Many Are Ghost Companies for Money Laundering

Key Figures Listed as Executives

Two months after filing a dissolution order against 10 corporations linked to the core La Deok-yeon group involved in the 'SG Securities-triggered stock price crash incident,' the court has ordered the dissolution of half of them. Since corporate dissolution involves a review related to asset liquidation, which requires extensive examination of materials, the unusually swift pace has drawn reactions from the legal community.

According to the legal community on the 19th, the Seoul Central District Court ordered the dissolution of five out of the 10 corporations, including Hoan FG, for which the Seoul Southern District Prosecutors' Office requested dissolution. The hearings for the dissolution orders are being conducted at the courts with jurisdiction over each corporation's location, so hearings for the remaining corporations are ongoing at courts such as the Northern District Court. At the time of the request, the prosecution explained the reason as "to impose legal responsibility not only on the natural persons who committed the crimes but also on the corporations that harmed public interest, and to prevent the corporations from being reused for criminal activities."

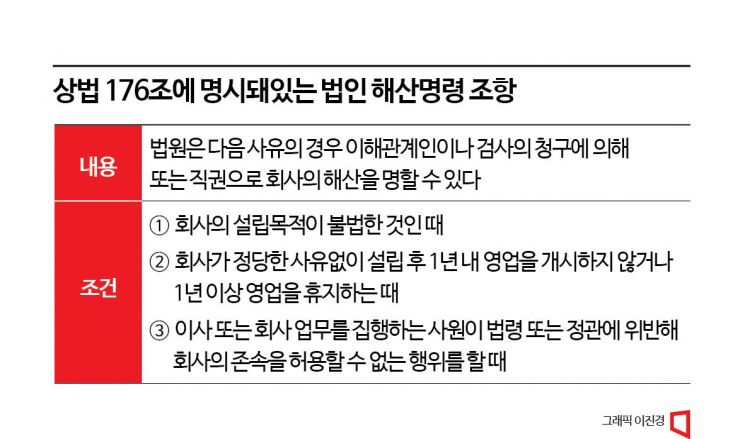

The dissolution order for corporations is stipulated in Article 176 of the Commercial Act. The court may order the dissolution of a company upon request by interested parties or prosecutors, or ex officio, if there are grounds. The conditions are ▲when the company's establishment purpose is illegal ▲when the company does not commence business within one year of establishment without justifiable reason or suspends business for more than one year ▲when directors or employees executing company affairs violate laws or articles of incorporation in a way that makes the company's continuation impossible.

The Seoul Southern District Prosecutors' Office's Joint Investigation Division for Financial and Securities Crimes (Chief Prosecutor Dan Seong-han) and the Public Interest Litigation Team of the Trial Division, on July 13, reviewed 28 corporations linked to La Deok-yeon’s group and requested dissolution orders for 10 corporations based on criteria including ▲establishing and operating corporations to conceal crimes such as collusive trading and to hide criminal proceeds (illegal establishment purpose) ▲not conducting any business other than creating false sales to disguise acquisition of criminal proceeds (business suspension for over one year) ▲cases where the corporation's CEO or executives are accomplices (violation of laws or articles of incorporation by corporate executives). The prosecution believes that if these corporations continue to exist, they could be exploited for further crimes by La’s group. A prosecution official said, "Since these corporations were created for criminal purposes, they must be dissolved quickly, and if they remain active, there is a risk of causing harm to others."

Among the five corporations ordered to dissolve this time, many are known to have been used for money laundering. La Deok-yeon’s group, currently on trial, faces charges including market manipulation of eight stock items and laundering and concealing criminal proceeds amounting to 194.4 billion KRW obtained through unregistered investment discretionary business by disguising them as sales income of corporations or restaurants they manage or receiving payments through nominee accounts. These corporations list key figures such as La Deok-yeon, Jo (41), who oversaw investment attraction and client management, Jang (36), who managed finance and criminal proceeds, former professional golfer Ahn (33), and La’s closest aide Byun (40) as executives. A corporation known as an unregistered quasi-investment advisory firm also received a dissolution order.

In the legal community, it is rare for the prosecution to request corporate dissolution orders, and considering that corporate dissolution usually takes a long time due to the many issues involved, the speed of this case is seen as exceptional. In fact, when the Seoul Central District Prosecutors' Office requested the dissolution of IDS Holdings in June 2019 related to a 1 trillion KRW investment fraud case, which attracted public attention as the 'second Jo Hee-pal case,' it took four months for the dissolution to be decided. The company's CEO Kim Seong-hoon was sentenced to 15 years in prison in 2017 for deceiving over 12,000 people since 2011 by promising monthly dividends of 1-10%, embezzling over 1 trillion KRW.

During the dissolution order request process for La Deok-yeon’s group’s corporations, the prosecution reviewed numerous materials including statements from corporate executives, corporate account transaction records, and tax-related documents, so the legal community expected the court’s approval to take time. Jeong Byung-won, CEO and lead attorney at One & Partners, said, "Since corporate dissolution involves dismantling others' assets, it inevitably requires substantial evidence and time, so processing it within two months is very unusual. The corporations ordered to dissolve can be seen as having their criminal charges well substantiated." There is also analysis that the corporations sufficiently met the conditions for dissolution orders. Professor Kwon Jae-yeol of Kyung Hee University Law School said, "If the grounds are clear, dissolution orders can be issued early. In cases where ghost companies are created, tax authorities can quickly identify them by examining transaction records."

Since the dissolution order was requested to prevent corporations from being reused for crimes, the prosecution is awaiting results for the remaining five corporations. The prosecution also discovered that some employees who worked at the requested corporations and later resigned fraudulently received unemployment benefits and reported this to the Labor Office. However, some corporations reportedly submitted opinions arguing that the prosecution’s request was unjust, so the process may take longer. Professor Kwon said, "If the corporation exists for criminal purposes or does not conduct business for over a year, it is subject to dissolution orders, but if they argue that they do not fall under these conditions, it could prolong the process."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)