KODEX Secondary Battery Industry Leverage Drops 22.05% in One Month

EcoPro, LG Energy Solution and Other Secondary Battery Stocks Adjusted

Reflects Short-Term Surge Fatigue and Electric Vehicle Demand Concerns

Secondary battery stocks, which heated up the stock market this year, are undergoing a correction, causing related exchange-traded funds (ETFs) to show poor returns. The rebound of secondary battery stocks is expected to be possible only after October, so the weakness of secondary battery ETFs is likely to continue for the time being.

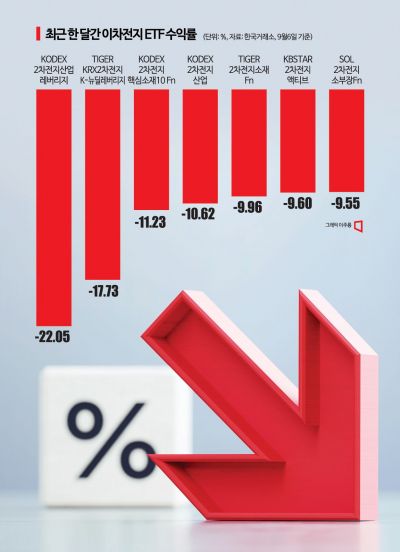

According to the Korea Exchange, the returns of secondary battery ETFs are among the lowest across all ETFs. As of the 6th, KODEX 2nd Battery Industry Leverage fell 22.05% over the past month, recording the lowest return among all ETFs. In addition, TIGER KRX 2nd Battery K-New Deal Leverage dropped 17.73%, KODEX 2nd Battery Core Materials 10 Fn fell 11.23%, KODEX 2nd Battery Industry declined 10.62%, KBSTAR 2nd Battery Active decreased 9.60%, and SOL 2nd Battery Materials Fn dropped 9.55%.

As secondary battery stocks showed a correction, the weakness extended to secondary battery ETFs. LG Energy Solution's stock price, which was in the 550,000 KRW range at the end of last month, fell to the 510,000 KRW range. POSCO Holdings, which rose to around 640,000 KRW at the end of July, recently dropped to about 560,000 KRW. Ecopro BM's stock price has fallen 15% over the past month. Ecopro's stock price, which was in the 1,250,000 KRW range at the end of last month, continued to decline recently and even broke below the 1,000,000 KRW level during trading on the 8th.

Secondary battery stocks showed weakness amid accumulated fatigue from a short-term surge and emerging concerns about a slowdown in electric vehicle demand. Choi Boyoung, a researcher at Kyobo Securities, explained, "Last month, battery cell makers' stock prices fell reflecting concerns about a slowdown in electric vehicle demand, and material suppliers gave back gains due to fatigue from the short-term surge and concerns about growth amid industry sluggishness."

Global electric vehicle sales in July reached 1,153,021 units, a 37% increase compared to the same period last year. Sales increased by 53% in the United States, 45% in Europe, and 32% in China, but China's growth rate significantly slowed compared to a 119% increase during the same period last year.

A rebound is not expected to be easy this month either. Researcher Choi said, "September will be a period to confirm the sluggishness of the secondary battery industry. Global electric vehicle sales are expected to continue slowing due to reduced subsidies in China and Europe, and price competition triggered by Tesla's price cuts is likely to continue for the time being, raising concerns about battery margin pressure."

A gap in orders and weak third-quarter earnings are also factors weighing on stock prices, and the rebound of secondary battery stocks is expected to be possible only after October. Researcher Ianna from Yuanta Securities said, "Although the order momentum remains in the second half, most orders are likely to take place in the fourth quarter, so there will be a gap in orders until earnings announcements. In the fourth quarter, long-term contracts for cathode materials and separators are expected, and separator companies are scheduled to announce their entry into North America, so momentum will be clear."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)