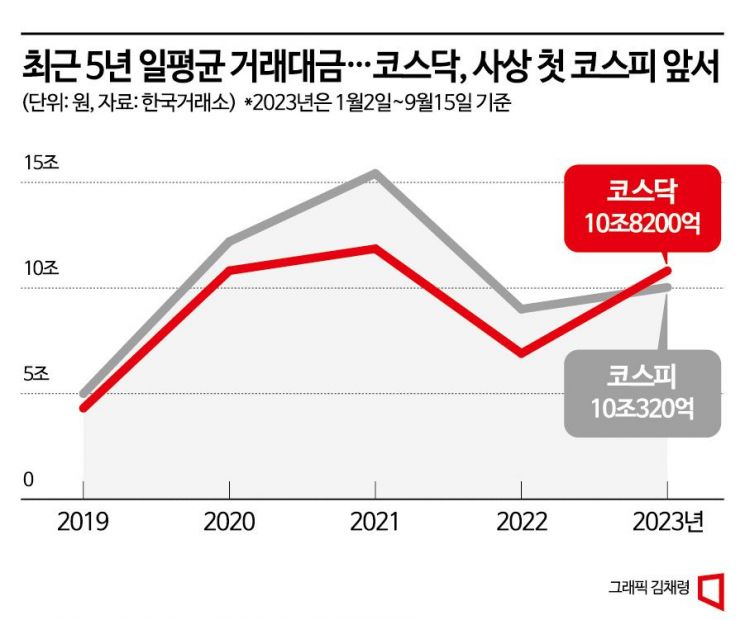

Average Daily Trading Value from January to September: KOSDAQ 10.816 Trillion KRW, KOSPI 10.032 Trillion KRW

Theme Stocks like Secondary Batteries and Robots Surge... High Turnover Individual Investors Flock in Large Numbers

Since the beginning of this year, the average daily trading value of the KOSDAQ market has surpassed that of the KOSPI market for the first time ever. This is attributed to unprecedented demand for secondary battery-related theme stocks listed on the KOSDAQ market in the first half of the year, as well as the expanding influence of individual investors with high trading turnover rates.

According to the Korea Exchange Information Data System, the average daily trading value of the KOSDAQ market this year (from January 2 to September 15) was recorded at 10.816 trillion KRW. This figure exceeds the KOSPI’s average daily trading value of 10.032 trillion KRW. Although the fourth quarter is still remaining, this is the first time in 27 years since the launch of the KOSDAQ market in 1996 that the KOSDAQ has surpassed the KOSPI in terms of average daily trading value for the year.

Trading values in both the KOSDAQ and KOSPI markets reached record highs during 2020?2021. In 2021, the KOSDAQ’s average daily trading value hit a record high of 11.86 trillion KRW. However, due to global tightening last year, it dropped to 6.9 trillion KRW before rebounding to the 10 trillion KRW level this year, marking an approximately 57% increase compared to last year. Although it did not reach the 2021 level, it was similar to the 2020 level.

The KOSPI’s trading volume has recovered more slowly in comparison. The KOSPI’s average daily trading value was 12.2 trillion KRW in 2020 and reached a record high of 15.424 trillion KRW in 2021. Last year, it sharply declined to 9 trillion KRW, and this year it has remained in the low 10 trillion KRW range, increasing by only about 11%.

Looking at the monthly trends, the KOSPI had higher trading values until January, but from February onwards, the KOSDAQ held the lead for three consecutive months. From February to April, the cumulative trading value of the KOSDAQ was 749.125 trillion KRW, which was 140.375 trillion KRW more than the KOSPI’s 608.75 trillion KRW during the same period.

This period was marked by an investment frenzy centered on individual investors in the so-called 'Ecopro Brothers,' representing the secondary battery sector. Among the top stocks purchased by individual investors during this time, Ecopro led with approximately 41 trillion KRW. Ecopro BM, POSCO Holdings, L&F, POSCO Future M, and Geumyang followed. The top six stocks purchased by individuals were all secondary battery-themed stocks. Except for POSCO Holdings and POSCO Future M, the other four companies are listed on the KOSDAQ. In terms of net purchase volume, POSCO Holdings led with 4.19 trillion KRW, followed by Ecopro (1.806 trillion KRW) and Ecopro BM (961 billion KRW). The top three net purchase stocks were all secondary battery theme stocks. The individual net purchase funds concentrated on these three stocks amounted to about 7 trillion KRW.

From May to July, the KOSPI had higher trading volumes. However, from last month to mid-October, the KOSDAQ regained the lead and currently leads on a cumulative annual basis. If this trend continues until the end of the year, it is expected that the KOSDAQ will surpass the KOSPI in trading volume for the first time ever. In terms of index fluctuations, the KOSPI has risen about 16% this year, while the KOSDAQ has surged about 32%, overwhelmingly outperforming the KOSPI. The emergence of the so-called 'Emperor Stock'?a stock priced over 1 million KRW?on the KOSDAQ rather than the KOSPI is also a symbolic event.

The growing influence of individual investors is also one of the factors behind the KOSDAQ boom. Individual investors, once scattered like grains of sand, have rapidly exchanged investment information through YouTube and social media (SNS), dominating specific sectors such as secondary batteries and overwhelming institutional and foreign investors. Kim Seunghyun, head of the Yuanta Securities Research Center, analyzed, "While individual investors account for about half of the trading volume in the KOSPI, they make up 80?90% in the KOSDAQ. This year, institutional investors’ influence has been extremely diminished, and foreign investors’ trading patterns have been erratic, whereas individuals responded cohesively with concentrated buying." He added, "Not only the hot secondary battery sector but also new growth industries like robotics, represented by Rainbow Robotics, which entered the top 10 by market capitalization on the KOSDAQ, have attracted individual investors’ attention, leading to relatively active trading on the KOSDAQ."

The high turnover rate of individual investors’ funds is another reason why the KOSDAQ has outperformed the KOSPI. Kim Hakgyun, head of the Shin Young Securities Research Center, explained, "Since the KOSPI is much larger in scale, it is natural for it to have a higher trading value, but this year, the reason it was not the case can be inferred from the influence of secondary batteries and individual investors. Many of the secondary battery stocks that individual investors concentrated on trading this year are listed on the KOSDAQ, and individual investors generally have a much higher turnover rate than institutions." As trading in high-priced secondary battery stocks became active, the trading value naturally surged.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)