Corporate economic outlooks for October have worsened compared to September. Companies expect that domestic demand, exports, and investment will all fail to recover, resulting in a continuation of the economic downturn for the 19th consecutive month.

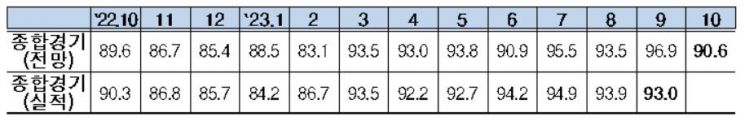

On the 26th, the Korea Economic Association (hereinafter KEA) conducted a Business Survey Index (BSI) targeting the top 600 companies by sales, and the October BSI outlook recorded 90.6. This is a 6.3-point drop from the previous month (96.9), marking the largest decline in 26 months since August 2021 (-7.1p) during the COVID-19 resurgence period (Delta variant).

The BSI indicates a positive economic outlook if it is above the baseline of 100 compared to the previous month, and a negative outlook if it is below 100. The BSI outlook has remained below the baseline of 100 for 19 consecutive months since April last year (99.1), indicating that companies continue to have a negative economic outlook. The actual BSI for September recorded 93.0, marking 20 consecutive months of downturn since February last year (91.5), which implies a prolonged deterioration in corporate performance.

In October, the BSI by industry showed simultaneous weakness in both manufacturing (88.1) and non-manufacturing (93.3) sectors for the third consecutive month. Among detailed industries, only non-metallic materials and products (100.0) reached the baseline, while the other nine industries all showed sluggish business conditions. Within the non-manufacturing sector, only electricity, gas, and water supply (100.0) maintained the baseline. Representative domestic demand industries such as leisure, accommodation, and dining out (76.9), as well as wholesale and retail trade (92.2), also showed simultaneous weakness. This reflects that despite the October holidays, corporate sentiment in domestic demand sectors has not improved due to a slowdown in recent consumption indicators.

The BSI by survey sector in October showed negative outlooks across all sectors. In particular, the three pillars driving the Korean economy?domestic demand (96.5), exports (94.1), and investment (95.4)?have not escaped simultaneous downturns for 16 consecutive months since July last year.

Choo Kwang-ho, Head of the Economic and Industrial Division at KEA, stated, “Recently, our economy is experiencing a triple weakness in production, consumption, and investment due to declining industrial vitality and shrinking consumer sentiment, increasing uncertainty about an economic rebound in the second half of the year.” He advised, “To promote economic recovery and enhance corporate vitality, it is necessary to continue regulatory innovation and labor reform, while closely monitoring price variables such as inflation to stimulate consumer sentiment.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)