Net Selling on KOSPI for 10 Consecutive Trading Days... Net Buying on KOSDAQ After 11 Trading Days

Expectations for Stock Market Return in Q4 as KRW-USD Exchange Rate Stabilizes and Exports Recover

The U.S. Treasury yields have surged sharply and the won-dollar exchange rate has also soared, leading to continuous foreign selling and causing the stock market to struggle. In particular, the supply gap from foreigners is expected to continue until concerns about high interest rates subside. Whether concerns about high interest rates and a strong dollar can be alleviated will likely be determined by the U.S. inflation indicators scheduled for release next week.

On the afternoon of the 4th, amid concerns over prolonged U.S. tightening, the KOSPI plunged more than 2%, and the won/dollar exchange rate hit a new yearly high. The KOSPI closing price and won/dollar exchange rate are displayed on the status board in the dealing room of Hana Bank in Jung-gu, Seoul.

On the afternoon of the 4th, amid concerns over prolonged U.S. tightening, the KOSPI plunged more than 2%, and the won/dollar exchange rate hit a new yearly high. The KOSPI closing price and won/dollar exchange rate are displayed on the status board in the dealing room of Hana Bank in Jung-gu, Seoul. [Image source=Yonhap News]

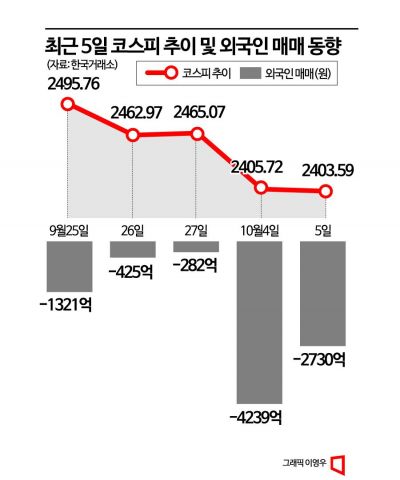

According to the Korea Exchange on the 6th, the KOSPI closed at 2403.60, down 0.09% from the previous session. After plunging 2.41% in the previous trading day, the KOSPI seemed to rebound on this day but failed to maintain the upward momentum due to foreign selling and closed slightly lower. The 2400 level was breached during the session but was defended near the close. The KOSDAQ ended down 0.79% at 801.02.

The sharp rise in U.S. Treasury yields and concerns over prolonged high interest rates are exerting downward pressure on the stock market. As interest rate concerns pushed the won-dollar exchange rate higher, foreigners have sold for 10 consecutive days in the securities market. On the previous day, foreigners sold securities worth 423.9 billion won and continued to sell 273 billion won on this day. However, in the KOSDAQ market, foreigners turned to buying for the first time in 11 trading days, purchasing securities worth 73.8 billion won. In the futures market, foreign selling continued for the fourth day.

Due to interest rate instability, the foreign supply gap is expected to persist for the time being. Choi Yoo-jun, a researcher at Shinhan Investment Corp., said, "The 10-year U.S. Treasury yield has risen 57 basis points (1bp=0.01 percentage point) since the end of August, the won-dollar exchange rate has hit a yearly high, and foreigners have net sold about 2 trillion won in the KOSPI since August," adding, "Until interest rates pass their peak, the foreign supply gap will continue due to discount rate and exchange rate burdens."

The market is expected to pay closer attention to U.S. economic indicators. This is because the employment data scheduled for release this weekend and the U.S. September Consumer Price Index (CPI) to be announced next week are expected to influence interest rates. Researcher Choi Yoo-jun analyzed, "The U.S. Labor Department's employment report will be released on the 6th, and since the interest rate rise has been so steep, the market may take a breather after confirming the employment data."

Na Jung-hwan, a researcher at NH Investment & Securities, said, "If the U.S. September employment data released on the 6th comes out strong, recession concerns will decrease, but concerns about prolonged high interest rates may continue," adding, "Concerns about high U.S. long-term yields and a strong dollar are expected to gradually ease after the U.S. September CPI release next week confirms a slowdown in core inflation."

For the already sluggish stock market to rebound, foreign capital inflow is crucial. Kim Seok-hwan, a researcher at Mirae Asset Securities, explained, "Looking at the annual cumulative net purchases by foreigners, it decreased from 13 trillion won in mid-June to 7.6 trillion won currently," adding, "During the same period, the KOSPI fell by 9.4%, so ultimately, whether the domestic stock market rebounds will depend on foreigners' risk-on (preference for risky assets) stance."

There are forecasts that foreigners will return along with export recovery after the fourth quarter. Kang Jin-hyuk, a researcher at Eugene Investment & Securities, said, "Although foreigners have been exiting the stock market by net selling 4.5 trillion won in the securities and KOSDAQ markets over four months since June, it is not yet a trend, so there is a possibility of reversal," adding, "Foreign supply is expected to begin recovering from the fourth quarter when the exchange rate stabilizes and earnings such as exports improve." He further added, "Considering that foreigners have shifted from a past net selling position to a net buying position after confirming the export bottom, there is hope for foreign capital inflow momentum driven by export recovery in the fourth quarter."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.