KCCI Manufacturing BSI Survey

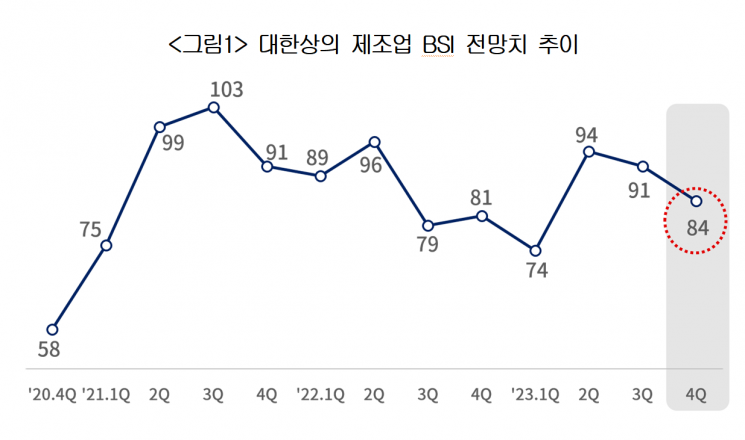

Outlook at 84... Declines for 2 Consecutive Quarters

"Due to High Oil Prices and China Economic Slowdown"

Domestic manufacturing companies' expected fourth-quarter sentiment worsened compared to the previous quarter, indicating that corporate sentiment contraction will continue throughout the second half of the year. Six out of ten manufacturing companies predicted that this year's performance will fall short of targets due to sluggish domestic sales and declining exports.

The Korea Chamber of Commerce and Industry (KCCI) announced on the 24th that the '2023 4th Quarter Manufacturing Business Survey Index (BSI)' conducted among 2,282 manufacturing companies nationwide showed a forecast BSI of 84 for the fourth quarter, down from 91 in the previous quarter. This marks a continuous decline for two consecutive quarters, with the rate of decrease growing larger.

The sectoral BSI forecasts, calculated separately for export and domestic companies, also fell by 6 points and 11 points respectively compared to the previous quarter: domestic (90→84) and export (94→83). A BSI above 100 indicates that more companies view the business climate positively compared to the previous quarter, while a BSI below 100 indicates the opposite.

The KCCI pointed out, "With the delayed recovery of the Chinese economy and IT sector, the export recovery trend has not yet become visible, and if the rise in oil prices prolongs, it could lead to inflation and weakened consumption. Increases in energy and raw material prices may negatively affect the export recovery trend, heightening corporate concerns."

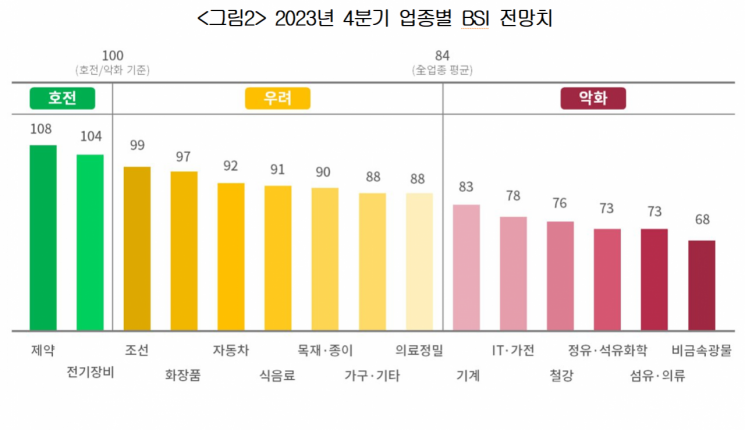

Despite the predominance of 'negative' outlooks, the pharmaceutical (108) and electrical equipment sectors, including batteries (104), exceeded the baseline, raising expectations for industry growth.

Outlooks for export-driven industries were mixed. Shipbuilding (99), cosmetics (97), and automobiles (92) showed slightly negative forecasts but were more positive compared to the overall industry average (84).

Conversely, sectors including semiconductors, IT, and home appliances (78), steel (76), and refining and petrochemicals (73) fell into the 70s range, indicating expected deepening sluggishness. The food and beverage sector (91), which had benefited from the endemic effect, also saw its fourth-quarter outlook turn downward.

With only three months left until the end of the year, many responses indicated that this year's business performance would fall short of targets.

When asked, "Based on the current business performance trend, do you expect to achieve the annual operating profit target set at the beginning of the year?" 59.2% of respondents answered "will fall short of the target level." Those who answered "will achieve the target level" accounted for 38.1%, while only 2.7% responded that they would "exceed the target."

Manufacturing companies cited "sluggish domestic sales" (71.9%, multiple responses allowed) as the biggest reason for not meeting operating profit targets.

Following that were responses citing "export decline due to overseas market economic slowdown" (37.9%), "increased financing costs such as high interest rates" (26.0%), "heightened volatility in oil prices and exchange rates" (22.5%), and "disruptions in raw material supply" (18.5%).

Kim Hyun-soo, head of the Economic Policy Team at the KCCI, analyzed, "Although the current account has recently returned to surplus, raising expectations for an export-led economic rebound, downside risks from the Chinese economy and uncertainties in raw material prices could act as burdens on the economic recovery trend."

He added, "With the inflation rate rebounding to the 3% range again in August and the burden of private debt due to high interest rates, if private consumption recovery is delayed, it will be difficult for either exports or domestic demand to drive economic recovery in the second half of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)