Among 9 Companies Listed Last Month, 4 Stocks Rise Over 100% Compared to IPO Price

Curiox Soars 380% Above IPO Price... Big Fish Interest Following Pado's Successful Listing

The stock prices of newly listed companies that entered the KOSDAQ market last month surged, invigorating the initial public offering (IPO) market. With Pado smoothly settling into the stock market, it is expected that IPOs of large-scale public offerings will continue.

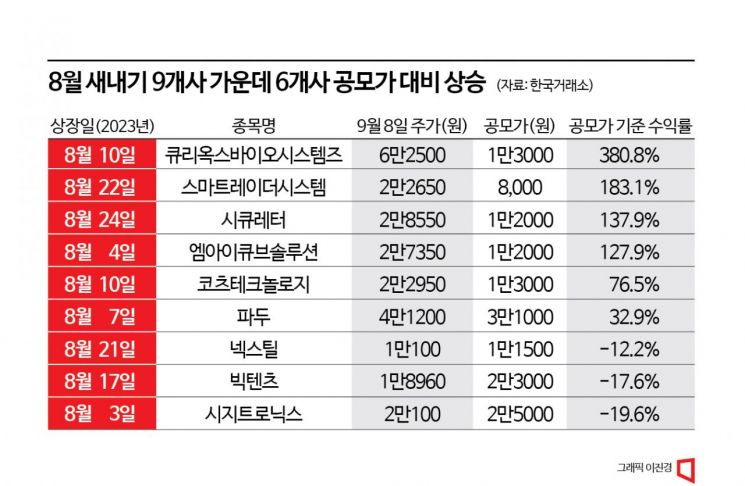

According to the Korea Exchange, among the nine companies newly listed on the domestic stock market last month (excluding SPACs), the stock prices of four companies rose more than 100% compared to their offering prices. Curiox Biosystems, which was listed on the KOSDAQ market on the 10th of last month, saw its stock price increase by 380% compared to the offering price. The stock prices of Smart Radar Systems, Secure Letter, and MIQ Solution also rose more than 100% compared to their offering prices. Considering that the KOSDAQ index fell by 0.8% last month, the stock prices of these newly listed companies performed quite well.

Founded in 2018, Curiox Biosystems is a manufacturer of automated cell analysis process equipment. It developed LW technology, an automated cell analysis process technology based on non-centrifugal separation. LW technology automates all processes from sample injection to analysis result output, reducing time compared to the traditional manual method while ensuring high accuracy. It also reduces reagent and consumable costs by about 50% compared to conventional methods. Donggeon Lee, a researcher at SK Securities, explained, "They have proven their technological capabilities by securing many global pharmaceutical companies as clients," adding, "LW products are expected to become the standard for analysis processes in cell analysis standardization recommendations."

Smart Radar Systems is the first domestic company to develop AI-based high-resolution 4D imaging radar. Unlike conventional 3D radar, 4D imaging radar can measure the width, length, and height information of targets. Based on 4D imaging radar technology, they are developing radar applied to the mobility sector, focusing on autonomous vehicles, drones, and special vehicles (heavy equipment). The stock price rose on expectations that the company will enter a full-fledged growth phase by starting to supply to domestic and overseas automakers from next year.

Secure Letter is a security solution developer. It supplies solutions that detect, analyze, diagnose, and block security threats entering via email. Secure Letter's solution recorded a 100% detection rate for malicious files in performance evaluations by the Korea Internet & Security Agency (KISA). In performance evaluations by the Telecommunications Technology Association (TTA), it demonstrated a diagnosis speed of 12.02 seconds, proving its competitiveness compared to existing APT solutions that take 3 to 5 minutes. Cheolhwan Yoon, a researcher at Korea Investment & Securities, explained, "Based on verified technological capabilities, Secure Letter supplies solutions to over 40 public institutions, including the National Pension Service and Korea Post," adding, "It also counts 15 financial companies such as banks and securities firms, as well as over 80 educational institutions and general enterprises as clients."

Pado’s stock price, which was below the offering price, rises more than 30% within a month of listing

Companies recognized for their technological capabilities in various fields have been listed one after another, and their stock prices have risen significantly compared to their offering prices. Moreover, Pado’s market capitalization, based on the offering price, exceeds 1.5 trillion KRW, and its stock price has steadily trended upward since listing, positively influencing the IPO market. Although Pado’s stock price was below the offering price on the first day of listing, it rose more than 30% compared to the offering price within a month. Its market capitalization is approaching 2 trillion KRW. Jongseon Park, a researcher at Eugene Investment & Securities, analyzed, "Pado is maintaining a stock price higher than the offering price after going through the process of absorbing circulating shares early in the listing," and added, "It is judged to be recognized as a successful IPO."

With newly listed stocks last month recording favorable stock returns and Pado, considered a large-scale public offering, settling in the stock market, the outlook for the IPO market in the second half of this year is bright. Doosan Robotics and Seoul Guarantee Insurance are preparing for listing. Based on the expected offering price range, Doosan Robotics’ anticipated market capitalization is between 1.4 trillion and 1.7 trillion KRW. Considering the recent surge in stock prices of robot companies listed on the stock market, including Rainbow Robotics, there is sufficient demand forecast for Doosan Robotics. Following Pado’s success, expectations for Doosan Robotics’ success are growing, strengthening the outlook that large-scale IPO candidates, which had been adjusting their timing for stock market entry, will soon announce their intentions. Seungyun Yang, a researcher at Eugene Investment & Securities, analyzed, "Doosan Robotics is the largest domestic collaborative robot company, holding a 4% share of the global collaborative robot market," adding, "After listing, it plans to expand sales channels, broaden its product lineup, and develop software sales and ecosystem construction."

More large-scale IPOs expected in the fourth quarter

This month, Iniswave Systems, Millie’s Library, IMT, Hanssak, Revu Corporation, and Doosan Robotics will conduct public subscription for IPOs. Purit, SLS Bio, and Shinseong ST will finalize their offering prices through demand forecasting. The expected number of IPO companies in September is around 10 to 12, exceeding the historical average of 7 companies in September from 1999 to 2022. Researcher Park stated, "It is judged that the investment sentiment of institutional and general investors toward IPOs has continued to recover," and forecasted, "Large-scale IPOs are expected to be possible starting from the fourth quarter of this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)