Steve Eisman as Famous as Michael Burry

Highlights Risks in Home Construction and Consumer Finance Stocks

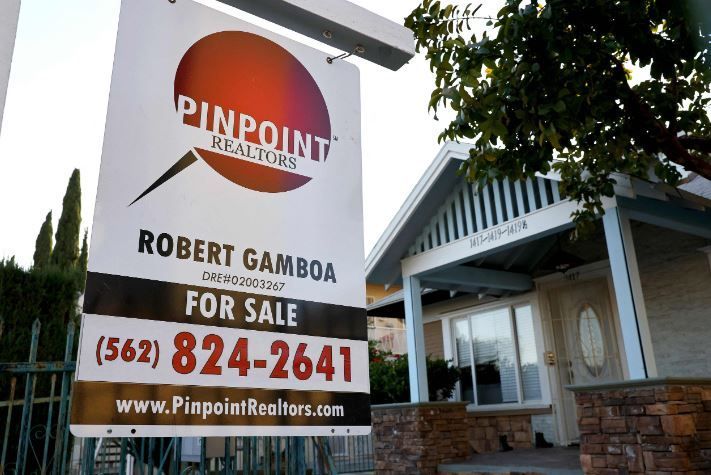

"Housing Market Locked... Can't Buy or Sell"

Investor Steve Eisman, known as one of the real-life protagonists of the movie 'The Big Short' alongside Michael Burry, advised avoiding stocks related to construction and consumer finance.

According to the U.S. economic media CNBC on the 10th (local time), Eisman said in an interview with the outlet, "Considering higher interest rates, I advise against buying stocks related to home construction and consumers."

He added, "I would not hold homebuilder stocks right now," explaining, "Homebuilders have been providing subsidies to customers with lower interest rates, but even that could be withdrawn."

The average 30-year fixed mortgage rate in the U.S. recently surged to 7.49%. It is the first time in 23 years that mortgage rates have reached this level. As a result, the household burden of housing loans has sharply increased, raising the risk of a freeze in real estate sentiment within the U.S.

U.S. mortgage rates are linked to the 10-year Treasury yield. The bond yield recently approached 5%, marking the highest level in 16 years. The Wall Street Journal (WSJ), CNN, and others have forecasted that mortgage rates could reach 8% accordingly.

Regarding this, Eisman explained, "No employed person will sell their house. That is why the housing market is locked. People are in a situation where they can neither buy nor sell."

Eisman also cautioned about consumer finance-related stocks. He emphasized, "Consumers may face higher costs to finance expensive goods, including automobiles. Stocks that finance new and used cars should not be bought. Simple math shows that problems can arise throughout that sector."

He also saw the banking sector as potentially risky. Eisman explained, "The banking sector will also find it difficult to invest in risky assets due to margin pressure and stricter regulations."

Eisman, a former fund manager at U.S. asset management firm Neuberger Berman, is famous for predicting the financial crisis triggered by the 2008 U.S. subprime mortgage crisis. Additionally, in the late 1990s, he gained attention while working as an analyst at the investment firm Oppenheimer by pointing out the insolvency issues of small mortgage companies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)