Over $1.1 but Allocation News Missing in White Paper Causes Decline

DeFi Deposit Size Shrinks, Outlook Uncertain

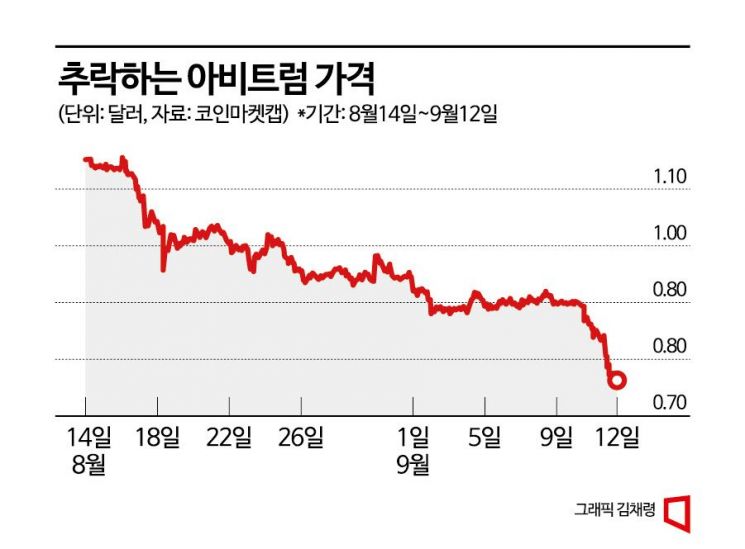

The price of Arbitrum, ranked 42nd in total virtual asset market capitalization, has recently been showing a sharp decline. Although it gained attention for addressing Ethereum's shortcomings, it has fallen to its lowest price, and negative factors such as a decrease in the total deposit size on the Arbitrum blockchain have overlapped, casting a gloomy outlook.

According to the global virtual asset market status relay site CoinMarketCap, as of 3:32 PM on the 12th, Arbitrum's price recorded $0.77 (approximately 1,022 KRW), down 7.82% from the previous day. Over the past month, Arbitrum's price has dropped by more than 33%. Until the 14th of last month, it was above $1.10, but it weakened until the 10th of this month, falling to around $0.89, and then continued to decline from the 10th onward. Compared to March 24th, when CoinMarketCap began tracking its price, it has plummeted by about 93%.

Arbitrum is based on Ethereum, an existing Layer 1 blockchain. The Arbitrum blockchain was developed to improve the speed of the Ethereum blockchain. When a transaction or contract occurs, instead of executing and storing it on the Layer 1 blockchain, the execution takes place on the Layer 2 Arbitrum blockchain. This improves speed and reduces costs.

However, this process uses a technology called optimistic rollup. When contracts are executed on Layer 2 and the information is transmitted to the Layer 1 Ethereum blockchain, there may be errors or manipulations in the data. Therefore, the Arbitrum blockchain sets a dispute period for the information sent to Layer 1 to maintain security. Only after the dispute period passes is the information considered final. If errors are found or objections are raised and deemed valid before then, the information reverts to the state before transmission. This process of reverting the blockchain state to before incorrect information is stored is called optimistic rollup.

Based on this optimistic rollup technology, the Arbitrum blockchain initially attracted market attention. On April 18th, Arbitrum's price even surged to $1.77. However, it declined amid various controversies. The Arbitrum Foundation caused turmoil by announcing the allocation of 750 million Arbitrum coins to the foundation as a special subsidy, which was not mentioned in the whitepaper. Discord also arose between the DAO (Decentralized Autonomous Organization) and the foundation over this issue. In July, the Arbitrum blockchain network repeatedly experienced outages, causing the price to plummet.

Furthermore, the total deposit size on the Arbitrum blockchain in the DeFi (Decentralized Finance) market is steadily decreasing, and the outlook is not bright. As the deposit size decreases, liquidity on the blockchain diminishes, which can hinder network growth and new participation. According to data from the DeFi analytics platform DeFiLlama, as of the 12th, the total deposit size on the Arbitrum blockchain was $1.642 billion (approximately 2.1781 trillion KRW), continuously declining since it recorded $2.623 billion on May 6th.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)