September Monetary and Credit Policy Report

The Bank of Korea recently stated that due to the lingering uncertainties surrounding the consumer price inflation rate amid rising international oil prices, it will focus on price stability and maintain a tightening stance for a considerable period while assessing the need for further rate hikes.

In the "Future Monetary and Credit Policy Direction" section of the Monetary and Credit Policy Report released on the 14th, the Bank of Korea said, "We will operate monetary policy with a focus on price stability to ensure that the inflation rate stabilizes at the target level (2%) over the medium term, while maintaining a tightening stance and paying attention to financial stability as we monitor growth trends."

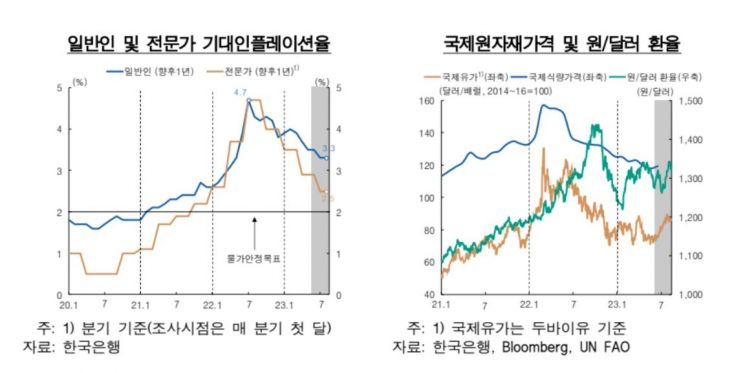

Domestic consumer price inflation has shown a clear deceleration trend since the second half of last year, recording a 2% range in June and July, while the core inflation rate has been gradually declining since the second quarter. However, significant uncertainty remains regarding whether and when the consumer price inflation rate will stably converge to the price stability target of 2%. In particular, as the base effect of petroleum prices diminishes, the consumer price inflation rate rose to 3.4% in August and is expected to fluctuate around 3% until the end of the year.

Moreover, the ongoing ripple effects of accumulated cost increases, demand-side pressures from the resumption of group tours to Korea by Chinese tourists and excess savings, and uncertainties related to public utility rate hikes may delay the deceleration of inflation. Amid increased volatility in international raw material prices such as crude oil and the won-dollar exchange rate, there is concern that changes in external conditions could further raise domestic prices and stimulate inflation expectations.

Regarding the domestic economy, the Bank of Korea forecasted a slight slowdown in growth recently due to weakening private consumption but expects gradual improvement through moderate consumption recovery and easing export sluggishness. However, it noted that the recovery could be constrained by delayed external demand improvement, weakened household purchasing power, and reduced private investment capacity domestically.

Exports have shown signs of gradual improvement despite monthly volatility, but the prolonged sluggishness in exports to China has delayed a full recovery. In China, the real estate market remains weak, and slow recovery in private consumption and continued export sluggishness are expected to slow the recovery pace more than initially anticipated. The Bank of Korea expects that China's efforts to internalize supply chains will reduce demand for intermediate goods imports and increase product competition between Korea and China in final goods markets, prolonging the sluggishness in exports to China.

Mixed Upward and Downward Factors in Housing Prices... High Uncertainty

In the housing market, the downward trend in sales prices has rapidly slowed this year and turned to an increase in July, with transaction volumes also rising, indicating a mitigation of the slump. While housing price increases in the Seoul metropolitan area are gradually expanding, non-metropolitan areas continue to show a decline, resulting in differentiated recovery levels by region.

Household loans, which had been gradually decreasing since September last year, turned to an increase centered on housing-related loans from April this year, with the growth rate expanding. In particular, the household loan delinquency rate continues to rise, and the delinquency rate among vulnerable borrowers is increasing faster than that of all borrowers, exceeding pre-COVID-19 levels. The Bank of Korea expressed concern, stating, "If negative income shocks occur, the risk of household loan defaults will increase, especially among vulnerable borrowers, and consumption capacity could be significantly constrained."

Looking ahead at household loan conditions, short-term factors driving increases include the expansion of housing sales transactions since the beginning of the year, increased apartment move-ins and pre-sales scheduled for the second half of the year, and loan demand for landlords' deposit returns. Subsequently, factors such as the government's adjustment of the supply pace of special home mortgage loans (Bogeumjari Loan) and monitoring of internet-only banks' mortgage loan status are expected to slow the growth trend, influenced by the housing market situation.

Regarding the housing price outlook, the Bank of Korea said, "There are mixed upward and downward factors for housing prices, resulting in high uncertainty. A decrease in supply in Seoul next year and easing of tax-related regulations are expected to support a continued rebound in housing prices, while the persistence of a high-interest-rate environment and declines in jeonse (long-term lease) prices will limit housing price increases and transaction volume growth."

It added, "Excessive household debt negatively impacts the economy by hindering long-term growth and widening asset inequality, so consistent cooperation among policy authorities is necessary to continue deleveraging (repayment and reduction of borrowing) over the medium to long term."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)