Tesla Model S and Model Y Prices in North America Drop Below Gasoline Car Prices

Battery Cell Price per kWh Falls Below $100

Electric Vehicle Demand Slump and Mineral Price Decline Combined

Accelerating EV Transition... Burden on Korean EV and Battery Companies

The so-called parity phenomenon, where electric vehicle (EV) prices fall below those of internal combustion engine (ICE) vehicles, has emerged. Battery prices have also dropped below $100 per kilowatt-hour (kWh), a level considered the "tipping point." Both indicators have been regarded as prerequisites for the explosive growth of EVs. However, recent developments are seen as temporary and not necessarily positive signals for domestic EV and battery companies.

On the 10th, Bloomberg reported that the prices of Tesla's popular EV models, Model 3 and Model Y, have fallen below those of competing ICE vehicles in the North American market. Tesla lowered the starting price of the Model 3 from $40,240 to $38,990 this month, making it $8,700 cheaper than comparable ICE vehicles. The Model 3 can now be purchased in the U.S. for $6,500 less than the lowest price of BMW's 3 Series. The Model Y was found to be $3,700 cheaper than the average price of ICE vehicles ($48,000).

This phenomenon has occurred more than two years earlier than experts had predicted. The market had anticipated that the price of pure EVs, excluding subsidies, would fall below that of ICE vehicles no earlier than 2025. The International Energy Agency (IEA) recently forecasted in a report that "price parity for small and medium-sized EVs in North America and Europe could be achieved by the mid-2020s." Jim Farley, CEO of Ford, also stated at Investor Day that "the cost of producing EVs will equal that of ICE vehicles after 2030."

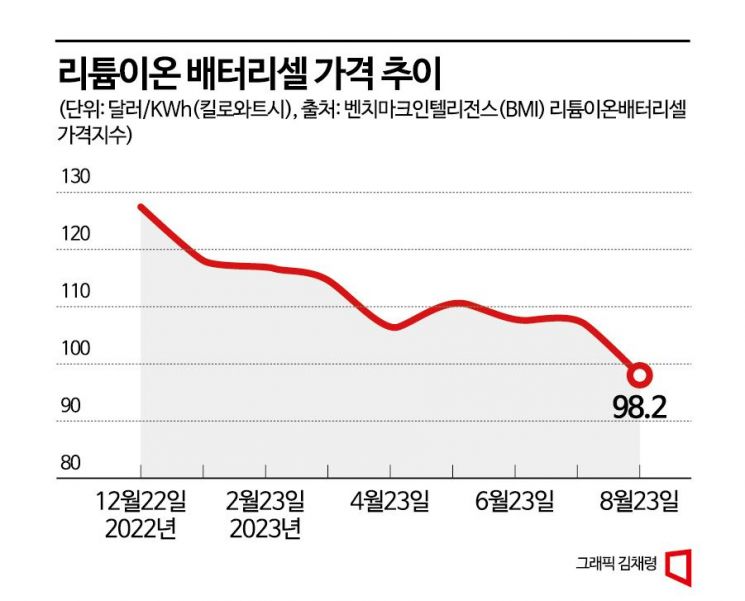

Reports have also indicated that the battery cell price, which accounts for the largest portion of EV costs, has fallen below $100 per kWh. Market research firm Benchmark Mineral Intelligence (BMI) announced that as of August, the price of lithium-ion battery cells was $98.2 per kWh, a 33% drop from $146.3 in March. According to BloombergNEF, the average battery cell price last year was $151/kWh.

BMI explained, "For EV prices to reach parity with ICE vehicles, battery cell prices must hit $100," adding, "The decline in battery cell prices will make the transition to EVs attractive to both automakers and consumers."

The drop in battery cell prices is due to a sharp decline in major mineral prices this year. According to BMI, prices of lithium carbonate and lithium hydroxide have fallen 52% and 58%, respectively, since the beginning of the year. Consequently, cathode and anode material prices are trading 41.9% and 17.6% lower.

The fall in EV prices below those of ICE vehicles may be a temporary phenomenon. Nonetheless, the price decline poses a burden on domestic EV and battery companies.

Byunghwa Han, director at Eugene Investment & Securities, explained, "The recent price cuts led by Tesla and China's BYD appear to be measures responding to decreased EV demand rather than cost reductions from increased demand and economies of scale."

In fact, Tesla's recent price cuts came after it announced that third-quarter deliveries fell short of expectations. Tesla reported on the 2nd that deliveries in July and August totaled 435,059 units, a 7% decrease compared to the second quarter.

Price competition in the EV market also puts pressure on battery cell and material suppliers. However, some analyses suggest that domestic battery companies will not be significantly affected. Samsung Securities analyst Junghoon Jang said, "While it may be psychologically burdensome, there are few alternatives to Korean battery companies in the global market, so the price pressure will not be substantial."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.