Last Year Whiskey Imports Reach $270 Million

Up 52.2%... Exports Under $100 Million

K-Food Booms but Alcohol Industry Remains Weak

Higher Prices Face Higher Taxes Under Specific Tax System

Competitive Disadvantage in Premium Alcohol Production

Most OECD Countries Use Quantity-Based Tax

Gradual Shift to Quantity-Based Tax Needed by Alcohol Type

Expand Traditional Liquor Scope and Revitalize Distilled Spirits Market

Through Global Benefits and Online Sales Permission

The Korean alcoholic beverage market has been expanding its diversity in recent years. In the past, a glass of soju after work was a common choice for almost everyone, but now people end their day with various types of alcohol such as whiskey and brandy. Amid the diversification of tastes and increased consumption of imported liquors, Korea's alcohol export performance remains somewhat sluggish. As the trade deficit in the alcoholic beverage sector rapidly grows, there is increasing concern about how to more powerfully introduce the nation's representative liquors to overseas markets.

Helpless Against the Flood of Imported Liquors... Trade Deficit of 1.3 Trillion Won

According to customs export-import trade statistics on the 12th, last year, the domestic import value of whiskey types such as Scotch, Bourbon, and Rye was $266.84 million (approximately 350 billion won), marking a 52.2% increase compared to the previous year ($173.54 million). After recording the highest annual import value in history in 2007 ($270.29 million), domestic whiskey imports had been declining but have been on the rise again since 2020. This year, despite last year's high growth, imports continued to increase, with the import value reaching $159.46 million (about 210 billion won) as of July, up 8.2% from the same period last year ($147.35 million).

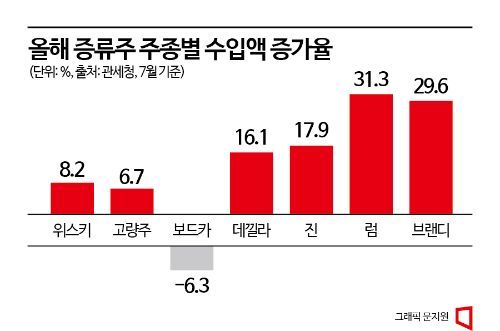

The increase in import value is not limited to whiskey. Although smaller in scale than whiskey, most famous foreign distilled spirits are also showing double-digit growth rates. The import value of rum, a sugarcane-distilled spirit, reached $2.18 million (about 300 million won) by July 2023, a 31.3% increase compared to the same period last year ($1.66 million). Brandy imports also rose by 29.6% during the same period. Additionally, gin (17.9%), tequila (16.1%), and gaoliang liquor (6.7%) continue to grow in the domestic market.

On the other hand, the export scale of domestically produced distilled spirits is relatively small compared to import values. Soju, the largest export product, recorded $93.32 million (about 125 billion won) in exports last year, a 13.2% increase from the previous year ($82.42 million). During the same period, liqueur exports rose 9.8% to $89.21 million (about 120 billion won). Soju exports, which were around $97.57 million (about 130 billion won) in 2018, declined to about $80 million during the COVID-19 pandemic but showed signs of recovery last year, though still falling short of $100 million.

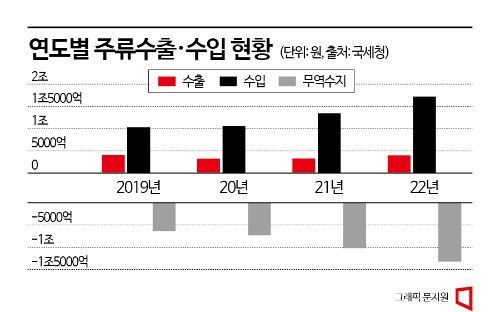

As Korean alcohol exports remain sluggish, the trade deficit in the alcoholic beverage sector has been significantly increasing every year. Last year, domestic alcoholic beverage exports amounted to 397.9 billion won, up from 325.7 billion won in 2021 but still below the 404.7 billion won level of 2019. Meanwhile, imports have surged annually, rising from 1.0295 trillion won in 2019 to 1.056 trillion won in 2020, 1.3454 trillion won in 2021, and 1.7219 trillion won last year. This represents nearly a 70% increase over three years since 2019. Consequently, the imbalance between exports and imports has deepened, with the trade deficit reaching 1.324 trillion won in 2021, more than double that of 2019.

The trade deficit in alcoholic beverages results from the influx of representative distilled spirits from around the world into the domestic market, while domestic manufacturers fail to produce competitive products for overseas markets. Although international interest in Korean culture is rising and awareness and preference for K-food are increasing, the alcoholic beverage sector struggles to create competitive products. While diluted soju is gaining attention in international markets, industry consensus holds that it is difficult to establish a firm position as a flagship distilled spirit for long-term exports.

The success story of Taiwan's whiskey brand 'Kavalan' has further expanded Korean consumers' interest in the domestic liquor industry. The Kavalan distillery was established in 2005 and released its first whiskey in 2008. It began gaining international recognition by winning a gold medal at the International Wine & Spirit Competition (IWSC) in 2013. In 2017, it became the first new whiskey-producing country to be named 'Distillery of the Year.'

