Government to Submit 'National Pension Comprehensive Operation Plan' to National Assembly in October

Struggling to Balance Financial Stability vs. Retirement Income Security

Need to Consider a Phased Approach

This year's regular National Assembly session and the government audit are expected to see pension reform emerge as a key issue. The government plans to submit the 'Comprehensive National Pension Operation Plan' this month, drawing attention to whether it can find solutions to the tangled pension reform issues. However, as the political sphere still struggles to find direction on pension reform, numerous challenges remain to be addressed.

National Pension Deficit Starting in 2055

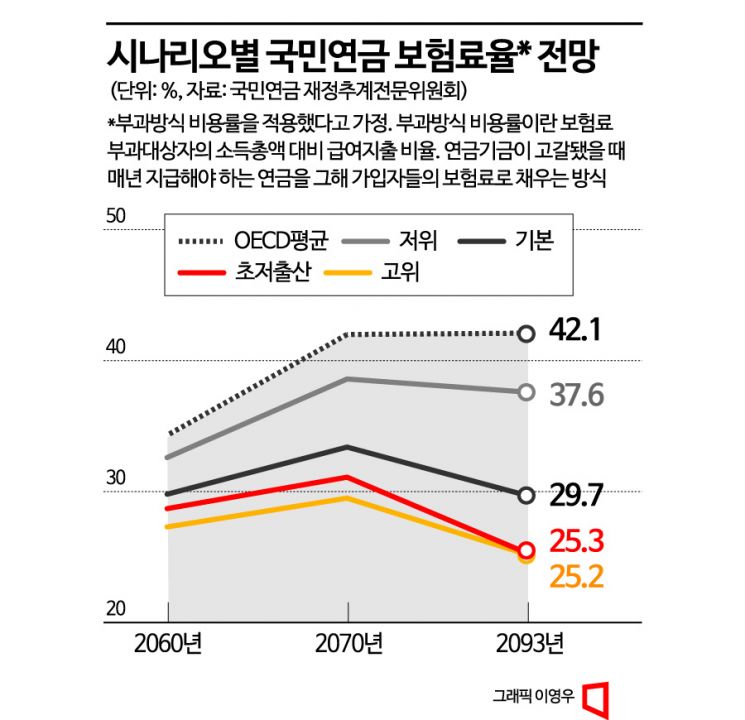

According to the 5th National Pension Financial Calculation released by the government in March this year, the depletion point of the National Pension fund is projected to be 2055. The National Assembly Budget Office's financial outlook for the National Pension shows a similar depletion timeline.

Projections indicate that the National Pension fund will accumulate up to 1,755 trillion won by 2040 but will turn into a deficit starting in 2041, with no remaining funds by 2055. This timeline advances the deficit point by one year and the fund depletion by about two years compared to the 4th financial calculation.

Besides the National Pension, the financial conditions of occupational pensions for public officials, military personnel, and private school faculty members are also deteriorating. According to the Budget Office, the Private School Pension fund is expected to be depleted by 2043, and deficits in the Public Officials Pension and Military Pension are projected to continuously expand. Although the degree varies, it is time to revise the pension systems.

Elderly Poverty Rate at 40.4%... What About Retirement Measures?

While financial depletion is an immediate concern, fundamentally, there are criticisms that the National Pension and similar schemes have limitations as retirement measures.

As of 2020, South Korea's elderly poverty rate stands at 40.4%, the highest among OECD countries. Moreover, when compared to the minimum retirement living expenses perceived by those aged 50 and above and the minimum guaranteed level of livelihood benefits, the payment amounts from the National Pension are significantly low. In fact, last year, the average National Pension payment was 580,000 won per month, whereas the minimum retirement living cost is 1.24 million won per individual and 1.99 million won for couples. For next year's livelihood benefits, the minimum guaranteed levels are about 620,000 won for a single-person household and 1.04 million won for a two-person household. This indicates that the National Pension alone cannot guarantee retirement income.

Given the limitations of the National Pension as a means of retirement income security, the issue of financial soundness must also be confronted.

Financial Stabilization vs. Retirement Income Security

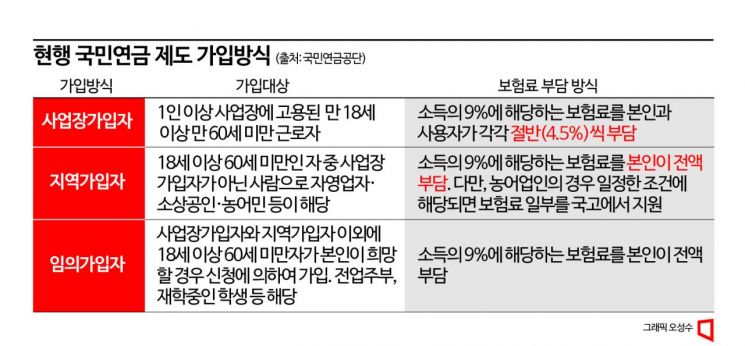

The core issue is whether to achieve financial stabilization to enhance the sustainability of pension finances or to strengthen retirement income security measures to serve as a practical means of retirement income. To improve sustainability, decisive actions such as raising contribution rates (paying more premiums) and delaying the pension eligibility age are necessary. Increasing contributions and raising the eligibility age naturally allow for collecting more funds and reducing payouts, thereby postponing the depletion of the National Pension fund. However, whether individuals and companies will readily agree to pension reforms that impose greater burdens is another matter.

Advocates for retirement income security argue for raising the contribution rate along with increasing the income replacement rate (the ratio indicating how much pension one receives relative to the average income during the pension contribution period). However, when the income replacement rate is increased alongside the contribution rate, the effect on financial stability appears relatively diminished.

Alongside pension reform, discussions must also address how to allocate roles among other retirement income security measures such as the Basic Pension. There is some consensus on the need to strengthen retirement pensions, but the direction for the Basic Pension remains unclear. Debates include whether to provide the Basic Pension universally to all citizens or to reduce recipients while increasing support amounts. However, concerns arise that the Basic Pension has limitations amid rapid population aging, as it is fully funded by taxes, which could strain public finances.

Will the National Assembly Kickstart Pension Reform?

Since July last year, the National Assembly has formed a Special Committee on Pension Reform to discuss fundamental and structural reforms of the four major public pensions, including the National Pension and the Basic Pension. However, with the general election approaching next year, it is uncertain how responsibly the political sphere will initiate pension reform.

The Legislative Research Office stated, "The government has expressed its intention to prepare the National Pension operation plan by the end of the year, reflecting the National Assembly's discussions. However, as it has been confirmed that discussions in the National Assembly have not made visible progress, it is time for the government to take a more proactive stance," and suggested, "The government should take the initiative in pension reform by proactively announcing the direction of the reform plans it has prepared so far."

Furthermore, it introduced, "Rather than aiming for an impossible goal of preparing a reform package that satisfies everyone simultaneously, it is necessary to establish a step-by-step solution plan that prioritizes and resolves the most urgent and long-standing issues that have triggered pension reform discussions at the current time. Similar to drafting a basic plan, setting reform goals and priorities first, then categorizing tasks into major, medium, and minor issues, and approaching them through 1-year, 3-year, and 5-year plans is a strategy worth considering."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)