MoEF, Monthly Fiscal Trends October Issue to be Released on the 12th

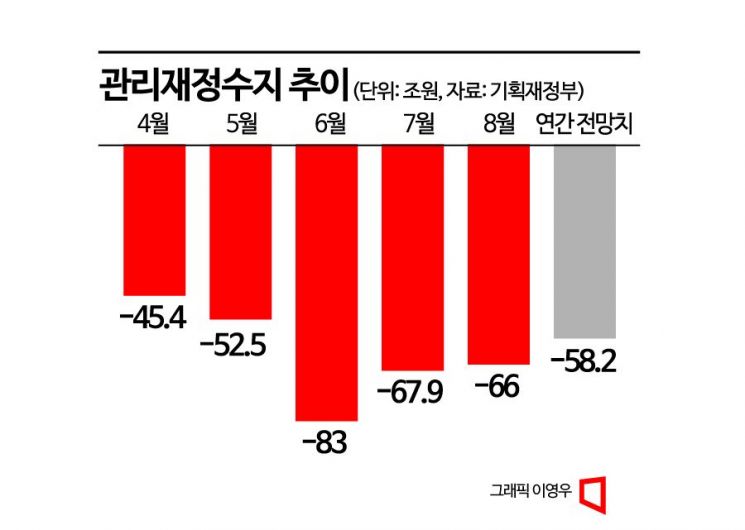

National debt exceeded 1,110 trillion won as of the end of August. The management fiscal balance, which reflects the state of the national finances, recorded a deficit of 66 trillion won. Although the deficit improved by 1.9 trillion won compared to the previous month, it still exceeds the annual forecast.

According to the monthly fiscal trend report released by the Ministry of Economy and Finance on the 12th, the management fiscal balance was recorded as a deficit of 66 trillion won as of the end of August. The management fiscal balance is the figure obtained by subtracting social security funds from the integrated fiscal balance (total revenue - total expenditure), representing the overall national finances. The deficit decreased from 67.9 trillion won at the end of July to 66 trillion won. Compared to the same month last year, it improved by 19.3 trillion won.

The Ministry of Economy and Finance explained that the management fiscal balance is continuously improving. The management fiscal balance, which recorded a deficit of 83 trillion won as of the end of June, continued to improve in July and August. The integrated fiscal balance also improved by 6.6 trillion won from the previous month to 31.3 trillion won as of the end of August. However, it still exceeds the government’s target of 58.2 trillion won for this year. There is also a base effect due to reduced spending from the downsizing of COVID-19 response projects (16.9 trillion won) and the end of compensation payments to small business owners (36 trillion won). A Ministry of Economy and Finance official said, “In the economic outlook for the second half of the year, the Ministry expects this year’s gross domestic product (GDP) to be 2,235 trillion won, and based on that, the management fiscal balance recorded 2.95%, falling below 3%.”

The reason the management fiscal balance deficit is larger than the government’s forecast is due to reduced government revenue caused by the economic downturn. Total revenue decreased by 44.2 trillion won compared to the same period last year, recording 394.4 trillion won, as national taxes and non-tax revenue declined. In particular, national tax revenue was 241.6 trillion won, down 47.6 trillion won from the same period last year. Corporate tax decreased by 20 trillion won due to worsening corporate performance, and income tax also fell by 13.9 trillion won due to a decline in real estate transactions. Non-tax revenue also decreased by 2.8 trillion won compared to the same period last year, recording 19.3 trillion won, influenced by a reduction in surplus funds from the Bank of Korea.

Amid the tax revenue shortfall, the government is tightening its belt, but national debt continues to rise. As of the end of August, total expenditure recorded 425.8 trillion won, down 63.5 trillion won compared to the same period last year, but central government debt increased by 12.1 trillion won from the previous month to 1,110 trillion won. In particular, it has already surpassed the year-end forecast of 1,101.7 trillion won this year, increasing by 76.5 trillion won compared to last year’s final settlement debt (1,033.4 trillion won).

The Ministry of Economy and Finance expects that continuous repayment of government bonds will reduce the debt amount to the government’s forecast by the end of the year. Government bond repayments are made in March, June, September, and December when maturities come due. A Ministry official explained, “We expect to repay about 24 trillion won going forward, so by the end of the year, the debt amount is expected to approach the forecast.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)