Regional Banks in Japan Launch 50-Year Mortgages One After Another

US Treasury Yield Deterioration and Japan's Real Estate Boom Overlap

As regional banks and credit unions in Japan successively launch mortgage loan products with repayment periods of up to 50 years, attention is focusing on the background behind this trend. This is in stark contrast to South Korea, which has begun to uniformly ban the sale of 50-year mortgages, citing the high risk of increasing household debt. The combination of the U.S. interest rate hikes significantly reducing the attractiveness of U.S. Treasury investments and a real estate boom within Japan is interpreted as the reason why Japanese banks are actively focusing on launching loan products.

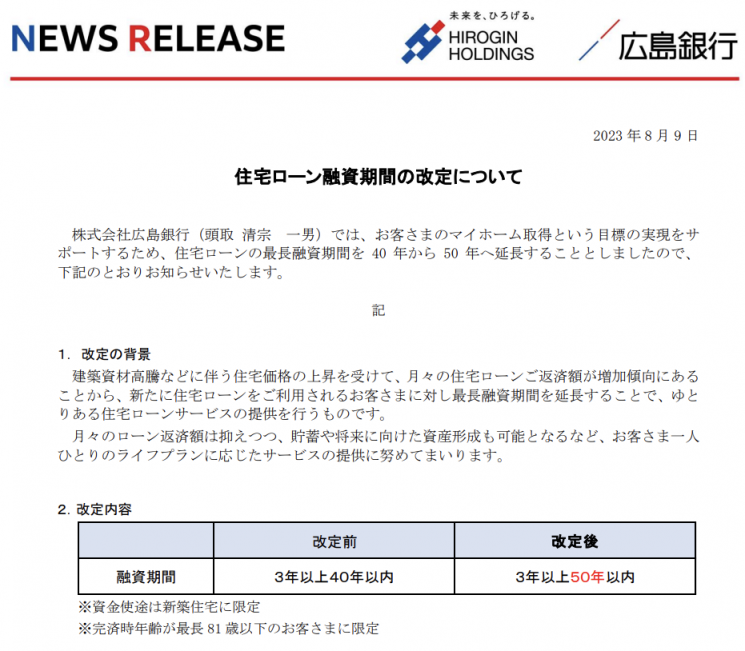

Press release from Hiroshima Bank announcing the extension of the mortgage loan period from 40 years to 50 years. (Photo by Hiroshima Bank)

Press release from Hiroshima Bank announcing the extension of the mortgage loan period from 40 years to 50 years. (Photo by Hiroshima Bank)

According to the Nihon Keizai Shimbun (Nikkei) on the 7th, Hiroshima Bank extended the repayment period for its mortgage loans from a maximum of 40 years to 50 years starting last month. The interest rates are 1.65% fixed for 10 years and 0.455% variable, with loans available up to 200 million yen (approximately 180 million KRW). A Hiroshima Bank official told Nikkei, "Financial institutions offering 50-year mortgages are emerging, so we judged it necessary as a competitive strategy."

In fact, besides Hiroshima Bank, other banks such as Nishi-Nippon City Bank, Joyo Bank in the Kanto region, and Fukui Bank, a regional bank in Fukui Prefecture, already offer 50-year mortgage products. According to Nikkei, over the past year, about ten regional financial institutions have introduced or expanded 50-year mortgage loans. Even internet-only banks like Sumishin SBI Net Bank have jumped into selling 50-year mortgage products.

Some institutions have increased their product offerings through partnerships with guarantee companies. Fukuoka Hibiki Credit Union and Hokkaido Kushiro Credit Union have signed business agreements with MG Guarantee, a credit guarantee company based in Tokyo and Hiroshima. These banks have already been providing 50-year loan products in collaboration with other guarantors, and by adding new guarantors, they have increased the number of products available. Since each guarantor has different screening criteria, the strategy is to maximize customer options so that if a loan is rejected by one guarantor, it may still be possible to obtain a loan through another product. An MG Guarantee official stated, "We are receiving increasing inquiries about business partnerships from financial institutions nationwide."

The reason why Japanese banks are collectively entering the 50-year mortgage market is interpreted as a response to changes in domestic and international conditions. Within Japan, daily life has returned to normal after COVID-19, and with the Bank of Japan (BOJ) maintaining its low-interest-rate policy, the previously stagnant real estate market has begun to revive. The Ministry of Land, Infrastructure, Transport and Tourism announced the "2023 January 1st Standard Land Prices" earlier this year, showing that the overall average increase rate of official land prices, combining residential and commercial land, reached the highest level in 15 years.

Sumishin SBI Net Bank promotes that purchasing a higher-level home is possible with a 50-year mortgage loan. (Photo by Sumishin SBI Net Bank)

Sumishin SBI Net Bank promotes that purchasing a higher-level home is possible with a 50-year mortgage loan. (Photo by Sumishin SBI Net Bank)

According to surveys, the average nationwide purchase price for newly built detached houses was 42.14 million yen (about 380 million KRW) last year, a 10% increase compared to three years ago. Of this, the average self-funded amount is 11.6 million yen (about 104.88 million KRW). The remaining 30 million yen (about 270 million KRW) is borrowed to buy the house. Even with a 30 million yen loan, applying Japan’s bank interest rates in the 1% range means monthly payments of only 64,000 yen (about 570,000 KRW) over 50 years.

Externally, the U.S. interest rate hikes have had an impact. Until now, banks operated funds collected from deposits by investing in securities, but as interest rate hikes have become a global trend, this has instead increased losses. With foreign debt management becoming difficult, banks have no choice but to increase profits by expanding loan products.

Under these domestic and international conditions, long-term mortgages are seen as a good incentive for banks to attract a large number of young customers. Above all, younger generations want to reduce their monthly repayment amounts, so the number of users of 50-year mortgages is steadily increasing. Okinawa Bank reported, "Recently, the use of long-term mortgages by customers under 30 has also been increasing."

However, Nikkei cautioned that as long-term loan products increase, financial institutions face greater difficulties in credit management. Nikkei added, "There are people who struggle with monthly repayments," and "Because of risks such as defaults or interest rate fluctuations affecting bank profits, bank screening and risk management will become even more important."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.