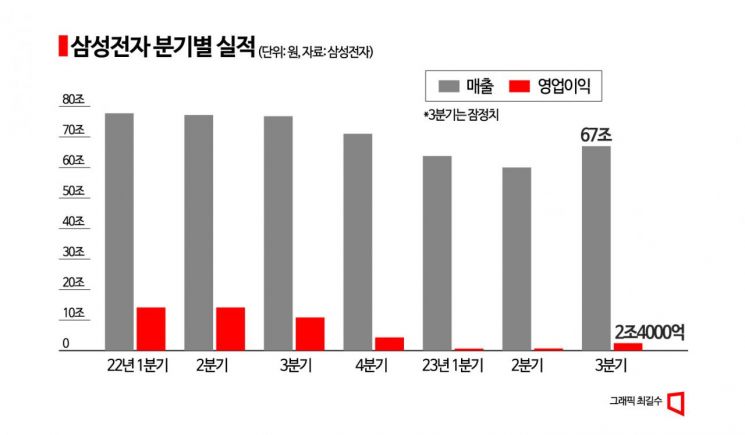

Samsung Electronics was able to achieve an operating profit of 2.4 trillion KRW in the third quarter, exceeding expectations, largely due to the gradual recovery of global IT demand and market conditions in the second half of the year, which led to noticeable improvements in both the set and component businesses. The effect of new smartphone launches was clearly reflected in the third-quarter performance of the Mobile (MX) and Display (SDC) divisions. The Semiconductor (DS) division succeeded in reducing losses through sales of high-value-added products such as ▲DDR5 ▲HBM3 and expanding new orders.

◆ Mobile and Display Businesses Benefit from New Smartphone Launches = Although the third-quarter results by business division have not been disclosed, industry insiders estimate that the Mobile division's operating profit in the 3 trillion KRW range more than offset the Semiconductor division's operating loss of around 3 trillion KRW. Additionally, the Display business generated nearly 2 trillion KRW in profit, and subsidiaries such as Harman in home appliances and automotive electronics maintained performance levels similar to last year, enabling Samsung Electronics' overall third-quarter operating profit to exceed 2 trillion KRW.

Samsung Electronics' estimated smartphone and tablet shipments in the third quarter were 59 million units and 5.9 million units, respectively. This significant increase in sales was driven by the launch of Samsung's new smartphones, Galaxy Z Flip5 and Galaxy Z Fold5, in August this year. The mobile industry expects that Samsung Electronics' MX division posted operating profits exceeding 3.2 trillion KRW, the amount earned a year ago in the third quarter. The strategy focused on flagship models and upselling (selling higher-end models) successfully boosted MX division results in the quarter when new smartphones were launched.

The Display division also played a key role in improving third-quarter results. For small and medium-sized displays, orders likely surged in conjunction with new product launches by major global smartphone clients such as Samsung and Apple. Many securities analysts, including those at Meritz Securities, predict that Samsung Electronics' Display division's profit will approach 2 trillion KRW. In home appliances, the company appears to have focused on expanding sales of eco-friendly, energy-efficient products based on SmartThings energy-saving features, while concentrating on the global expansion and operational efficiency of Bespoke appliances.

◆ Semiconductor Losses Narrowed Due to Memory Market Recovery = The Semiconductor division has recorded operating losses every quarter this year, but analysts note that the main culprit, memory semiconductor prices, has bottomed out and entered a recovery trajectory, leading to a reduction in losses. Expectations are rising that with memory prices increasing and the overall semiconductor market rebounding, the Semiconductor division could return to profitability next year.

Samsung Electronics is estimated to have recorded an operating loss of around 3 trillion KRW and sales of 140 to 150 trillion KRW in the Semiconductor division in the third quarter. The company posted operating losses of 4.58 trillion KRW and 4.36 trillion KRW in the first and second quarters, respectively, but conditions improved in the third quarter, allowing for a reduction in losses. This was due to the effects of memory semiconductor production cuts. The third quarter saw an increase in Samsung Electronics' DRAM shipments, with the average selling price (ASP) likely rising by about 3-4% compared to the previous quarter. DRAM ASP had been declining steadily in the first half of this year.

Additionally, optimizing the portfolio toward high-value-added and high-capacity products also contributed to narrowing losses. Samsung Electronics has expanded the proportion of advanced DRAM products such as Double Data Rate (DDR)5, Low Power Double Data Rate (LPDDR)5X, and High Bandwidth Memory (HBM) in high-performance servers and premium mobile products, while increasing the share of advanced NAND processes like V7 and V8. In the System LSI division, the company has secured performance for flagship mobile SoC (System on Chip) products and strengthened cooperation with clients to expand new business solutions beyond smartphones.

In the fourth quarter, the accounting books are expected to fully reflect performance improvements due to the semiconductor market recovery. Industry insiders are cautiously optimistic that DRAM and NAND prices could simultaneously rebound in the memory market during this period. This expectation is based on continued aggressive production cuts by memory manufacturers, including Samsung Electronics, which may have reduced inventory levels and balanced supply and demand in the market.

Next year, escaping semiconductor losses is also considered possible. There are growing forecasts that the entire semiconductor market, including memory, will recover next year. Recently, the Semiconductor Equipment and Materials International (SEMI) projected that semiconductor fab equipment investment will increase by 15% next year compared to this year, stating that "the semiconductor industry will move past the downturn and return to stable growth supported by increased demand."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.