Ecopro Short Selling Balance Surges to 1.6 Trillion KRW

Short Selling Balance of 6 Secondary Battery Stocks Also Exceeds 6 Trillion KRW

Most Secondary Battery Stocks Recently Plunge...Individual Net Buying Dispersed Variable

The front line is forming again around Ecopro, the first target of this year's short-selling war. The short-selling balance has exceeded 1 trillion won, making it the top stock in terms of short-selling balance in the KOSDAQ market, and the balance is now approaching 2 trillion won. Moreover, short-selling balances are accumulating mainly in secondary battery-related stocks such as Ecopro, Ecopro BM, POSCO Holdings, POSCO Future M, L&F, and LG Energy Solution. The silent war between individual investors and foreign hedge funds and other short-selling forces surrounding secondary batteries remains intense.

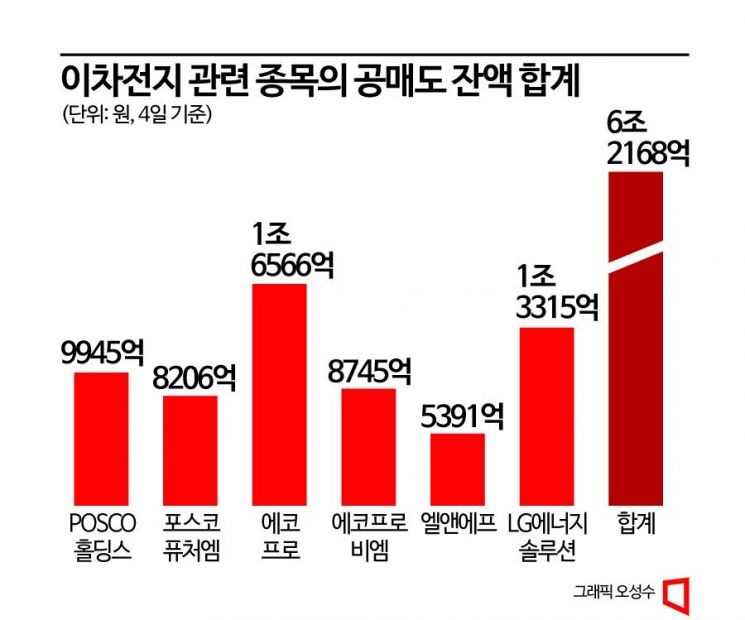

According to the Korea Exchange on the 8th, as of the latest available date, the 4th, the total short-selling balance of POSCO Holdings, POSCO Future M, Ecopro, Ecopro BM, L&F, and LG Energy Solution was 6.2168 trillion won. Among them, Ecopro stands out. Ecopro's short-selling balance, which was only 54 billion won on January 2 this year, surged to 1.3094 trillion won on July 17. The first short-selling war between individuals and foreigners took place. As the tide turned due to the consolidation of individual investors, foreign investors engaged in large-scale stock repurchases (short covering) to liquidate short positions, causing the short-selling balance to fall below 1 trillion won. Consequently, it remained in the 800 billion won range until the 30th of last month.

However, from the 31st of last month, it again exceeded 1 trillion won. As of the 1st, the short-selling balance reached 1.7254 trillion won. It more than doubled in just two trading days from 830.8 billion won on the 30th of last month. The short-selling ratio also jumped from the 2% range to 5.50% in one go. As of the 4th, Ecopro's short-selling balance was recorded at 1.6566 trillion won. The volume and value of short-selling transactions have also been increasing recently. Ecopro's daily short-selling volume maintained around 20,000 to 40,000 shares throughout last month but surged to 319,000 shares on the 31st. On the 1st and 4th of this month, about 90,000 and 76,000 shares were traded, respectively.

Not only Ecopro but most secondary battery-related stocks are suffering from short-selling. LG Energy Solution's short-selling balance also surpassed 1 trillion won again on the 29th of last month, increasing to 1.3078 trillion won on the 1st of this month. The last time LG Energy Solution's short-selling balance exceeded 1 trillion won was on the 8th of last month (1.0029 trillion won). On the 4th, it slightly increased to 1.3315 trillion won.

While Ecopro's short-selling balance decreased, the short-selling balance of POSCO Group stocks increased. It was interpreted that the stage of the second short-selling war between individuals and foreigners shifted to POSCO Holdings and POSCO Future M. POSCO Holdings' short-selling balance was only 188.2 billion won on July 11 but surged 5.5 times in about a month, surpassing 1 trillion won. It then fell back to the 900 billion won range but exceeded 1 trillion won again on the 30th of last month. On September 1 and 4, it was recorded at 962.9 billion won and 994.5 billion won, respectively. Short-selling balances of POSCO Future M (820.6 billion won), Ecopro BM (874.5 billion won), and L&F (539.1 billion won) have also shown steep increases since the end of August, approaching 1 trillion won.

The main entity accumulating short-selling funds in secondary battery stocks is foreigners. On the 4th of this month, foreigners accounted for 64.11% of the total short-selling transaction value (778.4 billion won) in the KOSPI and KOSDAQ markets. Considering that foreigners' share was 52.87% on July 26, when the total market short-selling transaction value hit a yearly high of 2.3616 trillion won, it is interpreted that foreigners are focusing on short-selling secondary battery stocks.

Who will be the winner of this short-selling war? The first war was won by individuals. Ecopro's stock price, which started at 103,000 won at the beginning of the year, surged to the 500,000 won range in early April. Foreign hedge funds and others, judging the stock price to be overheated, concentrated on short-selling. However, supported by individual buying power, Ecopro's stock price soared well above 1 million won. It even surged intraday to 1.539 million won, and the short-selling forces retreated by engaging in short covering. Short covering refers to investors who borrowed stocks expecting the price to fall (short sellers) buying back stocks to reduce losses when the price rises unexpectedly. The market estimates that foreigners suffered significant losses in Ecopro and others. A stock market expert said, "The recent surge in Ecopro's short-selling balance is interpreted as a move to recover previous losses."

Individuals continue to buy secondary battery stocks against short-selling forces. However, the foreign offensive is formidable. Individuals have bought the most Ecopro shares from the beginning of this month through the 6th, with net purchases amounting to 124.6 billion won. This was followed by POSCO DX (120.5 billion won), POSCO Holdings (115.3 billion won), LG Energy Solution (102.6 billion won), SK Hynix (81.9 billion won), and Ecopro BM (71 billion won).

However, the stock prices of secondary battery stocks are showing signs of instability. Ecopro BM's stock price plunged 33.44% from 462,000 won on July 25 to 307,500 won on the 4th of this month. During the same period, L&F (23.74%), Ecopro (14.08%), LG Energy Solution (10.77%), POSCO Holdings (10.33%), and POSCO Future M (26.25%) also experienced double-digit declines.

The industry holds a skeptical view of the secondary battery stock price outlook. Since the stock price has shown signs of overheating, a correction is inevitable, and the semiconductor sector recently emerging as a market leader is also a burden. Unlike the first short-selling war, individual net purchases may be dispersed. Ji-young Kim, a researcher at Kiwoom Securities, predicted, "Depending on Samsung Electronics' stock price direction, buying funds may flow into the semiconductor sector."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.