Despite Violations of the Automobile Management Act, Proper Punishment Not Enforced

Gangwon, Gyeongnam, Sejong, and Others Have Zero Punishments

The Financial Supervisory Service (FSS) has been found to have not requested investigations into insurance fraud related to false or exaggerated claims by automobile repair shops in the past two years.

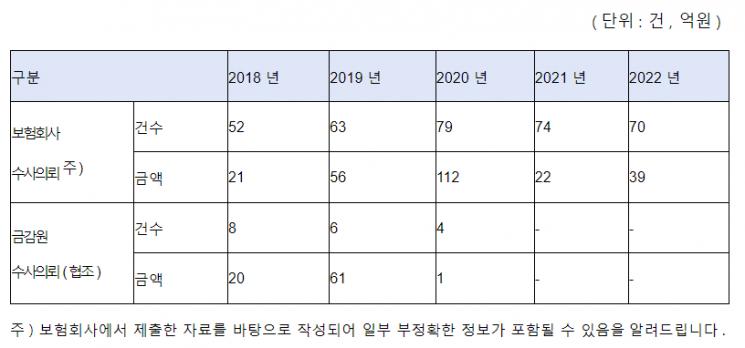

According to data submitted by the FSS to Hwang Unha, a member of the National Assembly's Political Affairs Committee from the Democratic Party of Korea, between 2018 and 2022, the FSS requested investigations into 18 cases involving false or exaggerated claims by automobile repair shops, amounting to only 8.2 billion KRW. No investigation requests were made in the last two years.

Status of Requests for Investigation (Cooperation) on Insurance Fraud Related to False and Exaggerated Claims by Auto Repair Shops by Year (Source: Financial Supervisory Service, Office of Hwang Unha, Democratic Party of Korea)

Status of Requests for Investigation (Cooperation) on Insurance Fraud Related to False and Exaggerated Claims by Auto Repair Shops by Year (Source: Financial Supervisory Service, Office of Hwang Unha, Democratic Party of Korea)

Over the past five years, a total of 1,288 complaints related to estimates from automobile repair shops were received by the FSS. Of these, 367 were accepted, and 350 were withdrawn after settlement. 921 complaints were not accepted. However, these figures do not represent data specifically managed for false or exaggerated claims by automobile repair shops. The FSS explained that these numbers were extracted through keyword searches for "repair costs" under the "excessive insurance payments" category in the insurance sector.

On the other hand, in the past five years, insurance companies themselves detected and requested investigations for 338 cases (worth 25 billion KRW). A total of 531 cases (4.09 billion KRW) were confirmed for insurance refunds through civil lawsuits, and 1,719 cases (4.49 billion KRW) were voluntarily refunded.

Despite violations of the Automobile Management Act due to exaggerated claims, many companies were not penalized. The Automobile Management Act stipulates that if false inspection and repair estimates or detailed repair statements are issued, registration can be canceled or business operations suspended for up to six months. In the past five years, administrative sanctions were imposed as follows: one case each in Incheon and Chungnam; two cases each in Seoul, Jeonnam, and Jeonbuk; four cases in Busan; seven in Daegu; 13 in Daejeon; 14 in Gyeongbuk; and 69 in Gyeonggi. No administrative sanctions were imposed in Gangwon, Gyeongnam, Gwangju, Sejong, Ulsan, Jeju, or Chungbuk.

False or exaggerated estimate claims by automobile repair shops are detected either at the insurance claim stage by insurance companies or through complaints to the FSS, but the FSS has not notified local governments of these cases.

Assemblyman Hwang stated, "Insurance money lost to fraud is ultimately passed on as increased premiums to many honest policyholders, so strengthening crackdowns on false and exaggerated claims is necessary to reduce consumer complaints." He added, "We will improve procedures so that the financial authorities notify local governments of false and exaggerated claims detected at automobile repair shops."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.