By 2030, 50% Share Expected in Total FC-BGA

Samsung Electro-Mechanics, First in Korea to Mass-Produce Products... Focus on Expanding Production

LG Innotek Preparing for Mass Production... Tightening Pursuit

Korean companies are challenging the Japanese-led market for server-use flip chip (FC)-ball grid array (BGA). Samsung Electro-Mechanics and LG Innotek are the main players. Both companies aim to diversify their businesses as the demand for server-use FC-BGA steadily increases due to the enhanced functionality and miniaturization of IT devices. They plan to continue investing despite the semiconductor industry slowdown to secure future growth engines.

FC-BGA is a high-value semiconductor substrate mainly used in central processing units (CPU) and graphics processing units (GPU) for PCs, servers, and networks. As artificial intelligence (AI) and cloud computing advance in performance, the demand for high-spec semiconductor chips and highly integrated semiconductor substrates continues to grow.

FC-BGA is broadly divided into PC-use and server-use. Among these, server-use FC-BGA, not for PCs, is the most challenging product among package substrates. Server-use FC-BGA substrates are more than four times larger in area than general PC-use FC-BGA and have more than twice the number of layers, exceeding 20 layers. Therefore, securing product reliability and managing production yield due to substrate enlargement and high multilayering are considered key.

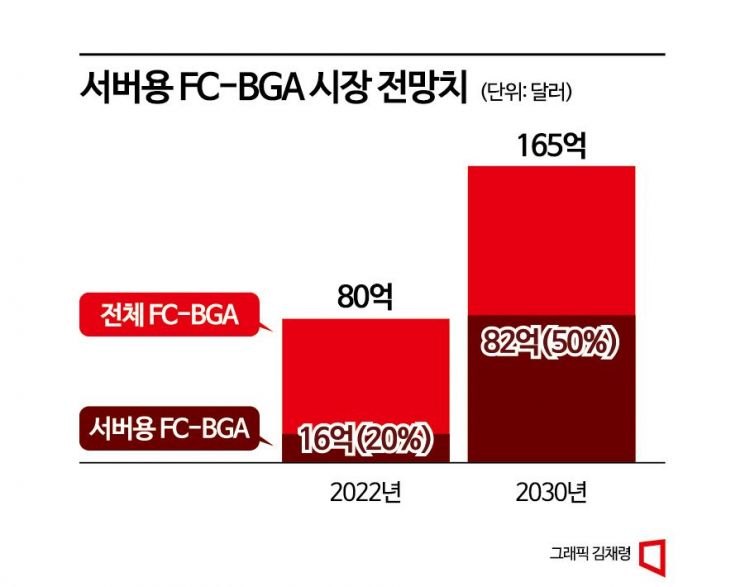

The semiconductor industry is paying attention to the growth potential of server-use FC-BGA. While the server-use segment accounted for 20% of the total FC-BGA market in 2022, it is expected to reach 40% by 2026 and nearly 50% by 2030. The overall FC-BGA market size is projected to grow from $8 billion in 2022 to $16.4 billion in 2030, with server-use FC-BGA expected to surge from $1.6 billion to $8.2 billion during the same period.

Only a very few companies can manufacture server-use FC-BGA. Until Samsung Electro-Mechanics succeeded in mass-producing server-use FC-BGA domestically for the first time last year, only established FC-BGA leaders such as Japan’s Ibiden and Shinko Denki, and Taiwan’s Unimicron were able to produce these products.

Samsung Electro-Mechanics is responding most aggressively to the server-use FC-BGA market. Its server-use FC-BGA features more than 60,000 terminals finer than the thickness of a hair on a substrate the size of a business card. Using embedded passive component technology (EPS) that integrates passive components into substrates thinner than 1 millimeter, power consumption can be reduced by 50%.

Samsung Electronics Chairman Lee Jae-yong posing for a commemorative photo with employees at the FC-BGA shipment ceremony for servers held last year at Samsung Electro-Mechanics' Busan plant.

Samsung Electronics Chairman Lee Jae-yong posing for a commemorative photo with employees at the FC-BGA shipment ceremony for servers held last year at Samsung Electro-Mechanics' Busan plant. [Photo by Samsung Electronics]

Given the high technical difficulty and market growth potential, Samsung Electronics Chairman Lee Jae-yong also visited the shipment ceremony to show support. Samsung Electro-Mechanics plans to focus on expanding server-use FC-BGA production this year. Since last year, Samsung Electro-Mechanics has invested 1.9 trillion won in semiconductor package substrates, aiming to become one of the global top three.

LG Innotek is preparing for mass production of server-use FC-BGA. As a latecomer in FC-BGA, LG Innotek is focusing on producing FC-BGA substrates for networks, modems, and digital TVs, which have relatively lower technical difficulty. Mass production of FC-BGA is expected to begin in earnest at the new Gumi plant around November to December, but server-use FC-BGA production is anticipated to take a bit longer.

However, the company plans to start with IT-use FC-BGA and quickly catch up by combining communication module and substrate miniaturization technologies. Since February last year, LG Innotek has been making facility investments totaling 413 billion won over three years in its substrate business.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.