Stock Prices Decline Amid Q3 Peak Season

WTI Hits Highest Level Since November 2022...Concerns Over Airlines' Operating Profit Decrease

The wings of the aviation sector appear to be clipped. Although the third quarter is the peak season, concerns are rising that airlines' operating profits may decline due to the continued surge in international oil prices.

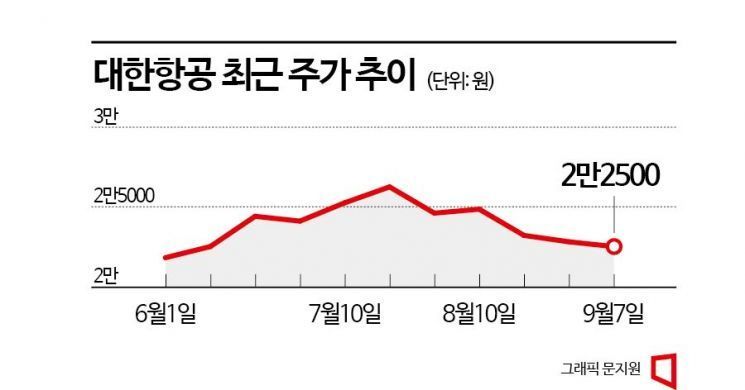

On the 7th, Korean Air's stock price closed at 22,500 KRW. This is an 8.16% drop compared to 24,500 KRW on July 3rd. During the same period, Asiana Airlines fell from 12,340 KRW to 10,800 KRW, Jeju Air from 15,060 KRW to 11,880 KRW, and T'way Air also dropped from 3,300 KRW to 2,630 KRW. In other words, the peak season expectations for airlines in the third quarter and their stock prices moved in opposite directions.

The recent decline in airline stock prices appears to reflect concerns over operating profit erosion due to rising international oil prices. Jet fuel accounts for 30% of airlines' cost of sales. The higher the jet fuel price, the more operating profits decrease. In the first half of this year, Korean Air spent about 1.4 billion USD (approximately 1.8471 trillion KRW) on fuel costs alone.

On the New York Mercantile Exchange, the October delivery West Texas Intermediate (WTI) crude oil futures price recorded 86.87 USD per barrel on the 7th (local time). This marked a decline after 10 trading days. However, the previous day it reached this year's highest level and the highest since November 11 of last year. Due to the rise in international oil prices, the price of jet fuel also increased. Jet fuel soared from 95.57 USD per barrel at the end of June to 126.37 USD per barrel in the last week of last month.

Concerns have also emerged that travel demand may shrink due to rising oil prices. This is because when jet fuel prices rise, fuel surcharges also increase accordingly. Fuel surcharges refer to fees that airlines separately impose on fares to compensate for cost losses caused by rising oil prices. The international fuel surcharge for September increased by three steps to level 11 compared to the previous month. Korean Air's fuel surcharge this month ranges from 20,800 KRW to 163,800 KRW one-way. This is a 30-40% increase from last month's 15,600 to 114,400 KRW.

However, benefits from group tours by Chinese tourists are expected. Soo-young Park, a researcher at Hanwha Investment & Securities, said, "Since inbound demand from Chinese tourists is expected to rise relatively faster, Chinese airlines are anticipated to be the primary beneficiaries," adding, "Domestic airlines can also sufficiently benefit, and since this is the first allowance of group tours in six years aimed at economic stimulus, passenger demand on Korea-China routes could be stronger than expected."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.