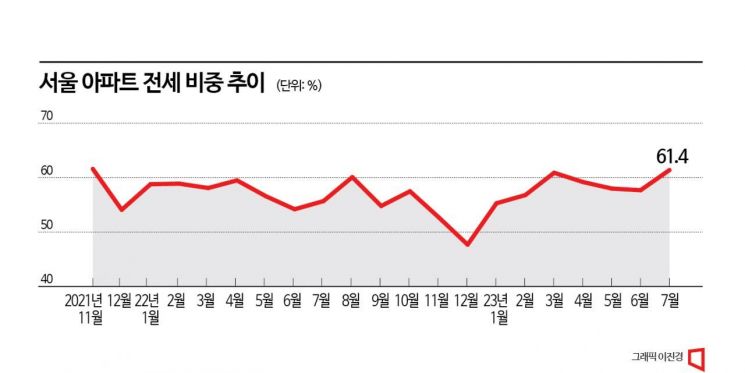

10,923 out of 17,797 Cases in July... 61.4%

High Interest Rates Deepen Jeonse Avoidance, Then Mood Reverses

"Monthly Rent Rises, Jeonse Loan Interest Rate Stabilization Effect"

Contrary to last year's buzz around the 'jeonse extinction theory' caused by high interest rates, the proportion of jeonse in Seoul apartments in July reached its highest level in 20 months. This is interpreted as the 'monthly rent-ification of jeonse' halting and jeonse demand increasing again due to a drop in jeonse prices compared to two years ago and relatively lower interest rates on jeonse loans.

According to the Seoul Real Estate Information Plaza, the total number of jeonse and monthly rent transactions for Seoul apartments in July was 17,797. Among these, the proportion of jeonse accounted for 61.4% (10,923 cases). This is the highest figure in 1 year and 8 months since November 2021 (61.6%).

The Seoul apartment rental market saw an acceleration in the monthly rent-ification of jeonse last year due to the sharp increase in the base interest rate. The jeonse proportion, which was around 60% on average in 2021, dropped to an average of 56% last year, and in December it was overtaken by monthly rent at 47.7%. This was due to the increase in deposit burdens as jeonse loan interest rates rose to the 6% range and the nationwide impact of the 'villa king jeonse fraud,' which caused severe aversion to jeonse. At that time, the jeonse extinction theory even emerged.

However, the proportion of jeonse in Seoul apartments rose to 55.3% in January this year, 56.8% in February, and reached 60.9% in March. It stalled at 57-59% from April to June but surpassed 60% again in July.

Experts analyze that the demand for jeonse has increased again because the deposit burden has decreased during new contracts or renewals as jeonse prices were significantly reduced compared to two years ago due to jeonse aversion.

Also, the jeonse-to-monthly rent conversion rate, used when converting jeonse deposits to monthly rent, rose to 4.8% in June (based on Seoul apartments) due to the impact of interest rate hikes, but the interest rates on jeonse loans from commercial banks fell to 4-5% annually, which seems to have increased the proportion.

The proportion of jeonse in Seoul apartments reported so far for August is around 63.5%, higher than in July. However, many cases without confirmed date registration remain, and since jeonse registrations are generally reported faster than monthly rent, the exact trend needs to be observed further.

Yeokyunghee, Senior Researcher at Real Estate R114, explained, "Although the burden of monthly rent has increased, jeonse loan interest rates have remained relatively stable, and compared to non-apartments, the risk of incidents such as 'empty shell jeonse' is lower, so the proportion of jeonse in Seoul apartments seems to have increased again."

Meanwhile, as jeonse demand gradually recovers, Seoul apartment jeonse prices have bottomed out and risen for 15 consecutive weeks. According to the Korea Real Estate Board, as of the fourth week of August, prices rose by 0.13% compared to the previous week. The increase was significant in areas such as Songpa (0.28%), Seongdong (0.23%), and Gangnam (0.2%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.