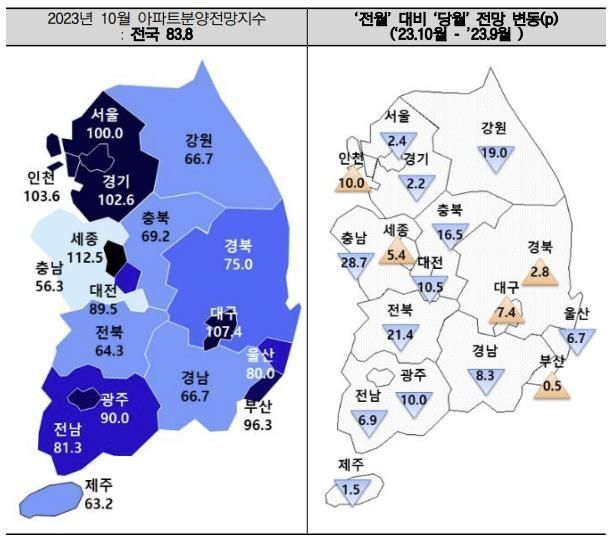

However, as the high interest rate trend is lasting longer than expected and the government has tightened loan requirements such as special housing loans, the future of the sale market is not entirely bright. According to the Housing Industry Research Institute, the apartment sale outlook index for October was 83.8, down 6.4 points from the previous month. This index is based on 100; a positive (+) means more businesses view the sale outlook positively, while a negative (-) means more view it negatively. The national index recorded 100.8 in August, surpassing the baseline of 100 for the first time in 2 years and 2 months since June 2021, but it has declined again since last month. In Seoul, the October index is still 100, indicating a stable outlook, but it continues to decline.

The Housing Industry Research Institute analyzed, "With continued high interest rates and strengthened special housing loan criteria, the apartment sale market may shrink further in the future. However, we need to observe how the U.S. Federal Reserve's decision on interest rate freezes and the government's recently announced housing supply activation plan will impact the market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.