Filed on the 14th... Second this year after Fly Gangwon

Common point: continuous losses since establishment

Also facing limitations of regional hub airports

Already saturated LCC market plays a role

If 'revived', "Proper inbound demand measures needed"

Hi Air, an LCC (low-cost carrier) based at Ulsan Airport, has filed for corporate rehabilitation. This is the second case this year following Fly Gangwon in June. Both companies chose airports in regions with low population density as their hubs, but it appears they have reached their limits. Analysts suggest that even if the companies survive, without sharp strategies such as diversifying international routes, they may fall back into financial difficulties.

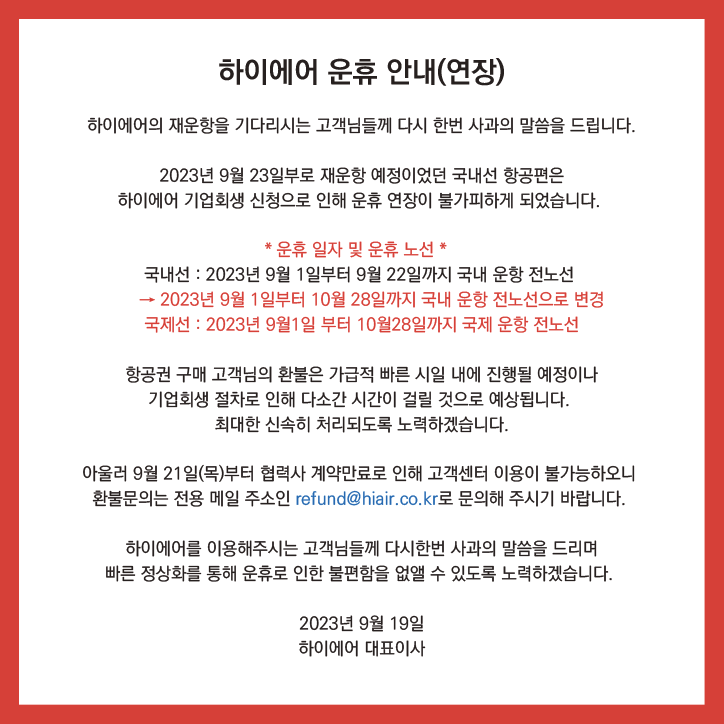

Hi Air filed for corporate rehabilitation with the Seoul Bankruptcy Court on the 14th. On the 19th, through its website, the airline announced that it would suspend domestic and international flights scheduled to resume on the 23rd until the 28th of next month. Corporate rehabilitation is a process where companies struggling financially undergo restructuring under court supervision. It is commonly known as 'court receivership.' The purpose is based on the view that saving a company is more beneficial to the overall economy than letting it fail.

Hi Air has been experiencing financial difficulties due to increasing deficits. According to last year's audit report, the company recorded a net loss of 11.1 billion KRW in 2021 and 10 billion KRW last year. In other words, over two years, it accumulated a pure deficit of 21.1 billion KRW without any profit. As a result, employees reportedly did not receive their salaries on time and many resigned in succession. Eventually, even the essential flight operation managers were lost, leading to the suspension of flights starting from the 1st. According to aviation safety laws, the approval of a flight operation manager is required to dispatch an aircraft or change flight plans. However, there is still a possibility of revival. After filing for corporate rehabilitation, Hi Air is reportedly negotiating the sale of management rights with a private equity fund operator.

Another LCC has undergone a similar process. In June, the 14th Division of the Seoul Bankruptcy Court announced the commencement of Fly Gangwon's rehabilitation proceedings. A new owner will be sought through a public competitive bidding process in October. Initially, the sale was pursued through a 'stalking horse' method to select a preferred bidder, but no buyer was found. This company also suffered from chronic deficits. From 2020 to last year, its revenue increased fivefold from 5.9 billion KRW to 25.8 billion KRW. However, it recorded losses every year: a net loss of 26.9 billion KRW in 2020, 6.7 billion KRW in 2021, and 28.5 billion KRW last year.

The reason these two companies are struggling is that they chose regional airports with low demand as their hubs. Hi Air is based at Ulsan Airport, and Fly Gangwon at Yangyang Airport in Gangwon Province. From January to August this year, the total number of domestic passengers using all domestic airports was 20,819,300. Among them, 130,430 used Ulsan Airport, and 52,150 used Yangyang Airport, ranking 8th and 13th out of 14 airports, respectively. The situation is similar for international flights. A total of 42,731,835 passengers used eight airports, but only 568 used Yangyang Airport, ranking last among the eight. Ulsan Airport did not have any international flights.

