Presidential Office "Replace with Different Criteria" Recommendation

Controversy Started Over Electric Cars... 130,000 KRW Annually

Price Criteria Introduction May Affect Car Companies Differently

Many Issues in Price Calculation and Eco-Friendly Car Distribution

US 'Varied Standards' EU 'CO2 Emissions'

"Various Criteria Should Be Applied Together"

The government has expressed its intention to change the automobile tax, which is currently based on engine displacement, to be centered on vehicle price. In other words, until now, cars with larger engine displacements paid higher taxes, but going forward, more expensive cars will be taxed more. Resistance is expected from electric vehicle owners who have only been paying about 100,000 won in taxes so far. It has been pointed out that other reasonable criteria to supplement the price should be presented to minimize 'tax resistance.'

On the 13th, the Presidential Office announced the results of the 4th National Participation Debate under the theme of 'Improvement of Automobile Property Tax Criteria Based on Engine Displacement.' Of the total 1,693 votes, 1,454 votes (86%) supported the improvement.

The most common reason for support, at 74%, was the need to consider "reasonable and fair tax imposition in line with changes in the times and environment." The Presidential Office recommended, "The engine displacement criterion should be replaced or supplemented with other standards such as vehicle price, considering fair taxation of automobiles and technological advancements."

The Beginning of the Debate: ‘Electric Vehicles’ Pay 130,000 Won Annually Regardless of Price

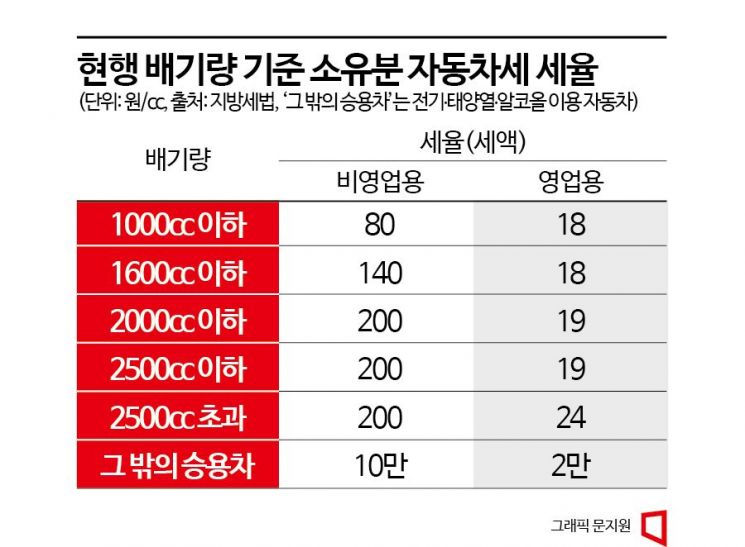

The automobile tax referred to here is the 'ownership portion of the automobile tax.' Automobile-related taxes are imposed at the acquisition, ownership, and operation stages. The tax that must be continuously paid while owning the vehicle is the ownership portion of the automobile tax. It has two characteristics: property tax and environmental pollution charge. In 2001, the Constitutional Court ruled on automobile tax, stating, "Automobile tax is strongly characterized as a property tax by taxing the ownership of the automobile itself, but it also has the nature of a user charge for road use and damage, as well as a charge for acts causing traffic congestion and air pollution."

The current ownership automobile tax is based on engine displacement. In the past, higher engine displacement meant more pollutant emissions and higher vehicle prices, so there was little controversy.

However, as electric vehicles have increased, calls for reform have grown. It is argued that this violates tax fairness. Electric vehicles ranging from the 20 million won Kia Ray EV to the nearly 200 million won Porsche Taycan all pay 130,000 won in taxes. Despite a tenfold price difference, the tax is the same. From the perspective of Kia Ray owners, this may feel unfair. Conversely, those driving internal combustion engine vehicles may feel that the electric vehicle tax is too low.

For example, a 19.75 million won Avante 1.6 gasoline pays an annual automobile tax of 290,820 won. The Porsche Taycan Turbo S electric vehicle, priced at 233.6 million won, has no engine displacement and thus pays only 130,000 won in automobile tax. It pays more than twice the tax of the similarly priced Ray EV.

