Youth Savings Products Established One After Another Under Moon and Yoon Governments

Interest Fades Due to Long Subscription Periods and Burden of Large Lump-Sum Payments

"The target age group is those who need a lump sum of money, but I thought a 5-year savings plan is quite long, so I gave up." Jinwoo Cha (30), an office worker living in Yangju, Gyeonggi Province, applied for the Youth Leap Account and got approval but decided not to open the account. Cha said, "At first, I thought I would just try applying," adding, "But since I plan to get married within two years and will have many expenses, maintaining a 5-year savings plan is quite burdensome." He continued, "Prices keep rising, but the government gives a subsidy of 24,000 won per month and asks to save 50 million won over 5 years. I don't know how many young people can actually save that much."

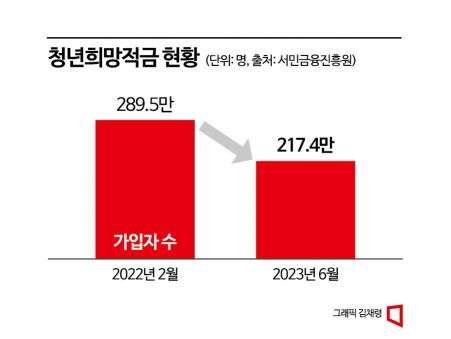

Although government-led 'Youth Lump Sum Savings' products have been introduced since last year, the response has been lukewarm. The Youth Leap Account, which offers up to 50 million won over 5 years at an annual interest rate of 6%, has barely surpassed 10% of the number of accounts opened for last year's Youth Hope Savings. The Youth Hope Savings, which effectively offers a 9% interest rate and allows saving 10 million won over 2 years, saw 25% of its subscribers cancel their accounts.

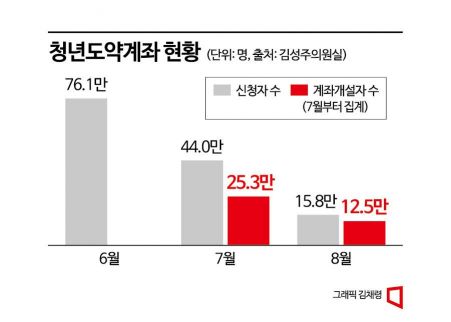

According to data submitted to Assemblyman Seongju Kim of the National Assembly's Political Affairs Committee by the Financial Services Commission on the 6th, the total number of applications for the Youth Leap Account launched in June reached 1,359,000 by August. Monthly figures show a sharp decline: 761,000 in June → 440,000 in July → 158,000 in August. Even after applying, there is another hurdle. Approval for account opening requires income and asset levels to be below a certain threshold. The cumulative number of approvals by July was 615,000 (393,000 in June, 222,000 in July).

Even after passing this hurdle, not everyone opens an account. Some young people who received approval give up on opening the account. By August, the total number of accounts opened was 378,000, with 253,000 in July and 125,000 in August, also showing a decline. Compared to the Youth Hope Savings, which gathered 2,844,000 subscribers within a month after its launch in late February last year, this is a modest performance.

The Youth Leap Account, which requires depositing 700,000 won per month to save 50 million won over 5 years, is considered an 'insurmountable wall' by many young people. Even the Youth Hope Savings, with a 2-year contract period and a monthly deposit of 500,000 won, is often abandoned midway.

According to the Korea Inclusive Finance Agency, the number of subscribers to the Youth Hope Savings, which initially had 2,895,000 subscribers at its launch in February last year, decreased to 2,174,000 by June this year. This means 25% of subscribers canceled their accounts midway. The number of cancellations started to rise immediately after the product's launch. In June last year, just three months after launch, 143,000 people canceled. In December of the same year, 153,000 canceled, and by June this year, 111,000 had canceled. Even with the maturity approaching in February next year, cancellations continue to reach around 100,000.

Canceling the Youth Hope Savings early means missing out on the effective 9% annual interest rate (including bank interest rates of 5-6%, savings incentives, and tax benefits) that requires completing the 2-year maturity. Assemblyman Seongju Kim said, "Even though the interest rate is much higher than regular savings products, the difficulty in maintaining subscriptions shows how tough young people's lives are," adding, "More practical measures for youth lump sum savings are needed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)