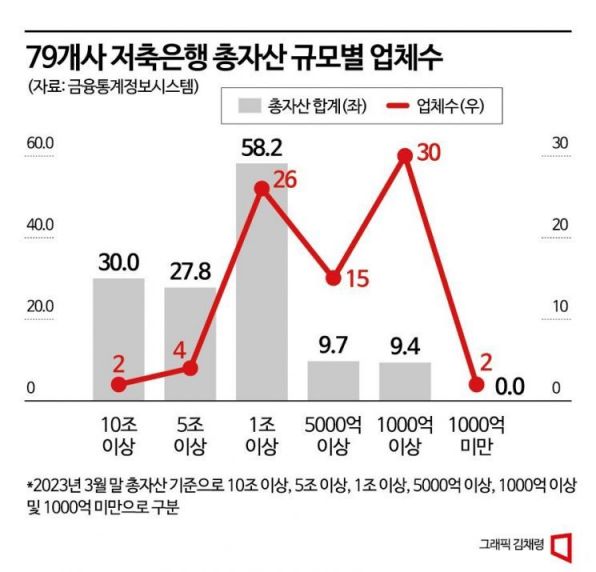

79 Savings Banks Hold Total Assets of 135 Trillion Won, Top 2 Account for 30 Trillion Won

Only 6 Savings Banks Have Total Assets Over 5 Trillion Won

Financial Authorities Ease M&A Regulations to Promote Consolidation

Industry Responds, "No Local Listings and Strict Major Shareholder Requirements"

It has been revealed that the gap between the rich and the poor is becoming more pronounced even among savings banks struggling with deteriorating performance. The top six companies in South Korea's savings bank industry (with total assets of 5 trillion won or more) accounted for more than 40% of the industry's total assets.

According to a savings bank industry report released by Korea Credit Rating on the 6th, as of the end of March, the total assets of the industry's No. 1 SBI Savings Bank and No. 2 OK Savings Bank were approximately 16 trillion won and 14 trillion won, respectively. These two were the only companies with assets exceeding 10 trillion won. There were only four companies with assets over 5 trillion won, including Welcome Savings Bank (about 6.7 trillion won), with total assets amounting to 27.8 trillion won. The top six companies accounted for 43% (57.8 trillion won) of the industry's total assets (135.1 trillion won).

As deposit interest rates rise in the banking sector, the balance of savings and fixed deposits is increasing. The secondary financial sector is also consecutively raising fixed deposit interest rates. The photo shows Welcome Savings Bank in Jung-gu, Seoul. Photo by Jinhyung Kang aymsdream@

As deposit interest rates rise in the banking sector, the balance of savings and fixed deposits is increasing. The secondary financial sector is also consecutively raising fixed deposit interest rates. The photo shows Welcome Savings Bank in Jung-gu, Seoul. Photo by Jinhyung Kang aymsdream@

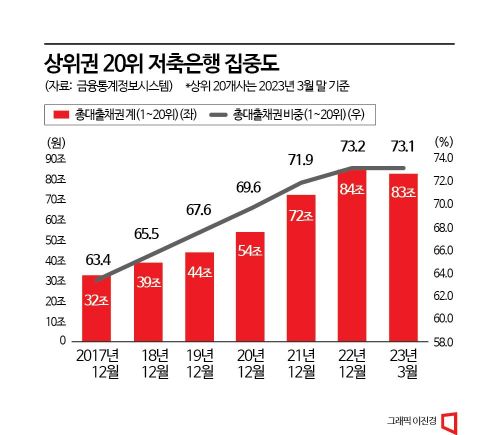

Looking at the scale of loan receivables, which make up the majority of total assets, the gap between the top two and other savings banks was also significant. SBI's total assets amounted to 13.8 trillion won, and OK's were 11.8 trillion won. Suyeon Kwak, a senior analyst at Korea Credit Rating, explained, "The size difference between the top two companies and the others ranges from 2 to 8 times or more." For reference, the loan receivables of the top 20 companies totaled 83 trillion won, accounting for 73.1% of total loan receivables. Analyst Kwak predicted, "As non-face-to-face transactions increase, the market share of the top companies is expected to expand further."

The net loss of savings banks in the first half of this year was 95.3 billion won. However, among the top five savings banks in the industry, only Pepper Savings Bank (-42.9 billion won) posted a loss in the first half of this year. Among the other four, OK Savings Bank recorded the highest net profit of 53.5 billion won. Welcome Savings Bank (23.8 billion won), SBI Savings Bank (10.5 billion won), and Korea Investment Savings Bank (3.1 billion won) followed.

As the top companies grow larger and the gap among the remaining companies widens, the Financial Services Commission announced a plan to ease merger and acquisition regulations last July under the pretext of "improving the efficiency and competitiveness of savings banks." The main point was to expand business areas only in non-metropolitan regions. In the case of mergers and acquisitions, even if the major shareholders are the same, each savings bank would be allowed to operate in up to four areas in non-metropolitan regions.

Currently, the business areas of savings banks include six regions: two metropolitan areas (Seoul and Incheon/Gyeonggi) and four non-metropolitan areas (Busan/Ulsan/Gyeongnam, Daegu/Gyeongbuk/Gangwon, Gwangju/Jeolla/Jeju, and Daejeon/Sejong/Chungcheong). Under current regulations, the same major shareholder could only own savings banks in two business areas.

However, there are doubts within the industry about how effective this will be. A senior official from the savings bank industry said, "Owners of savings banks in provincial areas operate very cautiously in a family business style and are reluctant to put them up for sale," adding, "If regulations are to be eased for mergers and acquisitions, the metropolitan area should also be included." He continued, "If a major shareholder receives criminal punishment with a fine of 10 million won or more, they cannot maintain their status as a major shareholder and must sell their shares. Since the major shareholder eligibility screening is strict, this level of regulatory easing is unlikely to motivate mergers and acquisitions."

Meanwhile, last month, financial authorities issued a 'major shareholder eligibility fulfillment order' to Sangsangin Savings Bank and Sangsangin Plus Savings Bank, effectively putting the two savings banks on the path to sale. As of the end of March this year, the total assets of the two savings banks amounted to 4.7994 trillion won, ranking seventh in the industry by asset size.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.