Higher Liquor Taxes on Premium Spirits... Hindering Growth of High-End Distilled Spirits

While Japan and Taiwan produce world-class whiskey and China targets the global market with gaoliang liquor, Korea lacks a representative distilled spirit because the institutional infrastructure necessary for premium distilled spirits to take root and grow is insufficient. At the core is Korea's liquor tax law system, which differs significantly from those of advanced liquor-producing countries. Korea's liquor tax law applies an ad valorem tax to distilled spirits such as soju and whiskey. The ad valorem tax is based on the retail price, meaning higher-priced liquors are taxed more heavily. In particular, the tax rate on distilled spirits is 72%, higher than the 30% rate on fermented liquors such as yakju, cheongju, and fruit wines, making distilled spirits more vulnerable to price increases.

For example, applying the current tax system to a bottle of whiskey with a domestic retail price of 100,000 won results in a liquor tax of 72,000 won. On top of this, an education tax of 21,600 won (30% of the liquor tax) and a 10% value-added tax (19,360 won) are added, pushing the final price well above 200,000 won. This means the consumer price more than doubles the tax base.

The opposite tax system to ad valorem tax is the specific tax, which levies taxes based on the volume of alcohol. Among OECD member countries, all except five?including Korea?adopt the specific tax system. Domestically, since 2020, beer and takju have been taxed under the specific tax system. The government accepted industry demands to improve the structural problem where taxes rise as the retail price increases due to the use of high-quality raw materials.

The adoption of an ad valorem tax system for distilled spirits means there is less incentive to produce premium diluted soju or whiskey. The longer aging period or the use of expensive ingredients raises the retail price, leading to a significant increase in the selling price. Price increases caused by taxes rather than production costs inevitably have a negative impact on product sales, as the price rise is unrelated to the actual value of the product.

The current liquor tax system, which applies ad valorem tax, also poses obstacles to producing domestic whiskey. Considering the high tax rate and production costs, producing whiskey domestically is not economically viable. A representative example is Golden Blue, which promotes itself as K-whiskey but imports whiskey distillate from Scotland and bottles it in Australia, despite having a production plant in Gijang, Busan. In conclusion, the current ad valorem tax system, where higher production costs lead to higher consumer prices due to high tax rates, reduces the profitability of premium distilled spirit businesses, ultimately hindering the growth of high-end distilled spirits domestically.

An industry insider said, "Under the current ad valorem liquor tax system, it is difficult to produce high-quality distilled spirit products," adding, "When specific tax was introduced for beer and takju, there was consideration for its application to all types of alcohol including distilled spirits, so it is necessary to gradually review the introduction of specific tax for distilled spirits such as soju and whiskey."

K-Distilled Spirits Blocked by Liquor Tax Law... Market Expansion Needed for Change

To nurture national representative distilled spirits, the opinion that the liquor tax system should be changed to a specific tax system is gaining the most traction.

The problem lies with diluted soju. If the tax system switches to specific tax, taxes on high-priced liquors like whiskey will decrease, lowering prices, but low-priced liquors like diluted soju will face increased tax burdens and inevitable price hikes. Moreover, since soju is a representative liquor enjoyed by the general public and is a key item monitored by the government whenever inflation control measures are implemented, switching to specific tax is a challenging task. Given this situation, voices are emerging to pursue a phased transition starting with fermented liquors other than beer and takju, then moving on to distilled spirits. Fermented liquors such as yakju, cheongju, and fruit wines, which are currently taxed under the ad valorem system, have relatively smaller price differences within the same category compared to distilled spirits, making it easier to persuade opponents.

Above all, there is a call to shift the direction of tax reform discussions, currently focused on fairness among liquor types, toward finding the optimal solution to prevent alcohol-related harm. An industry official said, "Most OECD countries adopt specific tax because it is considered the most effective way to reduce social costs caused by drinking," adding, "Higher alcohol content means greater potential social costs from alcohol, so it is appropriate to impose taxes proportionate to that."

'Hwayo' is not recognized as a regional specialty liquor under the Traditional Liquor Industry Act because its producer, the Gwangjuyo Group, is neither an agricultural management entity nor a producer organization.

'Hwayo' is not recognized as a regional specialty liquor under the Traditional Liquor Industry Act because its producer, the Gwangjuyo Group, is neither an agricultural management entity nor a producer organization.

There are also voices suggesting that relaxing the concept of traditional liquor is a more realistic alternative. The idea is to redefine traditional liquor by expanding the scope of regional specialty liquors to provide tax benefits and allow online sales, thereby revitalizing the distilled spirits market. If recognized as traditional liquor, producers receive tax benefits such as a 50% reduction in liquor tax and are permitted to sell online. According to current traditional liquor industry law and liquor tax law, traditional liquor refers to one of three categories: liquor made by intangible cultural heritage holders (folk liquor), liquor made by food masters (folk liquor), or liquor produced directly by agricultural management entities or producer groups using agricultural products from areas adjacent to the distillery (regional specialty liquor).

The industry believes that expanding the designation criteria for regional specialty liquor to include various foreign liquor types such as whiskey and general liquor companies should be considered within the scope of traditional liquor. Continuously creating incentives for manufacturing and selling premium liquors will lead to the release of diverse products in the market, where substandard products are filtered out and verified products circulate in a virtuous cycle.

An industry insider explained, "Designation as traditional liquor gives identity to companies aiming for exports," adding, "It is a way to break free from the ironic situation where liquors not recognized as traditional in Korea must be exported overseas." They continued, "A market environment where good-quality domestic liquors can be sold and purchased at good prices is necessary for market growth and for producing proper products worthy of export. Selling liquors with low domestic recognition and popularity overseas is nonsensical."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.