FSS Overhauls Credit Card Interest Rate Disclosure System

It will become easier and clearer to check the interest rates for card loans, cash services, and revolving (partial amount rollover agreements). It is expected that users will be able to check interest rates by credit score and even review past trends.

On the 12th, the Financial Supervisory Service announced that it had formed a task force with the Korea Federation of Credit Finance and the credit card industry to prepare the "Enhanced Disclosure Plan for Card Loan and Revolving Interest Rate Comparison" containing these details.

First, a new section will be added on the Financial Supervisory Service’s financial consumer information portal "Fine" website that directly links to the "Credit Card Product Disclosure System." Additionally, a summary screen has been created where the average interest rates for card loans and revolving by company can be viewed on one page.

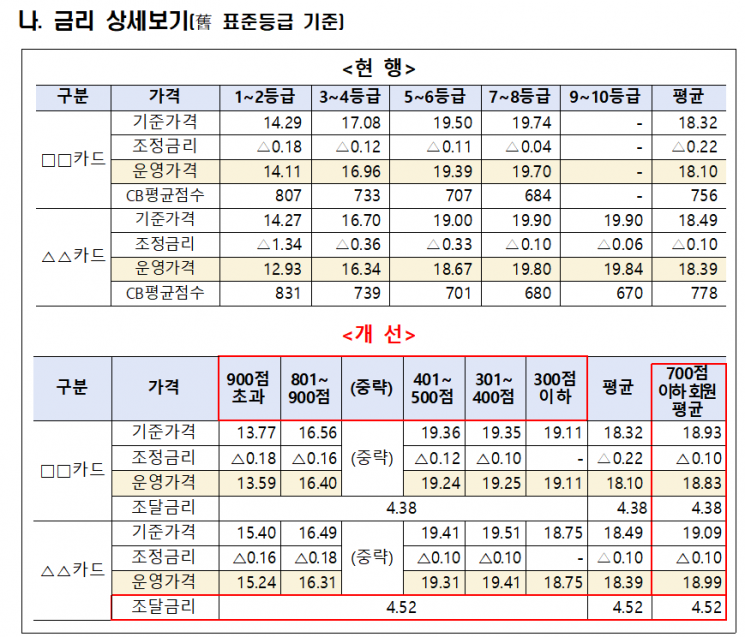

The detailed interest rate information related to card company loans will also be made easier to understand. The previous standard grade (which standardized internal grades by card company; consumers could not know their own grade) based interest rate criteria will be changed to "credit score."

The card companies’ funding cost, which is the basis for loan interest rates, will also be disclosed. The "View Interest Rate Details" disclosure will include the card bond interest rate as well. As of the end of the first half of this year, the proportion of card bonds among the total funding balance of card companies reached 61.3%.

Along with this, a "View Interest Rate Details" section will be newly added to revolving fee rates, similar to card loans and cash services. This will allow users to check the base price of the revolving fee rate (pre-discount fee rate) and the adjusted interest rate (such as marketing discount fee rates).

The average interest rate for low-credit users will also be disclosed. Specifically, the average handling interest rate for members with a credit score of 700 or below will be additionally disclosed.

To allow more accurate confirmation of card product interest rates, the disclosure cycle for cash service interest rates has been shortened from quarterly to monthly. Furthermore, the disclosure date for cash service and revolving interest rates has been changed from the end of each month to the 20th.

In addition, past data will be disclosed so that users can check the levels and trends of interest rates over time. The Korea Federation of Credit Finance plans to launch this new credit card product disclosure system starting on the 20th.

A Financial Supervisory Service official stated, "With various interest rate information, consumers will be able to compare and analyze card loan and revolving interest rates, which will help consumers make rational product choices and encourage interest rate competition among card companies. We will continue to review the appropriateness of disclosure items with the Korea Federation of Credit Finance and continuously improve any shortcomings."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.