It has been revealed that the operating profit of small-scale MVNO operators, excluding large corporations and financial sector MVNO operators, has reached 100 billion KRW over the past five years. This confirms with statistics that the vague perception that operating an MVNO business is still difficult is not true.

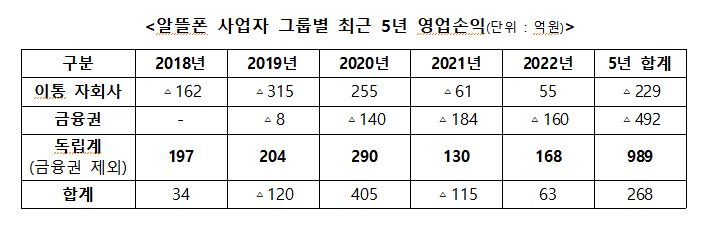

According to data submitted by the Ministry of Science and ICT to Yoon Young-chan, a member of the National Assembly's Science, Technology, Information and Broadcasting and Communications Committee from the Democratic Party of Korea, the total operating profit of all MVNO operators over the past five years amounts to 26.8 billion KRW. The worst performance was in 2019 with a loss of 12 billion KRW, while the best was in 2020 with a profit of 40.5 billion KRW.

Looking at the details, it can be confirmed that large deficits occurred in subsidiaries of large corporations and financial sector MVNOs, which are effectively leading the current MVNO market. The large-scale deficits of these operators distort the profitability indicators of the entire MVNO market.

Over the past five years, the cumulative operating loss of five MVNO subsidiaries of the three major telecom companies is 22.9 billion KRW, and KB’s cumulative operating loss reaches a staggering 49.2 billion KRW. The operating losses of these six operators exceed 70 billion KRW. In other words, the operating profit of independent general MVNO operators excluding these six companies during the same period amounts to 100 billion KRW.

The large-scale operating losses of the three major telecom subsidiaries and KB stem from their excessive business practices. They have rapidly increased subscribers through aggressive promotions and various giveaways by leveraging the strong financial power of their parent companies, the three major telecom companies, and major commercial banks.

Analyzing the performance of the independent small and medium MVNO market excluding these six companies, they recorded operating profits of several billion KRW annually. Last year, among about 80 MVNO operators with subscribers as of the end of the year, only 12 operators recorded losses.

There were many companies, including representative independent MVNO operators such as InscoBi and KCT, that consistently achieved results exceeding the average operating profit margin level of the three major telecom companies. In particular, some small-scale operators with sales around 1 billion KRW recorded operating profit margins exceeding 20%, which contradicts the claim that the survival base of small operators is weak.

The Ministry of Science and ICT announced plans to strengthen support for MVNO operators, including making the wholesale provision obligation regulation, which had been operated under a sunset clause, permanent in the telecommunications market competition promotion plan announced last July.

Assemblyman Yoon said, "Analyzing the data submitted by the Ministry of Science and ICT, the losses in the MVNO market are not due to insufficient regulations or policy environment, but because large corporation subsidiaries and financial sector operators have engaged in abnormal business practices by accepting losses." He added, "The government is misleadingly portraying the entire MVNO market as still requiring financial support based solely on the operating losses of some operators conducting abnormal business practices with strong capital, while in fact, it is only focused on strengthening its regulatory authority."

He pointed out, "It is now necessary to accurately diagnose the market situation and seriously consider what policies can induce the healthy development of the MVNO market, such as promoting investment and strengthening user protection, rather than simple financial support."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)