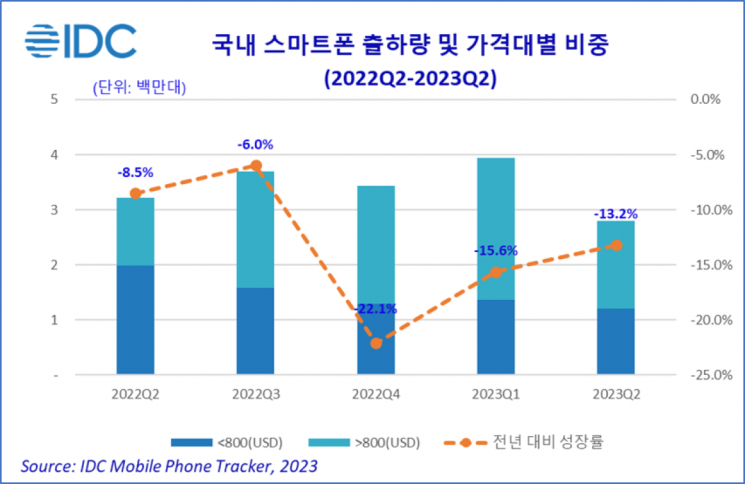

On the 20th, Korea IDC announced that the domestic smartphone market shipments in the second quarter of 2023 recorded 2.8 million units, a 13.2% decrease compared to the previous year.

Although the overall consumer sentiment index is recovering, economic uncertainties continue, causing the total smartphone market demand to keep declining. Korea IDC analyzed that major brands are making various efforts to secure customers by launching new 4G mid-range products and opening offline stores to improve profitability.

The 5G device share slightly decreased to 85.7%. This is attributed to the increased demand for 4G smartphones as major Android brands such as Samsung Electronics and Xiaomi launched new 4G mid-range products.

By price range, the share of flagship products priced above $800 (approximately 1,064,000 KRW) recorded 57%, an increase of 18.7 percentage points compared to the same period last year. Due to polarization in consumer demand, the demand for ultra-premium products such as Samsung Electronics’ Galaxy Ultra and Apple’s iPhone Pro and Pro Max continues from the previous quarter. Additionally, the price increase of new premium product lines was analyzed as a major cause.

Foldable smartphone shipments sharply decreased compared to the same period last year, recording about 110,000 units. The contraction of the smartphone market due to the economic recession, along with Samsung Electronics reducing foldable production to lessen inventory burden ahead of its third-quarter new product launch, influenced this decline.

Researcher Kang Ji-hae of Korea IDC stated, “Despite the continued market contraction, major brands are making efforts to respond to the steady demand in the premium market.” She also said, “With the increase in offline activities after the COVID-19 endemic and the emphasis on customer experience, the concept of offline stores of major brands is changing. Offline stores are expanding customer experience beyond smartphones through experiential programs using various products, promoting sales of diverse devices, and enhancing market competitiveness by securing loyal customers within the overall device ecosystem.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.