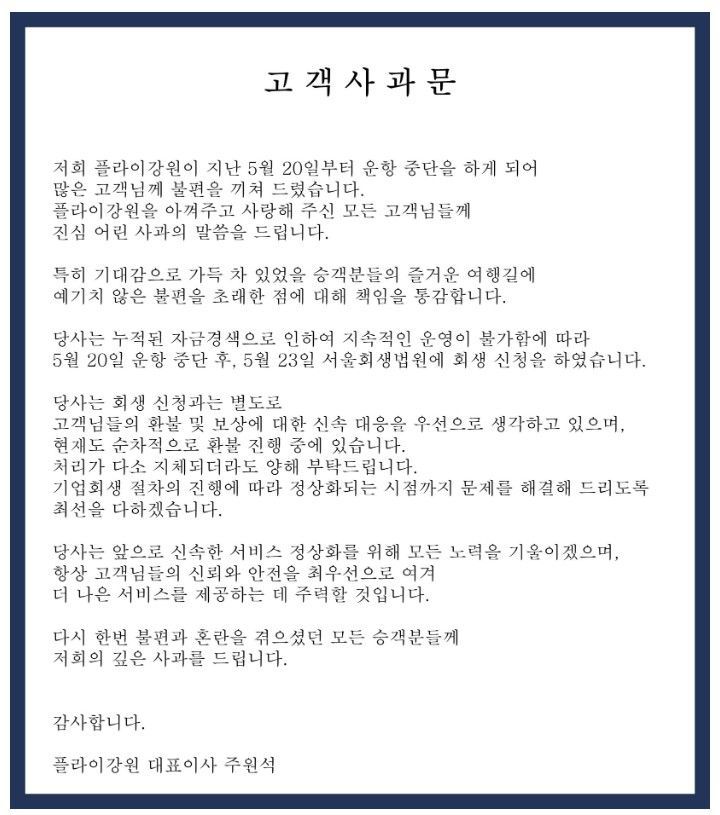

Juwon Sik, CEO of Fly Gangwon, posted an 'Apology to Customers' on the Fly Gangwon website.

Juwon Sik, CEO of Fly Gangwon, posted an 'Apology to Customers' on the Fly Gangwon website. [Photo by Fly Gangwon website capture]

The government and others were already aware of these issues. Fly Gangwon applied twice for an Air Operator Certificate (AOC) from the Ministry of Land, Infrastructure and Transport (MOLIT) between 2016 and 2017 but was rejected. An AOC is a kind of 'license' issued by the Minister of Land, Infrastructure and Transport to determine whether an airline is qualified to operate aircraft. Fly Gangwon finally received the AOC in 2019. At that time, MOLIT explained the rejection reasons as “uncertainty in securing sufficient demand and concerns about financial stability,” and “the concentration of LCC routes is intensifying, raising the possibility of excessive competition.” Additionally, there is an obligation to maintain the hub airport for three years as a condition of issuance, making it difficult to move the hub to another airport.

Hi Air operates five domestic routes from Ulsan Airport and one international route (Jeonnam Muan - Kitakyushu, Japan) from Muan Airport. International routes are more profitable because they carry more passengers and can sell tickets at higher prices compared to domestic routes. However, the company operates that single international route from Muan Airport, which is one of the airports with low passenger numbers. Muan Airport had 134,064 passengers, ranking 7th among eight airports. In other words, even the profitable international route is structured in a way that it cannot generate profits.

The domestic aviation market is already saturated, which also plays a role. Currently, there are nine domestic LCCs (Jeju Air, T'way Air, Jin Air, Air Busan, Air Seoul, Air Premia, Aero K, Fly Gangwon, and Eastar Jet). Including the small air transport operator Hi Air, there are ten. The United States, with six times the population, has nine LCCs. Japan and Germany have six and five, respectively, which means Korea has a relatively large number of LCCs compared to its population.

Even if the two companies recover, to generate steady profits, they need to attract inbound passengers coming to Korea from abroad. The population in regions where regional airports are located is limited. However, foreign demand can be created by collaborating with local governments to develop tourism products. In fact, Fly Gangwon has previously revealed a blueprint to contribute to regional economic revitalization by attracting Chinese tourists (Yukeo) to Gangwon Province with support funds from the Gangwon Provincial Government.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.