Frequent Duplicate Fraud Using Latest Methods

Need for Integrated Information Sharing Among Insurers

Insufficient Sharing of Post-Detection Measures

"Will Also Help Prevent Financial Leakage in Health Insurance"

As the amount of detected insurance fraud increases every year, it surpassed 1 trillion won for the first time last year. There are calls for an integrated information system to handle insurance fraud information at the industry level.

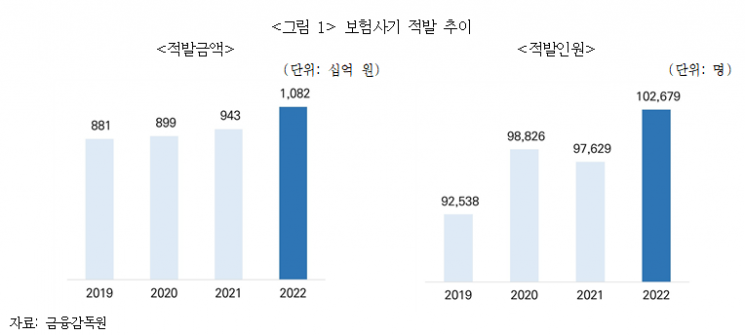

On the 24th, the Korea Insurance Research Institute stated this in a report titled "Information Cooperation Measures for Effective Prevention of Insurance Fraud." According to the Financial Supervisory Service, the amount of detected insurance fraud last year was 1.082 trillion won. This represents a 14.7% increase compared to the previous year, surpassing 1 trillion won for the first time in history. The number of detected individuals also increased by 5.2% during the same period, totaling 102,679 people. Since insurance fraud often involves multiple crimes using the same method or imitation of fraud techniques, data analysis by insurance companies is considered essential.

Therefore, the report emphasized the need for information inquiries between insurance companies. It analyzed that private insurance companies could improve their detection and prevention capabilities, and by sharing insurance fraud-related information among similar insurance types and between public and private sectors, financial leakage occurring in National Health Insurance, Industrial Accident Compensation Insurance, National Pension, and others could also be prevented.

Currently, there are systems for information inquiry and analysis between insurance companies. These include the Insurance Credit Information System (ICIS) operated by the Korea Credit Information Services and the Insurance Fraud Awareness System (IFAS) by the Financial Supervisory Service. However, insurance fraud is still on the rise. To enhance the predictive power of these systems, it is pointed out that the quality of analysis data must be improved through ▲ clear definitions of aggregated statistical variables and ▲ improved information management of institutions involved in insurance fraud.

Byun Hye-won, a research fellow at the Korea Insurance Research Institute, stated, "Each company has slightly different definitions of insurance fraud reported to the Financial Supervisory Service, and the provision of related information is very conservative. Recently, a significant portion of insurance fraud is carried out in connection with medical institutions and repair shops, so related information such as hospital admission and outpatient dates for each insurance claim must be accurately managed."

She particularly emphasized the need for information cooperation and analysis between public and private insurance sectors, as insurance fraud frequently involves claims made to both public and private insurance or fraud committed using the same methods. In fact, in cases of fraudulent hospital operators detected by the National Health Insurance, false medical records were created to unjustly claim medical benefits, and false hospitalization certificates were issued to help patients fraudulently obtain hospitalization fees from private insurers. In industrial accident insurance, there were cases where workers injured outside the workplace applied for injury insurance benefits from private insurers and industrial accident insurance benefits from the Korea Workers' Compensation and Welfare Service simultaneously.

The report proposed establishing an integrated insurance fraud information system under the Insurance Investigation Council. Currently, the Insurance Investigation Council includes the Financial Services Commission, Ministry of Health and Welfare, National Police Agency, Financial Supervisory Service, National Health Insurance Service, Health Insurance Review & Assessment Service, Korea Workers' Compensation and Welfare Service, National Pension Service, Life Insurance Association, General Insurance Association, Insurance Development Institute, and Korea Credit Information Services. It explained that while installing an integrated insurance fraud information system under the Insurance Investigation Council, a plan to designate access rights to view each statistic should be considered.

Additionally, by aggregating and managing the results of insurance fraud investigation requests and related statistics within the integrated insurance fraud information system, it emphasized that this could help efficient punishment of insurance fraud and the establishment of effective insurance fraud prevention policies. Research fellow Byun pointed out, "Currently, there is no comprehensive system that allows inquiry of the results of investigation requests after insurance fraud detection, nor aggregation and provision of related statistics such as criminal trial conviction rates and recovered amounts. When automobile repairers or medical personnel are prosecuted or punished for insurance fraud, the prosecution should notify the competent authorities, but it is judged that there is no system currently aggregating and managing related statistics."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)