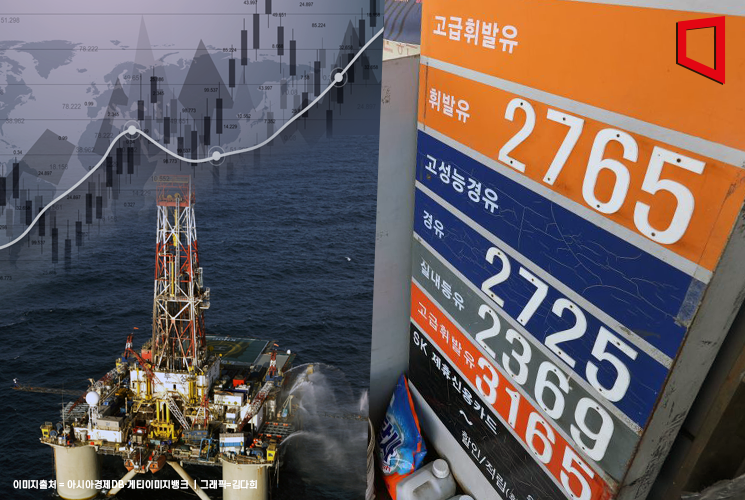

International oil prices soared to their highest level since November last year amid concerns over supply shortages. Observers predict that the price per barrel could soon surpass $100 if the current trend continues. This rise in oil prices raises concerns about tightening measures, as it could rekindle inflation worries that had recently shown signs of easing.

On the 12th (local time) at the New York Mercantile Exchange, the price of West Texas Intermediate (WTI) crude oil for October delivery closed at $88.84 per barrel, up $1.55 (1.78%) from the previous session. This closing price is the highest since November 11 last year. WTI rose on 11 of the past 13 trading days. It has surged more than 10% since the beginning of the year and over 6% this month alone. The international oil price benchmark Brent crude also hit $92.06 per barrel, marking its highest level since November 16 last year.

This follows the Organization of the Petroleum Exporting Countries (OPEC) maintaining its global oil demand forecasts for this year and next in a report released that day. Earlier, Saudi Arabia and Russia announced plans to reduce supply until the end of the year, and OPEC’s report indicating steady demand has fueled market concerns over supply and demand. Global oil demand this year is expected to reach an average of 104.31 million barrels per day. Meanwhile, supply from non-OPEC oil-producing countries is estimated at about 74.28 million barrels per day.

Edward Moya, senior analyst at OANDA, said, "The OPEC monthly report suggests that the oil market will be much tighter than initially expected, which is driving prices up." News of severe flooding in Libya, an OPEC member, leading to the closure of four oil export terminals in the eastern region also added upward pressure on oil prices. Matt Smith, senior analyst at commodity logistics firm Kpler, explained, "There are many ports in Libya that cannot export, which adds to the strength of oil prices."

On the same day, the U.S. Energy Information Administration (EIA) released a short-term outlook report predicting that global oil inventories will decrease by nearly 400,000 barrels per day due to supply slowdowns. The EIA also raised its Brent crude price forecast for the fourth quarter from $86 to $93 per barrel. It is expected that oil inventories will need to recover before prices fall back to around $87 per barrel. Analyst Moya predicted that if economic indicators in Europe and China begin to improve, the oil market could tighten further, potentially pushing Brent crude prices easily to $100 per barrel. The International Energy Agency (IEA) report will be released the following day.

Currently, the market is flooded with analyses suggesting that the recent rise in oil prices will pose a burden on the U.S. Federal Reserve (Fed), which is entering the final stages of tightening. The rise in oil prices not only increases inflationary pressures but could also dampen expectations for an early end to Fed tightening. Although energy prices are not included in the core Personal Consumption Expenditures (PCE) price index favored by the Fed, they indirectly raise costs across all sectors of the economy. If the oil price rally continues, the Fed will have no choice but to implement additional tightening measures.

Accordingly, investors are closely watching how much of the recent oil price increase will be reflected in the U.S. Consumer Price Index (CPI) to be released the next day. The August CPI inflation rate is expected to slightly exceed the previous month’s increase of 3.2%, hovering around 3.6%. Omar Sharif, president of Inflation Insights, forecasted, "Since late June and early July, the rise in oil prices has clearly put upward pressure on gasoline prices, and the August headline CPI will see a significant increase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.