Krafton and NCSoft Both Break 52-Week Lows

Krafton Expected to Recover in Q3 Earnings... NCSoft Likely to Rebound Only After Next Year

The leading gaming stocks have continued to show sluggish price trends, with both recording 52-week lows consecutively. However, the outlook is mixed. While there are expectations for Krafton’s profit and stock price recovery, NCSoft is evaluated as having limited investment appeal due to declining earnings.

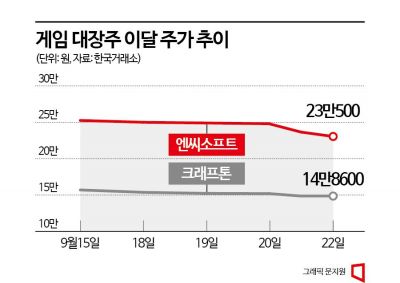

According to the Korea Exchange on the 25th, Krafton and NCSoft recorded 52-week lows on consecutive days, the 21st and 22nd. Krafton fell to 146,000 KRW intraday on the 22nd, breaking its 52-week low set just a day earlier. After four consecutive days of decline, Krafton seemed to rebound slightly but gave back its gains by the end of trading, closing flat. NCSoft also hit a 52-week low again intraday at 226,500 KRW, continuing its five-day losing streak. NCSoft’s stock price, which had risen to 470,000 KRW at the beginning of the year, has halved to the 230,000 KRW range.

Since the beginning of the year, the absence of new releases and poor earnings have led to continued weak stock performance among gaming companies. This is also true for Krafton and NCSoft, considered leading gaming stocks. NCSoft posted sales of 440.2 billion KRW and operating profit of 35.3 billion KRW in Q2, down 30% and 71% respectively from the same period last year. Krafton’s Q2 results also declined, with sales of 387.1 billion KRW and operating profit of 131.5 billion KRW, down 8.6% and 20.7% year-over-year.

Although Krafton and NCSoft share the same trend of poor earnings and weak stock prices, their outlooks diverge. Krafton is expected to see a recovery in earnings and stock price. Jae-min Ahn, a researcher at NH Investment & Securities, explained, "The sharp stock price decline in Q2 was due to decreased sales of China’s 'HwaPingJungYeong,' but these sales have entered a downward stabilization phase. Meanwhile, the full three-month reflection of India’s 'Battlegrounds Mobile India (BGMI)' sales will help recover earnings. Although there is a lack of new release momentum, considering that most sales are global, the recent stock price drop is excessive."

In Q3, earnings recovery is expected to become visible. Hyun-yong Kim, a researcher at Hyundai Motor Securities, predicted, "Krafton’s Q3 sales are expected to be 433.4 billion KRW, a 0.1% decrease year-over-year, and operating profit is forecasted to increase by 11.1% to 160.6 billion KRW, marking a shift from the first half’s declining profit trend to positive earnings growth."

The outlook for NCSoft is not optimistic. Researcher Kim said, "NCSoft’s Q3 sales are expected to decline 29.1% year-over-year to 428.4 billion KRW, and operating profit is forecasted to drop 85.9% to 20.4 billion KRW, falling short of market expectations. The sharp profit decline is expected to continue because labor costs, which account for half of operating expenses, are fixed costs, and sales are significantly decreasing due to the absence of new releases."

Although NCSoft is preparing to launch the new title 'Throne and Liberty (TL)' in Q4, there are opinions that a turnaround will be difficult with a domestic release alone. Researcher Kim said, "The key to a Q4 earnings rebound is the success of TL. However, until Q4, there will inevitably be a mismatch between less than a month of domestic sales and the marketing expenses for the launch, making a sharp earnings rebound difficult." He added, "Due to declining earnings, valuation merits are also hard to highlight, so investment appeal is limited. However, if the TL release date is set as scheduled in December, it could be a catalyst for a stock price rebound."

Stock price recovery is expected to be possible only after the performance of new releases is confirmed. Ho-yoon Jung, a researcher at Korea Investment & Securities, said, "In 2024, new releases including TL will resume, and in 2025, there is the possibility of releasing the highly anticipated 'Aion 2,' so the potential for further stock price decline is limited. However, confirming the success of new releases is necessary for stock price recovery."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.