[China Finding Loopholes in US Sanctions]②

Supporting with Semiconductor Fund Creation

"The Chinese-made chip embedded in China's Huawei Mate60 Pro clearly signifies China's victory in neutralizing U.S. sanctions." (Hong Kong South China Morning Post (SCMP))

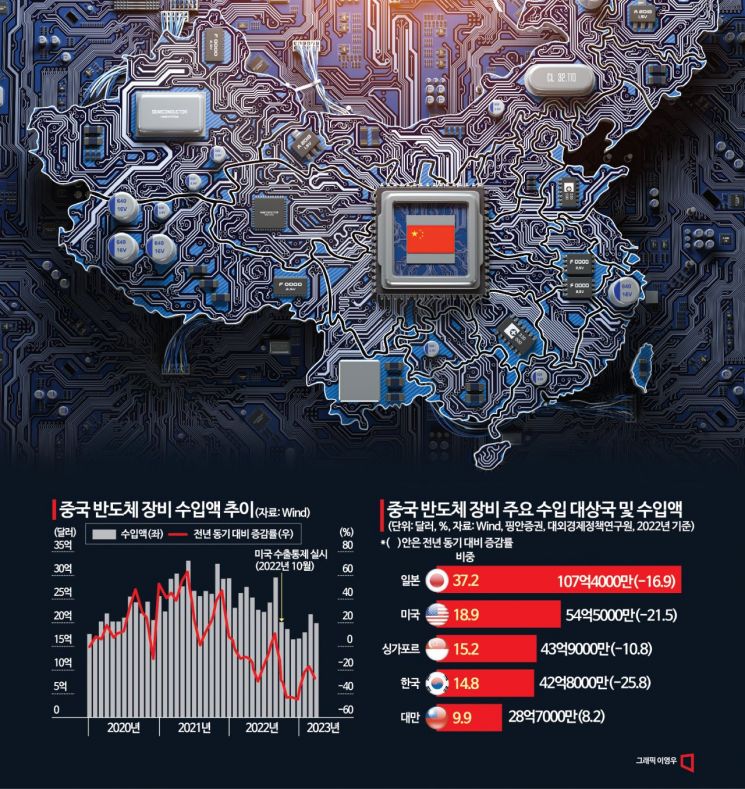

China's largest telecommunications equipment company Huawei unveiled its smartphone 'Mate60 Pro' on the 29th of last month, attracting global attention immediately upon release. This was because the product was equipped with a top-tier processor despite the inability to source advanced semiconductors externally due to U.S. sanctions. In China, there was a cheer as Huawei, a representative company that had been under particularly intense pressure from the U.S., was seen to have succeeded in counterattack and revival. Analysts also suggest that U.S. sanctions acted as a catalyst accelerating China's technological independence. Not wanting to miss the timing, China is igniting its characteristic aggressive investment, preparing to pour astronomical capital into semiconductor technology development led by both government and private enterprises.

Third Semiconductor Fund Established... Largest Scale Ever

Following the market release of Huawei's new smartphone, major U.S. media and specialized outlets rushed to dismantle the product. Media that examined the Mate60 Pro concluded unanimously that it used a 7nm (nanometer) semiconductor chip (Kirin 9000) developed by SMIC (Semiconductor Manufacturing International Corporation). Although the technology lags behind South Korea's Samsung Electronics and Taiwan's TSMC by more than five years, the success in circumventing sanctions has shaken the U.S.'s strategy of sanctions against China.

Behind this achievement lies China's characteristic astronomical investment. Even last year, when Huawei's business conditions hit rock bottom, it invested 161.5 billion yuan (approximately 29.4641 trillion KRW) in research and development (R&D). This amount is close to 25% of its revenue (642.3 billion yuan). As a result, net profit plunged 70% compared to the previous year. In the first half of this year, Huawei spent 82.6 billion yuan on R&D. According to local media, Huawei's total R&D investment over the past decade amounts to 977.3 billion yuan.

