Samsung Electronics is expected to report operating profits in the 'trillion-won range' in its preliminary earnings announcement for the third quarter (July to September) on the 11th. After having to settle for operating profits in the 600 billion won range due to the semiconductor market downturn in the first and second quarters of this year, there is strong anticipation that Samsung Electronics will begin recovering trillion-won level profits in the third quarter and embark on a full-scale earnings rebound from the fourth quarter.

The consensus operating profit for Samsung Electronics in the third quarter, as provided by financial information provider FnGuide (average of securities firms' forecasts), is 68.0287 trillion won in sales and 2.1927 trillion won in operating profit. It is predicted that sales will decrease by 11.40% and operating profit by 79.79% compared to the third quarter of last year. Among 15 securities firms that recently presented earnings forecasts for Samsung Electronics, five expect operating profits exceeding 2 trillion won.

Although Samsung Electronics is about to announce earnings smaller than last year, the prospect of operating profits recovering to the trillion-won level is encouraging. In August this year, sales of Samsung Electronics' new smartphones, Galaxy Z Flip5 and Galaxy Z Fold5, increased, leading to a clear improvement in the MX (mobile) division's performance. Moreover, with the recovery in demand for IT devices, demand and prices for DRAM semiconductors have bottomed out and rebounded, narrowing the semiconductor division's losses, which supports the achievement of trillion-won operating profits. Additionally, the SDC (display) division is expected to make a significant contribution to overall earnings improvement, buoyed by the launch of new products by North American clients.

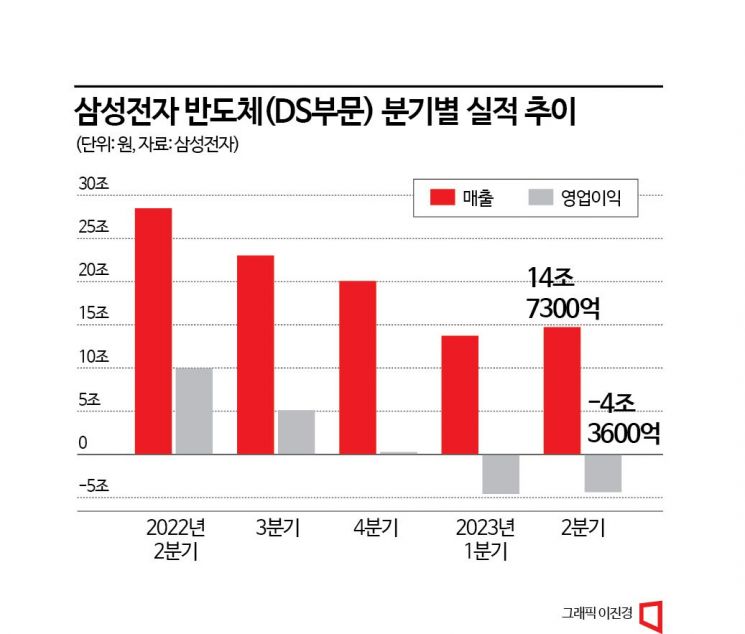

The market, which anticipates Samsung Electronics' recovery to trillion-won operating profits, is now focusing on how much the semiconductor division can reduce its losses in the third quarter of this year. Samsung Electronics posted operating losses of 4.58 trillion won in the semiconductor (DS) division in the first quarter and 4.36 trillion won in the second quarter. The semiconductor losses were the biggest reason why Samsung Electronics' total operating profit for the first and second quarters was limited to the 600 billion won range. However, the semiconductor division's losses, which reached 9 trillion won in the first half, are expected to start decreasing significantly from the third quarter. Industry insiders expect the semiconductor division's losses in the third quarter to be in the 2 to 3 trillion won range, decreasing by more than 1 trillion won compared to the first and second quarters, and to shrink to around 1 trillion won in the fourth quarter.

The immediate basis for expecting the semiconductor operating loss to be reduced by more than 1 trillion won is the recovery of the DRAM and NAND markets due to production cuts. The average fixed transaction price of PC DRAM general-purpose products (DDR4 8Gb 1Gx8) in September was $1.30, maintaining the same level as the previous month. The average fixed price of DRAM had fallen for five consecutive months until August after dropping 19.89% in April compared to the previous month, but the decline stopped in September due to the effects of production cuts in the memory industry. NAND flash prices are also expected to rebound as the industry is currently increasing the scale of production cuts.

If the current trend continues, there is hope that Samsung Electronics' semiconductor division will turn from an operating loss of about 14 trillion won this year to a profit exceeding 10 trillion won next year. Min Bok Wi, a researcher at Daishin Securities, said, "In the fourth quarter, DRAM contract prices are expected to rebound, and NAND prices are also expected to rise, which could reduce the deficit to less than 1 trillion won in the fourth quarter." Dongwon Kim, a researcher at KB Securities, also said, "It is estimated that Samsung Electronics has implemented double-digit price increases for DRAM and NAND for major clients in the fourth quarter. The prices of DRAM and NAND are rebounding for the first time in two years since the third quarter of 2021, which could advance the timing of the memory semiconductor business's return to profitability by more than six months compared to initial market expectations."

Meanwhile, the U.S. government has effectively indefinitely postponed restrictions on the import of U.S.-made semiconductor equipment to Chinese factories of Korean semiconductor companies, resolving uncertainties about Samsung Electronics' semiconductor production in China. Samsung Electronics operates NAND factories in Xi'an and semiconductor back-end (packaging) factories in Suzhou, China. A Samsung Electronics official welcomed the development, stating, "Uncertainties regarding the operation of semiconductor production lines in China have been largely resolved through close consultations between governments."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.