Large-Scale Perpetual Bond Issuance by SKT, Kolon Industries, Hyosung Chemical, etc.

Minimal Real Financial Structure Improvement...Only Interest Burden Increases

Affiliates of large conglomerates are consecutively issuing new types of capital securities (perpetual bonds) that can be recognized as capital. This is to slightly reduce the rapidly rising debt ratio caused by prolonged poor performance and increased borrowings. However, there are concerns that the effect on improving financial structure is not significant, and the high interest rates on bond issuance could only increase interest burdens.

Interest Burden Increases If Not Redeemed Early

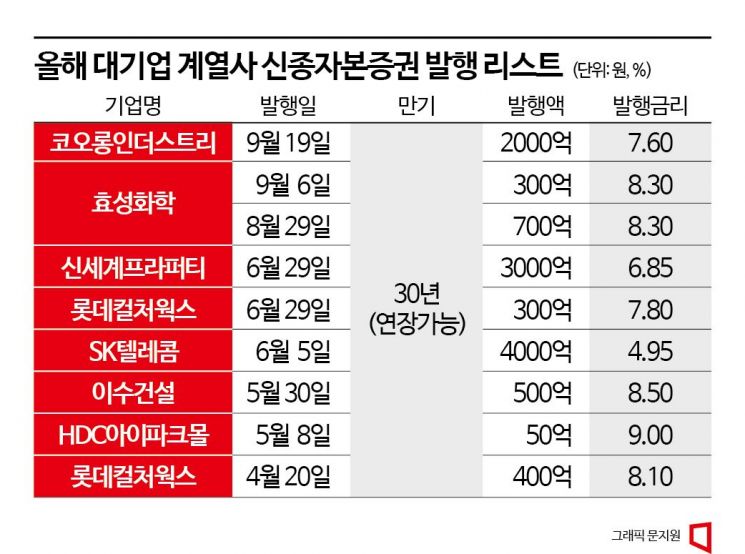

According to the investment banking (IB) industry on the 21st, Kolon Industries selected Korea Investment & Securities as the lead manager and issued 200 billion KRW worth of perpetual bonds on the 19th. The bond maturity is 30 years, with the option to extend the maturity further, and a call option (early redemption right) can be exercised from September 2026, three years later, to repay principal and interest. The issuance interest rate is 7.60%, and if the bonds are not redeemed early after three years, the interest burden will continue to increase.

Hyosung Chemical recently issued 100 billion KRW worth of perpetual bonds in two installments within a week. On the 6th, it issued 30-year maturity perpetual bonds worth 30 billion KRW under the lead management of Korea Investment & Securities, and on the 29th of last month, it issued 70 billion KRW worth of perpetual bonds under the lead management of KB Securities.

At the end of June this year, Shinsegae Property and Lotte Cultureworks raised funds by issuing perpetual bonds worth 300 billion KRW and 30 billion KRW, respectively. In early June, SK Telecom issued 400 billion KRW worth of perpetual bonds. The perpetual bonds issued by SK Telecom are the largest single issuance this year. In the first half of the year, Isu Construction (50 billion KRW), HDC I'Park Mall (5 billion KRW), and Lotte Cultureworks (40 billion KRW) also issued perpetual bonds.

The reason large conglomerates issue perpetual bonds is to lower their debt ratios. Perpetual bonds allow companies to decide whether to repay principal and interest through call options or maturity extensions, so they can be recognized as capital rather than debt in accounting.

Hyosung Chemical, which recently issued perpetual bonds, saw its debt ratio rise to 8938% at the end of the first half of this year. Although it made a 1.6 trillion KRW facility investment in Vietnam through external borrowings, continuous losses at the local factory caused the debt ratio to increase significantly. It has been in a state of capital erosion after recording large deficits for six consecutive quarters.

Shinsegae Property's financial situation deteriorated as it invested large sums in mergers and acquisitions (M&A) such as acquiring the U.S. winery 'Shafer Vineyard,' Starfield Cheongna, and Dong Seoul Terminal, as well as large-scale development projects. Borrowings, which were only 21.8 billion KRW in 2018, increased to 1.3 trillion KRW as of March this year, causing the debt ratio to rise rapidly.

An investment banking (IB) industry official said, "There is high demand for perpetual bond issuance among construction and retail companies whose debt ratios have risen significantly due to COVID-19 and the downturn in the construction and real estate market," adding, "As many companies face deteriorating financial conditions due to poor performance, demand for perpetual bond issuance is expected to continue increasing."

Far from Fundamental Financial Improvement

There are repeated criticisms that issuing perpetual bonds only lowers the debt ratio but is far from fundamentally improving the financial structure.

In the case of Hyosung Chemical, issuing 100 billion KRW worth of perpetual bonds increased its equity capital from 36.3 billion KRW at the end of the first half to 136.3 billion KRW. As the denominator in the debt ratio calculation, capital increased, so the debt ratio simply decreased to about one-third of the previous level.

However, the borrowing burden does not decrease. Although the maturity of perpetual bonds is permanent, if not redeemed early after three years, the interest rate rises exponentially. It is practically no different from issuing a three-year maturity bond.

Moreover, the burden of interest rates on perpetual bonds has increased significantly due to rising market interest rates. The issuance interest rates of perpetual bonds by Kolon Industries, Hyosung Chemical, Lotte Cultureworks, Isu Construction, and HDC I'Park Mall approach 7-10%. This is about 1-3% higher than the interest rates for general corporate bonds.

A credit rating agency official pointed out, "Issuing perpetual bonds can slightly reduce the accounting debt ratio figures, but the actual effect on improving the financial structure is minimal," adding, "Rather, the increased interest expense burden raises the real financial burden even more."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.