Not only companies but also at the national level, China is preparing to launch a capital offensive. According to major foreign media, China plans to establish a state-supported fund worth 300 billion yuan for the semiconductor sector, known as the 'Big Fund.' This fund has received approval from Chinese authorities, and the Ministry of Finance is expected to contribute about 20% of the fund, approximately 60 billion yuan.

Previously, China also established state-owned semiconductor funds in 2014 (138.9 billion yuan) and 2019 (204.1 billion yuan), effectively intervening directly in the industrial ecosystem. At that time, financially strong state-owned enterprises such as China Development Bank, China Tobacco Corporation, and China Telecom were mobilized in large numbers.

Going further back, China began announcing and encouraging semiconductor industry development policies at the national level from 2000. At that time, tax incentives were provided to manufacturing companies, and R&D investment was actively promoted. In 2021, through the '14th Five-Year Plan,' semiconductors were designated as a core area for national security and development, emphasizing the development of next-generation semiconductors and addressing bottlenecks such as EDA (Electronic Design Automation), materials, and advanced memory, with more detailed strategies being formulated.

Looking at the bigger picture, the establishment of the STAR Market in Shanghai in 2018 also aims to facilitate funding for innovative companies in semiconductors and artificial intelligence (AI). In fact, among the 51 semiconductor companies listed between 2019 and 2021, when U.S.-China competition intensified, 43 companies went through the STAR Market to raise large-scale funds. In May, Nexchip and SMIC, which were listed on the Shanghai main board, attracted funds through dual listings on the STAR Market, and Hua Hong Semiconductor also conducted a dual listing in July.

Concentrated Investment ≠ Success... Significant Technology Gap Remains

However, some assessments suggest that Huawei's new product launch is not a reason for China to celebrate yet. The 7nm chip used this time was already embedded in Apple's iPhone since 2018. The current iPhone operates with a 4nm process chip, and the upcoming iPhone 15, to be released on the 12th, will feature a 3nm process chip. Competitors have already advanced far ahead.

In terms of sales volume and market share, it is still premature to celebrate victory. Guo Mingzi, an analyst at TF International Securities, forecasted that the Mate60 Pro would sell over 12 million units. This is a significant increase compared to the Mate50 Pro's 2.5 million units released last year. However, compared to the estimated 90 million units of the upcoming iPhone 15, it still lags far behind.

Bloomberg described the Mate60 Pro launch as "evolutionary rather than revolutionary," diagnosing that "Beijing's celebrations and Washington's despair are both premature." Dylan Patel, head of semiconductor research at consulting firm Semianalysis, explained, "It's groundbreaking but not unexpected." SCMP also predicted, "While Huawei's launch will help regain its lost position in the Chinese mobile phone market, it is unlikely to return to the heyday before 2020 when it challenged Apple and Samsung globally."

Past precedents also highlight that China's quantitative offensive does not necessarily lead to success. Some local government projects related to semiconductor localization in China have failed massively due to corruption among fund managers and poor investment decisions by officials lacking technical understanding. A representative case is the November 2017 incident where Wuhan Hongxin Semiconductor Manufacturing (HSMC)'s planned 128 billion yuan semiconductor fab construction project was revealed to be fraudulent. The losses were borne by local governments, and executives of Huaxin Investment, the semiconductor industry fund management company, were investigated.

The possibility of the U.S. imposing additional sanctions following Huawei's technological counterattack cannot be ruled out. Edison Lee, a Hong Kong stock analyst at Jefferies, predicted to SCMP, "Huawei will face even stricter semiconductor technology sanctions from the U.S. government in the fourth quarter." Dan Hutchison, vice president of TechInsights, told major foreign media, "This (Huawei's) achievement shows the resilience of China's semiconductor technology," but also warned, "It poses a significant geopolitical challenge to countries trying to block China's access to critical manufacturing technologies, and as a result, much harsher sanctions may follow."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.