Foreigners Sell Net for 6 Consecutive Trading Days... Offload 1.11 Trillion Won

Sell-Off in Stocks Soaring This Year Including SK Hynix, EcoPro BM, LG Energy Solution

Risk Asset Avoidance Movement... KOSPI Recovery to 2600 Level Within the Year Seen Difficult

In the domestic stock market, the departure of foreign investors is becoming more apparent. This is attributed to increased economic uncertainty, such as the sharp rise in bond yields and the strengthening of the US dollar in the second half of the year. The securities industry expects the stock market correction phase to continue for the time being.

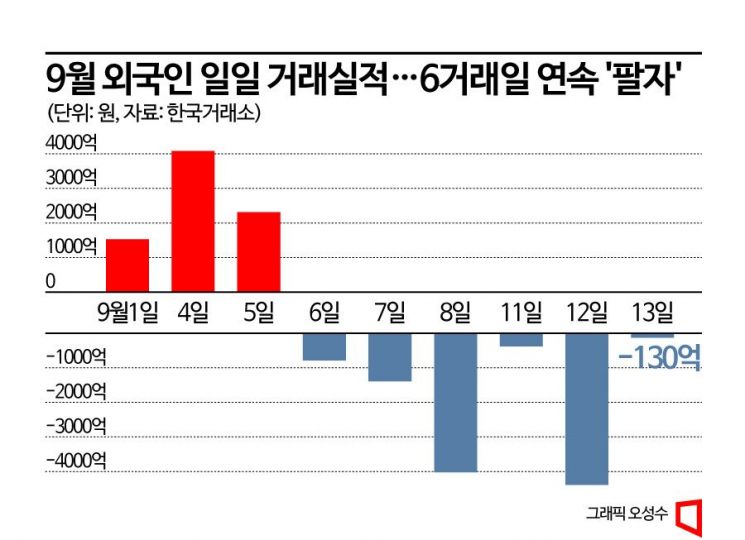

According to the Korea Exchange on the 14th, foreign investors have sold domestic stocks (combined KOSPI and KOSDAQ) for six consecutive trading days from the 6th to the previous day. During this period, a total of 1.11 trillion KRW flowed out. This is the first time this year that daily foreign investor funds have recorded net sales for six consecutive trading days.

During this period, the stock most sold by foreign investors was SK Hynix, with a net sale of 186 billion KRW. This was followed by Ecopro BM (-175 billion KRW), LG Energy Solution (-113 billion KRW), L&F (-84 billion KRW), POSCO Holdings (-82 billion KRW), CJ (-74 billion KRW), and POSCO Future M (-55 billion KRW). SK Hynix, Ecopro BM, and POSCO Holdings are stocks whose prices have risen about 2 to 3 times compared to the beginning of the year. After the frenzy over the secondary battery theme cooled down, and with the recent stock market losing clear direction, it is interpreted that profit-taking has been carried out mainly on stocks that had high returns this year.

Looking at the monthly trading performance of foreign investors, net sales continued for two consecutive months following last month (-743 billion KRW). In September, net sales amounted to 318 billion KRW up to the previous day. If this trend continues, monthly trading performance is expected to record negative figures for two consecutive months for the first time this year. Compared to the record-breaking net purchases in the trillions of KRW at the beginning of the year, the atmosphere has clearly changed in the second half. Institutional investors, who tend to be relatively conservative, also net sold 637 billion KRW just this month.

The securities industry points to interest rates as the main reason for the outflow of foreign funds. As of the previous day, the 3-year government bond yield was 3.86%, close to the year's highest level recorded on March 2 (3.87%). Lee Woong-chan, a researcher at Hi Investment & Securities, said, "While the stock market in the third quarter has been alternating between correction and rebound, there is an expectation for a rebound as negative factors disappear. However, the essence of the correction is not that stocks are adjusting due to bad news, but that stocks are vulnerable to bad news because they are not attractive compared to bonds, especially short-term interest rates." He added, "Given the various events piling up until the end of October, it is highly likely that the stagnation phase will continue. We maintain a conservative view of the stock market in the second half, expecting a box range of 2480 to 2590 points." He believes it will be difficult for the KOSPI to recover to the 2600 level within the year.

In fact, recent overseas institutional investors have forecasted that the end of the US tightening cycle will be delayed much longer than expected. According to the September Global Fund Manager Survey published by Bank of America (BofA) Merrill Lynch, 38% of respondents answered "second half of next year" when asked about the timing of the Federal Reserve's rate cuts, the highest proportion. Previously, in the September survey, the most common answer was "second quarter of next year," indicating a reversal in ranking. Regarding the economic outlook for the next 12 months, the percentage expecting contraction exceeded those expecting expansion by 53 percentage points, weakening confidence compared to the previous month (45 percentage points). As concerns about economic contraction grow, there is a stronger tendency to reduce the proportion of risky assets such as stocks, which is generally interpreted as negative for the stock market. Kim Il-hyuk, a researcher at KB Securities, said, "The timing of rate cuts has been pushed further back, according to institutional investors' judgment. If rapid rate cuts are not expected despite weakening economic confidence, growth expectations will weaken in a high discount rate environment, which is unfavorable for stocks."

The strong US dollar and the recent sharp rise in international oil prices are also sources of concern. The US Dollar Index, which measures the average value of the US dollar against six major currencies, surpassed 105 on the 7th, reaching its highest level since March. Oh Chang-seop, a researcher at Hyundai Motor Securities, explained, "Since the fourth quarter of last year, the dollar weakened and the stock market strengthened, but in the second half, the dollar strengthened and risk asset preference in financial markets weakened. As concerns about economic slowdown grow, capital outflows are continuing mainly in emerging markets." International oil prices continue to hit yearly highs day after day. Roh Dong-gil, a researcher at Shinhan Investment Corp., said, "The high influence of oil prices is expected to increase caution until next week's FOMC, creating an unfavorable environment for growth stocks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.