There are criticisms that applying the current automobile tax criteria to internal combustion engine vehicles is unreasonable. Automobile manufacturers are developing technologies to reduce engine size while maintaining output to reduce environmental pollution. As a result, engine displacement and price no longer correlate. Especially popular imported cars tend to have high prices but relatively low engine displacement. Concerns about tax revenue shortages also fuel the reform debate. If the current criteria are maintained while electric vehicles increase, tax revenue will inevitably decrease.

Winners and Losers Among Car Companies if Price-Based Criteria Are Introduced

The Presidential Office's announcement shows that the most frequently suggested alternative is 'vehicle price.' If this criterion is introduced, consumers' vehicle purchasing patterns may change.

Under the current engine displacement criteria, American cars pay relatively higher automobile taxes even for the same vehicle size, while European cars pay less. If changed to price-based criteria, American cars would benefit, and European cars would be disadvantaged.

American car manufacturers produce many vehicles equipped with large naturally aspirated engines. There is a strong preference in the U.S. for pickup trucks and muscle cars (high-performance vehicles with high output) that can carry heavy loads.

Both vehicle types rely heavily on engine instantaneous torque. The greater the torque, the more responsive the car is. In contrast, European manufacturers have reduced engine size due to environmental regulations, resulting in relatively lower engine displacement. Instead, they mainly developed 'turbo' technology to maintain output.

Is It Okay to Reform Based on Vehicle Price?

The logic of taxing more for those who buy expensive cars seems reasonable. However, upon closer examination, there are issues. First, many ask how vehicle price would be assessed. For new cars, the factory price can be used as a standard. But for used cars, it is different. There is no unified standard, and vehicle value and price vary.

Also, it may conflict with government policies aimed at increasing electric vehicle adoption. The government has declared a goal to increase electric vehicle adoption to 4.2 million units by 2030. There are many systems to promote eco-friendly vehicles, including subsidies for electric vehicle purchases every year.

However, changing automobile tax to be based on price could slow electric vehicle adoption. Consumers who bought electric vehicles because of low tax burdens despite high prices might change their minds. The Genesis G80 electric vehicle costs 82.81 million won. The G80 3.5 gasoline turbo, built on the same platform with similar maximum output performance, costs 62.11 million won.

There is a 20 million won difference. Another problem is the conflict between the environmental tax nature of automobile tax and the principle of taxing more for expensive cars. As vehicles age, their price decreases. However, aged internal combustion engine vehicles emit more carbon dioxide (CO2), potentially causing higher environmental costs. If taxation is based solely on price, the tax burden on these vehicles may actually decrease.

Looking at Overseas Cases... U.S. ‘Varied,’ EU ‘CO2 Emissions’

Looking at cases in various countries, the U.S. has different automobile tax criteria by state. Twenty-six states impose a fixed tax per vehicle, which is the most common. Owners pay a set amount annually and no other taxes are collected for vehicle ownership. For example, Texas charges $50.75 per vehicle, and Pennsylvania charges $38. Seven states impose taxes based on vehicle price, similar to what our government is currently considering.

Some states base the tax on vehicle weight. Heavier vehicles cause more road damage and thus must pay accordingly. In this case, electric vehicles are relatively disadvantaged because they carry heavy batteries and are heavier than internal combustion engine vehicles. Most electric vehicles cannot use mechanical parking systems because they are too heavy for the machinery. Fourteen states in the U.S. impose automobile tax based on weight.

Europe has structured automobile taxes to favor electric vehicles. In 17 EU (European Union) countries, CO2 emissions are used as the tax base.

Experts: “Various Criteria Should Be Applied Together”

Voices are emerging that if automobile tax reform is necessary, multiple criteria should be applied together rather than relying on a single standard. As the Constitutional Court previously ruled, both the property tax nature and environmental tax nature of automobile tax should be considered.

Because battery prices are high, electric vehicles are more expensive than internal combustion engine vehicles of the same model. If automobile tax is based on price, it has been pointed out that the price difference should be deducted from the electric vehicle price. Electric vehicle owners are spending more money to protect the environment. Weight should also be considered for electric vehicles.

Kim Pilheon, a research fellow at the Korea Local Tax Research Institute, stated in the report "A Brief Review of Recent Automobile Tax Reform Discussions," "It is difficult to find a single indicator that reflects both the property tax and environmental tax characteristics of automobile tax," and added, "Price-based and CO2 emission-based criteria can complement each other's strengths and weaknesses."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)