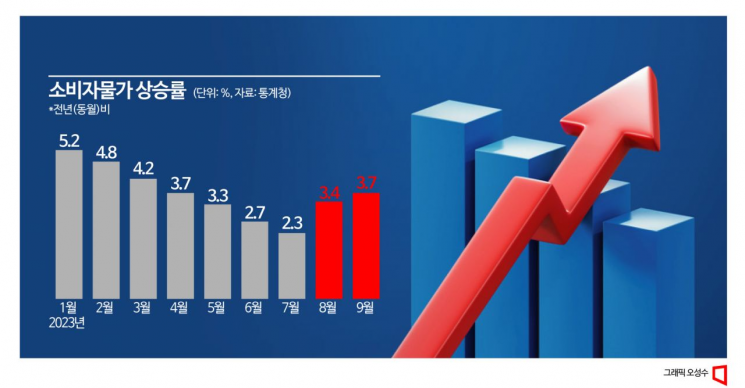

September Inflation Rate 3.7%... Inflation Elusive Despite Signs of Control

Exchange Rate Volatility and Household Debt Rise at Largest Margin

The Bank of Korea is facing deep concerns ahead of this month's interest rate decision due to soaring exchange rates, a renewed rise in inflation, and rapidly increasing household debt. While the strong dollar and inflationary pressures are increasing the pressure to raise the base interest rate, the possibility of financial instability grows if the base rate is raised further, given that market interest rates have already risen significantly.

Consumer price inflation, which had been declining since the beginning of the year, has rebounded with high momentum for two consecutive months. The inflation rate, which had fallen to the 2% range in July, jumped to 3.4% in August and 3.7% in September, with the rate of increase expanding for two months in a row. The Bank of Korea had forecast that inflation would slow down again starting this month and settle around 3% by the end of the year, but it seems premature to be optimistic about the slowdown. Professor Ha Jun-kyung of Hanyang University’s Department of Economics explained, "The inflation rate decline in the first half of the year was largely dependent on the base effect. If external conditions do not improve, the upside risks to inflation remain significant."

Among the upward inflation factors are recent domestic and international causes driving up prices of major food items. The harvests of major sugar-producing countries such as India and Thailand have sharply decreased due to drought and abnormal weather, raising concerns about 'sugarflation' (sugar + inflation) and 'milkflation' (milk + inflation) caused by rising milk prices.

Volatility in international oil prices is also a variable. International oil prices, which had fallen to the $70 range per barrel for Brent crude in July, surged to $94 in September. Although prices have somewhat stabilized this month, experts say it is too early to be reassured. According to the International Finance Center, global oil supply shortages are expected to continue driving prices higher through the end of the year. Professor Ha stated, "Energy supply-related variables have not yet been resolved. The strong dollar briefly influenced the oil price decline, but it is premature to assume the downward trend will continue." Moreover, considering factors such as increased heating demand in winter, oil prices are likely to hinder price stability in South Korea.

In addition, increases in public utility fees such as electricity and subway fares are also contributing to upward pressure. Earlier, the government had estimated the necessary electricity rate increase this year at 51.6 won per kWh, but the cumulative increase in the first and second quarters was only 21.1 won per kWh. Considering that rates were frozen in the third quarter, an increase in the fourth quarter is inevitable. Starting from the 7th, the basic subway fare in the Seoul metropolitan area will rise by 150 won from 1,250 won to 1,400 won, adding to the inflation burden.

The Bank of Korea is also concerned about the impact of the sharply rising U.S. long-term bond yields on domestic loan interest rates with a time lag. On the 3rd, the U.S. 10-year Treasury yield surpassed 4.8%, reaching its highest level in 16 years. Although it slightly declined after the U.S. employment data release, it remains high at around 4.7%. South Korea tends to follow the U.S. in long-term bond yields. The rise in government bond yields affects bank bond yields, which in turn is likely to push up loan interest rates with a delay.

Moreover, worries about household debt exceeding GDP are adding to the Bank’s concerns. According to the International Monetary Fund’s (IMF) 'Global Debt Database,' South Korea’s household debt-to-GDP ratio increased by 16.2 percentage points over five years, from 92% in 2017 to 108.1% last year. This is the highest increase among 26 comparable countries, and on the 5th, Deputy Prime Minister Choo Kyung-ho described the situation as "a level that requires serious vigilance."

The won-dollar exchange rate, influenced by the strong dollar trend, is also problematic. Due to the slowdown in U.S. employment data, the exchange rate opened at 1,345.6 won on the 6th, down 4.9 won from the previous day’s closing price, but it is difficult to predict a sustained decline. Professor Yoo Hye-mi of Hanyang University’s College of Economics and Finance explained, "With the Federal Reserve more likely to raise interest rates once more, there will be discussions about narrowing the interest rate gap between Korea and the U.S. to reduce exchange rate volatility."

For the Bank of Korea, which has kept rates unchanged for five consecutive times, the two remaining monetary policy meetings this year (October 19 and November 30) will inevitably bring increased challenges. Professor Kang In-soo of Sookmyung Women’s University’s Department of Economics said, "The recent rise in the won-dollar exchange rate due to the strong dollar pushes up import prices, and the expected inflation triggered by public utility fee hikes is anticipated. However, since the economy is currently very weak, it will be difficult to decide on a rate hike unless inflation reaches 4-5%."

Professor Yoo added, "For the Bank of Korea, financial stability is as important a goal as price stability. Raising the base interest rate could help curb inflation faster, but if market interest rates, influenced by rising government bond yields, rise further due to a base rate hike, it could increase interest burdens on households and businesses, making it difficult to make a decision easily."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.