Samsung Small and Medium 55.4%, LG Large 61.7%

Chinese Small and Medium BOE, Large EDO, etc. Chasing

"Only 'Super Gap' Technology Can Outpace"

Korean display companies such as Samsung and LG widened the gap with Chinese companies in the OLED (organic light-emitting diode) market in the second quarter. It is significant that Korean companies expanded their lead over China in their core businesses.

According to the second-quarter mobile OLED market share (revenue share) announced by global market research firm Omdia on the 20th, Samsung Display ranked first with 58.9%. Chinese company BOE (16.2%) and LG Display (11.9%) followed.

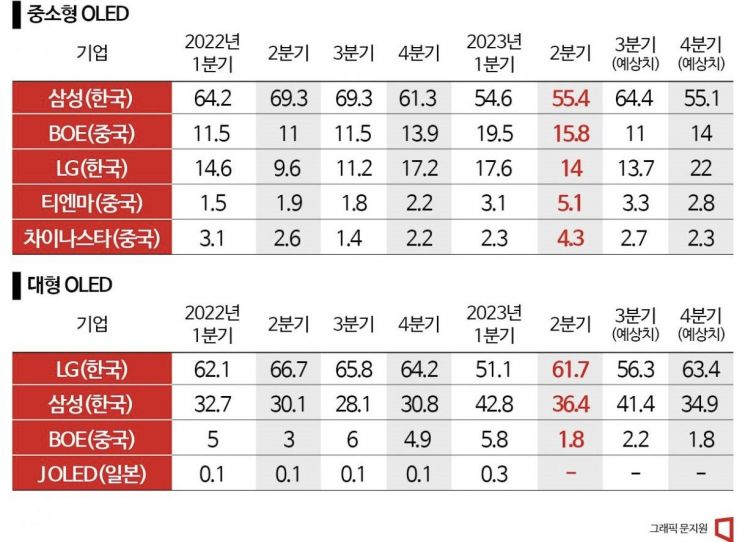

Omdia also releases sales statistics for the small-to-medium-sized market, which combines display panels for small products like smartphones, and the large-sized market, which combines panels for larger products such as laptops and TVs. Samsung, the mobile market leader, maintained its top position in the small-to-medium OLED market with a 55.4% share. BOE (15.8%) and LG (14%) ranked second and third. LG dominated the large-sized market. The ranking was LG Display (61.7%), Samsung Display (36.4%), and Chinese company EDO (1.8%).

Samsung maintained a 'super gap' with competitors in the small-to-medium OLED market, while LG did so in the large OLED market. Samsung increased its small-to-medium OLED market share from 54.6% in the first quarter to 55.4% in the second quarter, up 0.8 percentage points (p). BOE's share fell 3.7 p from 19.5% to 15.8% during the same period. LG's large OLED share also rose 10.6 p from 51.1% in the first quarter to 61.7% in the second quarter.

Junghwan Kim, a researcher at Korea Investment & Securities, said, "With the launch of the iPad OLED model next year, recovery in OLED TV demand, expansion of OLED applications to laptops and PCs, and additional investment in Samsung Display's QD-OLED, the OLED market is expected to continue growing," adding, "The technological gap with China in large panels is also being maintained."

The criteria for calculating display companies' market shares are divided into panel shipments (production volume) and panel sales (profitability). Omdia calculated market share based on sales. According to analyses based on shipment volume, China is expected to surpass Korea by 2025. At the end of last month, market research firm UBI Research predicted that China's smartphone OLED shipment share would reach 54.8% in 2025, surpassing Korea's 45.2%.

UBI Research also forecasted that China could surpass Korea in sales by 2028. Industry experts analyze that to continue outperforming China in sales, it is necessary to diversify into not only mobile phones and TVs but also microdisplays for XR (extended reality), IT displays such as tablets and laptops, and automotive displays.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.