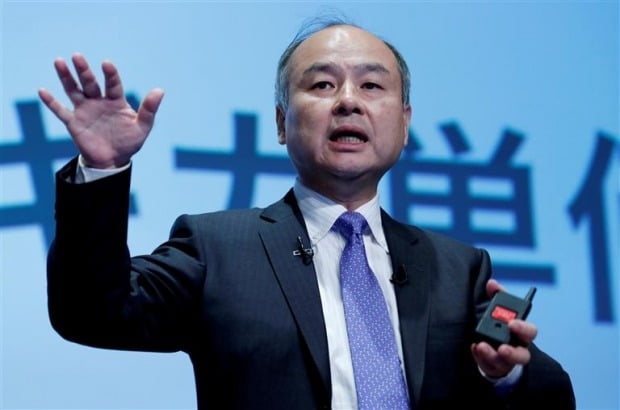

Son Jeong-ui's Aggressive Investment in AI Companies

Secures $5 Billion through ARM IPO

Invests in Autonomous Driving Key Company Mapbox

SoftBank is investing $280 million (approximately 370.1 billion KRW) in Mapbox, a U.S.-based location-based mapping service company. Masayoshi Son, chairman of SoftBank, who has secured ample funds through the listing of the UK semiconductor company ARM, appears to be making a full-scale move to expand AI investments.

On the 18th (local time), major foreign media outlets cited anonymous sources reporting that SoftBank plans to invest in Mapbox, reflecting Chairman Son's intention to expand AI investments.

Mapbox is a company that develops location-based navigation, one of the core technologies for autonomous driving. It collects information on terrain covering up to 200 million miles daily by reflecting data generated as users utilize the service onto real-time maps. Mapbox's technology is also applied in the in-vehicle navigation systems of Toyota Motor, BMW, and GM (General Motors). The market values Mapbox's enterprise worth at between $1.2 billion and $1.3 billion.

Peter Sirota, CEO of Mapbox, stated, "The newly injected funds will be used to develop technology that allows AI software to interact more closely with vehicle cameras and other sensors."

This investment plan came just one week after SoftBank's ARM listing. The market views that Chairman Son, having secured funds through ARM's listing, has launched a full-scale AI investment offensive. It is estimated that SoftBank raised up to $4.87 billion through this listing.

At SoftBank's regular shareholders' meeting in June, Chairman Son expressed his intention to launch a counteroffensive centered on AI. SoftBank recorded a net loss of 970.1 billion yen (approximately 8.6795 trillion KRW) in fiscal year 2022 (April 2022 to March 2023) due to Vision Fund investment failures, marking two consecutive years of significant losses. However, breaking a seven-month silence, Chairman Son appeared at the shareholders' meeting and emphasized his determination to reverse the situation through AI investments, stating, "We have over 5 trillion yen (approximately 45 trillion KRW) in cash by restraining new investments over the past three years."

With ARM's successful listing, Chairman Son seems to be materializing these plans. He is reportedly reviewing investments mainly in AI-related companies deemed highly valuable, such as OpenAI, the creator of the generative AI 'ChatGPT.' Mapbox is also a company that SoftBank once considered listing through a Special Purpose Acquisition Company (SPAC) in 2021. However, the listing plan was canceled due to the IPO market freezing amid high interest rates.

Major foreign media reported, "Combining the funds raised through ARM's listing and existing cash holdings, SoftBank is estimated to have secured a total of $65 billion," adding, "ARM will be a key driving force for (Chairman Son) to dominate the AI world."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.