Lee Ssi Brothers Publishing Company Employee Also Indicted

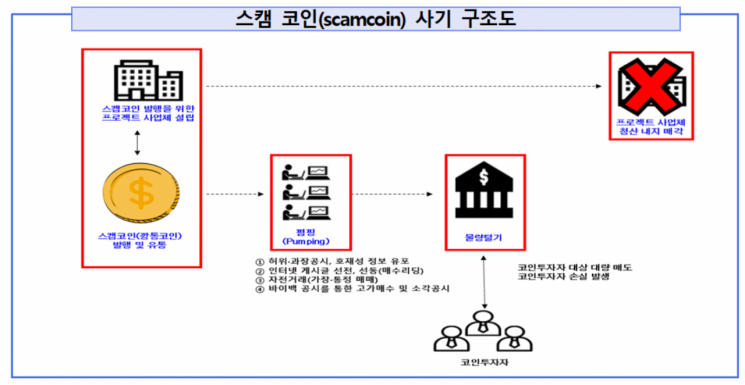

Lee Hee-jin (37), known as the "Cheongdam-dong Stock Rich," and his younger brother have been indicted for issuing scam coins such as Pica Coin, luring investors, embezzling about 90 billion KRW, and misappropriating 27 billion KRW of that amount. Scam coins refer to coins issued by foundations that deceive investors by falsifying the business substance and embezzling investment funds.

On the 4th, the Seoul Southern District Prosecutors' Office's Joint Investigation Team for Virtual Asset Crimes (Head Lee Jeong-ryeol) arrested and indicted Lee and his younger brother Lee Hee-moon (35) on charges of fraud and breach of trust under the Act on the Aggravated Punishment of Specific Economic Crimes. An employee, Kim (34), who was in charge of managing and supervising the coin business at the coin issuing company operated by the Lee brothers, was also arrested and indicted on fraud charges.

According to the prosecution, from March 2020 to September 2022, Lee and others issued and listed three coins including Pica Coin, and through deceptive acts such as false and exaggerated promotions and market manipulation, they sold these coins and embezzled a total of approximately 89.7 billion KRW. The prosecution identified that the amount embezzled through the coins was about 33.9 billion KRW from Pica Coin, 21.7 billion KRW from G Coin, and 34.1 billion KRW from T Coin.

After being detained for stock fraud, Lee used his financial resources and personal network to secretly establish the G Coin issuing company in 2019, and through his younger brother Lee Hee-moon and employee Kim, managed the company and directed the issuance, distribution, and listing of the coins. From March 2020, immediately after his release, he directly issued and distributed three additional scam coins including T Coin, and also issued and distributed seven other scam coins such as P Coin on consignment, fully engaging in the criminal activities.

The Lee brothers are also accused of misappropriating about 412.12 Bitcoins (worth approximately 27 billion KRW at the time) received as payment for T Coin sales from February 9 to April 19, 2021, by transferring them to anonymous accounts on overseas exchanges instead of returning them to the victim company, the T Coin issuing foundation. The funds were also used to purchase luxury real estate in Cheongdam-dong.

The prosecution found that Lee and others used the stock price manipulation technique called "scraping orders" for coin price manipulation as well. "Scraping orders" involve submitting high-priced buy orders above the best ask price, causing multiple sell orders to be executed simultaneously and rapidly driving up the price. Since the virtual asset market has coin prices and quotes ranging from about 0.01 KRW to 1 KRW, much smaller than stocks, such orders are frequently used for price manipulation, and the absence of upper and lower price limits makes the impact very significant. Additionally, Lee and others used YouTube broadcasts with many subscribers to recommend coin stocks, artificially raise coin prices, and increase follower trading forces.

They employed not only traditional price manipulation methods but also techniques exploiting the characteristics of the coin market. Considering that coins have no intrinsic value and their market price essentially defines their value, and that if trading volume decreases, the value tends to converge to zero, Lee and others used "wash trading bots." Through this, they generated trading volume via fictitious trades to prevent price declines.

They also raised buy quotes through fictitious trades exploiting gaps in buy and sell orders. This price manipulation technique is less exposed than "scraping orders" and takes advantage of the market characteristic where most coin quantities are held by the foundation, and foundation-held exchange accounts typically receive fee discounts as a market custom. For example, if the current coin price is 10,000 KRW and 500 sell orders are submitted at 10,000 KRW without any quote gaps, the current price drops to 9,900 KRW and the 10,000 KRW quote becomes vacant. If wash trading occurs at the vacant 10,000 KRW quote, the current price rises back from 9,900 KRW to 10,000 KRW. This continues until another investor submits a buy quote at 10,000 KRW and the market situation is restored.

The prosecution advised that scam coins are highly likely if ▲ the coin whitepaper is excessively complex or abstract or biased toward promotional content, ▲ the coin issuer is unclear or effectively anonymous, and ▲ the coin investment is promoted by promising large short-term profits. A prosecution official stated, "The lead prosecutor will personally handle the prosecution to ensure that the defendants receive sentences commensurate with their illegal acts, and all criminal proceeds obtained by the defendants will be fully confiscated and forfeited."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)