IMM PE to Raise 2 Trillion KRW by Year-End with Rose Gold No. 5

Han & Company Forming 4.2 Trillion KRW Fourth Blind Fund

IMM PE Focuses on B2B Firms with High Entry Barriers and Long-Term Supply Contracts

Han & Company Pursues Growth and Profit Maximization Strategy Post M&A

As fund contributors (LPs) such as the National Pension Service and Government Employees Pension Service concentrate their investments in major asset management firms, large private equity (PE) funds like IMM Private Equity (IMM PE) and Hahn & Company are successfully raising capital. A chief investment officer (CIO) at Institution A stated, "With the prolonged high-interest-rate environment, there is a tendency to prefer large firms that have a solid market position in deal sourcing capabilities." He added, "Due to the impact of the Saemaeul Geumgo incident, institutions avoid selecting small and medium-sized firms with weak track records, as it could unintentionally lead to issues." The CIO of Institution B also noted, "Because institutions are highly anxious, funding tends to concentrate on so-called top-tier asset managers and well-known general partners (GPs) who have extensive experience and have shown strong performance during past crises."

IMM PE Raises KRW 1.2 Trillion for Rose Gold Fund V... Expecting KRW 2 Trillion by Year-End

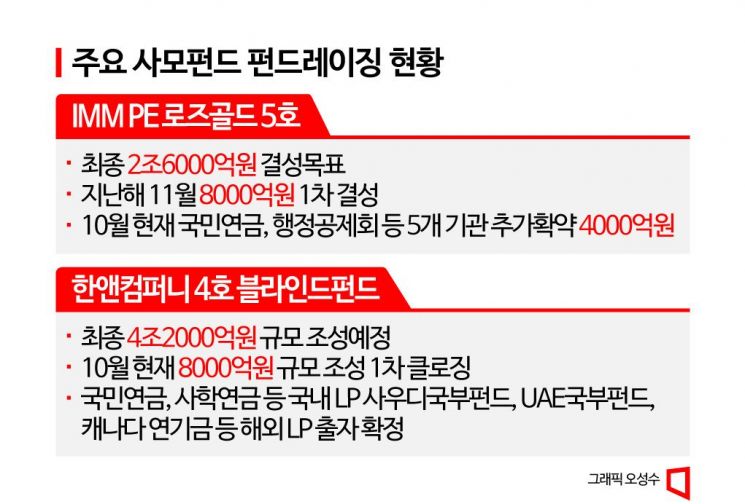

According to the investment banking (IB) industry, IMM PE has currently raised about KRW 1.2 trillion for the Rose Gold Fund V, which is in the process of being established. The final target is KRW 2.6 trillion. Since the first closing of KRW 800 billion in November last year, five institutions including the National Pension Service and the Government Employees Pension Service have made additional commitments of about KRW 400 billion, securing over KRW 1.2 trillion in total. The formation of Rose Gold Fund V is ongoing. More than ten institutions such as pension funds, mutual aid associations, banks, and insurance companies are reviewing investment approvals this fall, so it is expected that nearly KRW 2 trillion will be raised by the end of the year.

Rose Gold Fund V aims to invest in business-to-business (B2B) companies with resilience. These are sectors with high entry barriers that generate stable cash flows based on long-term supply contracts with clients. Structural growth industries such as healthcare, semiconductors, and platform companies are also areas of interest for Rose Gold Fund V. IMM PE achieved results in its previous funds by investing in companies like Daehan Electric Wire, Taelim Packaging, Genewon Science, W Concept, and Pet Friends. Considering the current capital market conditions, the strategy is to take a conservative approach to leverage use and investments in listed companies or B2C sector firms. While actively interested in artificial intelligence and secondary battery sectors, the fund plans to focus its portfolio on companies with validated business models rather than early-stage firms, which are typically the domain of venture capital (VC). An IB industry insider said, "IMM PE's portfolio companies such as Hanatour, Able C&C, and Hanssem, which faced difficulties during the COVID-19 period, have successfully turned around this year." He added, "Especially, the successful sale of a 30% stake in Air First to BlackRock met investors' expectations."

Hahn & Company Raising KRW 4.2 Trillion Mega Fund

Hahn & Company is also in the process of raising a mega-sized fourth blind fund worth KRW 4.2 trillion. The fourth fund has completed its first closing at about KRW 800 billion with a dual structure involving both overseas and domestic LPs. Major domestic LPs include the National Pension Service, Teachers' Pension, and other domestic pension funds and mutual aid associations, as well as several financial holding companies. Key overseas LPs include the Saudi Arabia Public Investment Fund (PIF), the Abu Dhabi Mubadala Investment Company (MIC), and major institutions such as the Canadian pension fund, all of which have confirmed their commitments. Despite the unstable economic situation, the smooth capital raising is attributed to the track record of returns. Hahn & Company's first blind fund recorded an internal rate of return (IRR) of 20%, the second fund 25%, and the third fund 37%.

The investment strategy for the fourth fund is largely consistent with previous funds. It focuses on maximizing corporate value through various methods such as management buyouts and mergers & acquisitions (M&A), external growth, profitability improvement, business and organizational restructuring, operational rationalization, and bolt-on acquisitions of related companies. Since its inception, Hahn & Company has implemented an investment strategy combining financial investors (FI) and strategic investors (SI) models, directly participating in management after acquiring controlling stakes. An IB industry insider said, "Hahn & Company is reviewing export-based companies leveraging South Korea's manufacturing competitiveness and leading domestic industry companies as key investment targets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.