Business Agreement for IRP Project to Promote Retirement Pension 활성화

Starting as early as the end of this year, workers from companies that have gone out of business will be able to reclaim their retirement pensions. The government is conducting a project to widely promote and revitalize retirement pensions in collaboration with related retirement pension institutions and financial institutions.

The Ministry of Employment and Labor, the Financial Services Commission, the Financial Supervisory Service, and other government-related retirement pension agencies, along with 20 financial institutions (including banks, insurance, and securities firms), announced on the 20th that they have signed a "Business Agreement to Promote the IRP Project for Retirement Pension Revitalization" based on these contents.

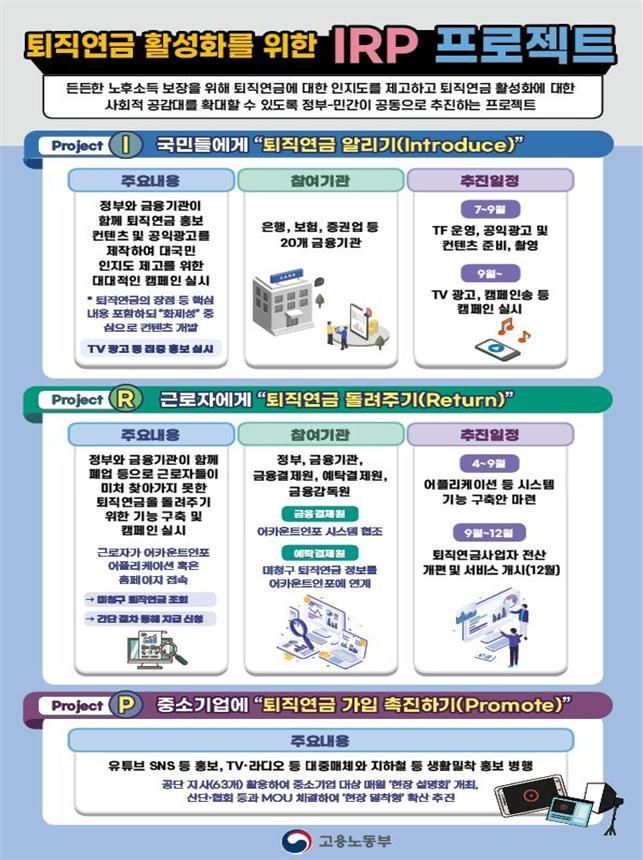

The IRP project is a joint initiative between the government and the private sector aimed at enhancing awareness of retirement pensions and expanding social consensus on revitalizing retirement pensions to ensure a secure income in old age.

First, the I project, named after the first letter of "Introduce," is about "Introducing retirement pensions to the public." The Ministry of Employment and Labor, the Korea Workers' Compensation and Welfare Service, and financial institutions will collaborate to produce promotional content and public service advertisements to raise public awareness of retirement pensions. Starting with today's signing ceremony, intensive promotions such as TV commercials, campaign songs, and YouTube ads will be conducted from September to December.

The R (Return) project is about "Returning retirement pensions to workers." The government and financial institutions will establish a system to return approximately 125 billion KRW worth of retirement pensions that workers have not yet claimed due to company closures and other reasons. To this end, the Ministry of Employment and Labor and the Financial Services Commission plan to prepare the legal basis for this return initiative by revising the Enforcement Decree of the Employee Retirement Benefit Security Act by December.

Once the legal basis is established, individual workers will be able to check how much unclaimed retirement pension they have through the Financial Settlement Service's app, Account Info. Additionally, the Financial Supervisory Service plans to encourage financial institutions to incorporate pension inquiry functions into their websites and apps. Based on the efforts and cooperation of various institutions, unclaimed retirement pensions due to company closures and other reasons will be returned to workers' accounts as early as the end of this year.

The P (Promote) project aims to "Promote retirement pension enrollment among small and medium-sized enterprises (SMEs)." As of 2021, the retirement pension enrollment rate for workplaces with fewer than 30 employees was about 24.0%. In contrast, workplaces with 30 to 299 employees had a rate of 78.1%, and those with 300 or more employees had 91.4%.

This shows that the enrollment rate among SMEs is significantly low. The Ministry of Employment and Labor, the Korea Workers' Compensation and Welfare Service, and financial institutions will actively promote retirement pension funds for SMEs.

Kim So-young, Vice Chairman of the Financial Services Commission, stated, "The ultimate goal of financial investment is retirement, and pensions are a well-established and reliable means for long-term retirement security. Therefore, preparing for pensions should 'never, ever' be delayed or neglected." She added, "Along with the IRP project, the government is pursuing regulatory rationalization for more flexible fund management and diversification of retirement pension product maturities."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)