Easing Restrictions on Subordinated Bonds and Hybrid Capital Securities Issuance

Proposals to Simplify Investment Discretionary Business Registration Requirements

There is an analysis suggesting that in order for domestic insurance companies to expand their overseas presence more actively, regulations related to restrictions on self-borrowing purposes and borrowing limits need to be eased.

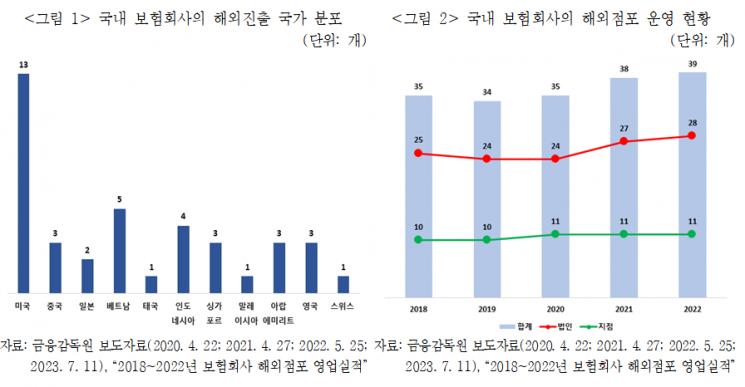

On the 10th, the Korea Insurance Research Institute pointed this out in a report titled "Measures to Activate Overseas Expansion of Insurance Companies." According to the report, domestic insurance companies began attempting overseas expansion in the 1970s by establishing local offices mainly for some non-life insurance companies and reinsurance companies. As of the end of last year, four life insurance companies and seven non-life insurance companies have established 39 overseas branches (28 local corporations, 11 branches, excluding offices) in 11 countries including the United States, the United Kingdom, Switzerland, China, Vietnam, and Indonesia, conducting overseas business.

Compared to 35 overseas branches at the end of 2018, there has been little significant change. Among the overseas branches, 30 are engaged in insurance business, and 9 are involved in non-insurance businesses such as financial investment and real estate leasing, indicating a high dependence on insurance business.

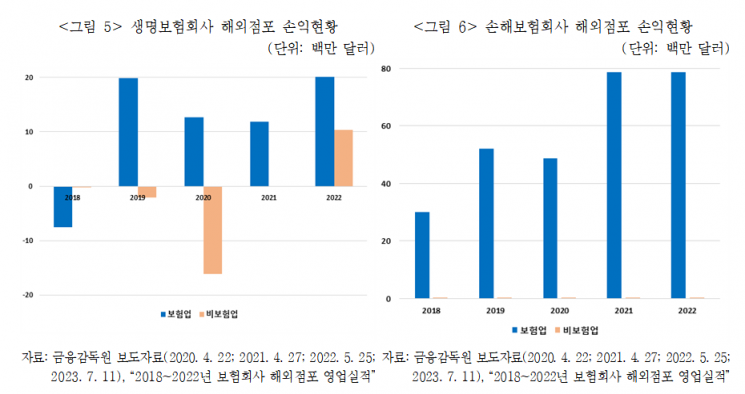

Looking at the financial status of domestic insurance companies' overseas businesses over the past five years, there has been an overall increase in assets and liabilities due to new entries into emerging markets and the expansion of overseas insurance sales. This can be seen as a positive signal for the expansion of overseas business, but the scale is still considered too small to serve as a growth engine for insurance companies. As of the end of last year, the proportion of overseas branch assets to the total assets of domestic insurance companies conducting overseas business was only 0.9%.

The profit and loss status of overseas business is still volatile. While the net profit from insurance business has generally been positive, uncertainties remain in sales expansion due to competition in local insurance markets and differences in localization capabilities. This highlights the need for efficient cost management to generate stable profits.

Non-insurance businesses have shown losses for certain periods or net profits at levels insignificant compared to insurance business. It was emphasized that through business diversification beyond financial investment and real estate leasing, new revenue sources, synergy effects, and risk dispersion should be pursued. To this end, additional regulatory easing related to funding and support for asset management of subsidiaries is necessary.

Byung-guk Oh, a research fellow at the Korea Insurance Research Institute, stated, "The main overseas insurance business entry methods for domestic insurance companies?joint ventures, new investments, and acquisitions and mergers (M&A) of local insurance companies?allow strong control over overseas business but are direct investment methods with relatively high risk compared to investment. Therefore, it is necessary to diversify funding methods required for business expansion." He explained, "Currently, insurance companies can borrow funds only to meet financial soundness standards or maintain adequate liquidity, and the total issuance limit of subordinated bonds and hybrid capital securities recognized as capital is limited to within one times their own capital."

On the other hand, countries where domestic insurance companies have already entered and where multiple insurance companies are present, such as Japan, France, and the United Kingdom, do not impose restrictions on the purpose of insurance company bond issuance. In particular, Japanese insurance companies in the past quickly expanded overseas business by raising funds through subordinated bond issuance, which has advantages in managing solvency ratios.

In the same context, there were also suggestions to ease restrictions on borrowing purposes or expand borrowing limits specifically for insurance companies' overseas insurance business. It was argued that insurance companies should be able to efficiently raise funds for overseas business expansion by utilizing subordinated bonds and hybrid capital securities. However, even if the borrowing scope for overseas business is expanded, careful approval is needed for hybrid capital securities with interest rates excessively high compared to the operating asset yield.

Additionally, it was advised that measures are needed to strengthen support for asset management of overseas subsidiaries so that domestic insurance companies can establish overseas insurance and non-insurance subsidiaries and achieve stable initial settlement. Research fellow Oh said, "Insurance companies can strengthen asset management support for overseas subsidiaries through registration as discretionary investment business operators," and analyzed, "In the case of registration limited to the purpose of asset management support for overseas subsidiaries of insurance companies, easing registration requirements and simplifying procedures should be reflected in future amendments to the Capital Markets Act as a measure."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.